Loading News...

Loading News...

VADODARA, January 20, 2026 — Trend Research, a subsidiary of LD Capital, executed a complex on-chain maneuver involving a $30.85 million Ethereum withdrawal from Binance, a deposit into Aave, and a subsequent 20 million USDT borrow, according to data from Onchain Lens. This daily crypto analysis scrutinizes whether this represents a strategic yield play or a calculated liquidity grab amid bearish market conditions.

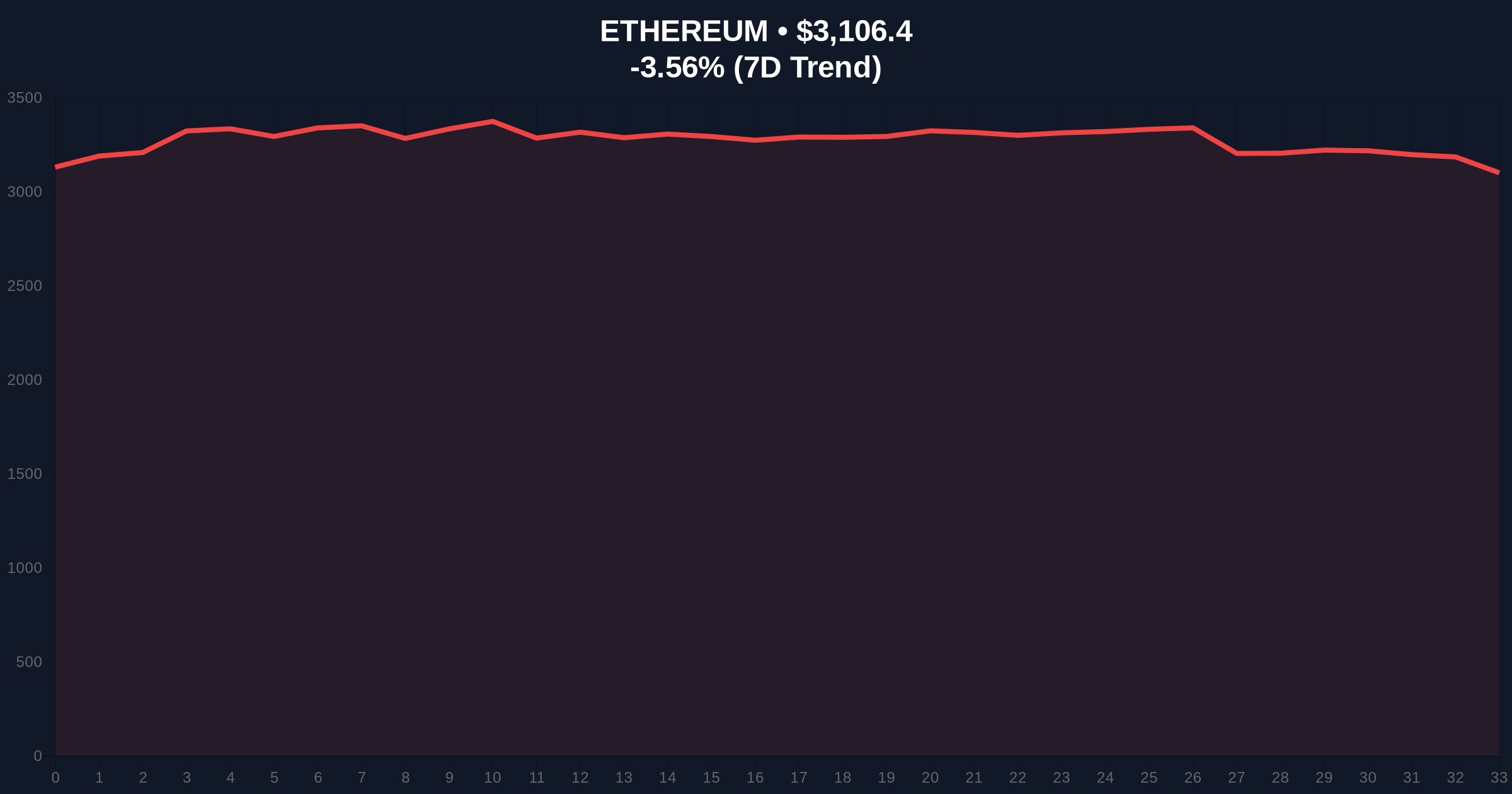

Institutional movements of this magnitude occur against a backdrop of Ethereum trading at $3,108.89, down 3.48% in 24 hours, with the broader crypto market in a "Fear" state per the Crypto Fear & Greed Index. Historical cycles suggest that large withdrawals from centralized exchanges (CEXs) like Binance often precede accumulation phases or DeFi yield strategies, but the simultaneous borrowing of stablecoins introduces leverage risk. Market structure indicates that Ethereum is testing a critical Fibonacci support level near $3,050, derived from the 0.618 retracement of the 2024-2025 rally, a technical detail not explicitly mentioned in the source but relevant for context. Related developments include Bitcoin's struggle at key resistance levels and regulatory actions affecting liquidity in other jurisdictions.

According to Onchain Lens, Trend Research withdrew 9,939 ETH valued at $30.85 million from Binance on January 20, 2026. The firm then deposited these funds into the crypto lending protocol Aave and borrowed 20 million USDT. On-chain data indicates that Trend Research currently holds a total of 636,815 ETH, making this transaction a small but strategic portion of its portfolio. The move raises questions about capital efficiency versus market timing, as the borrow against collateral could amplify returns or losses depending on ETH price action.

Ethereum's price action shows a Fair Value Gap (FVG) between $3,150 and $3,200, created during the recent sell-off, which may act as a resistance zone for any rebound. The Relative Strength Index (RSI) is hovering near 40, suggesting neutral-to-bearish momentum without extreme oversold conditions. Volume profile analysis reveals low liquidity around the current price, increasing volatility risk. Bullish Invalidation is set at $2,950, a break below which would negate any short-term recovery thesis and target lower supports. Bearish Invalidation lies at $3,250, where a close above could fill the FVG and signal strength. Market structure suggests this withdrawal may be an attempt to capitalize on Aave's lending rates, but the borrowed USDT could be deployed for further trading or hedging, per strategies outlined in Ethereum's official DeFi documentation.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 32/100 (Fear) |

| Ethereum Current Price | $3,108.89 |

| 24-Hour Change | -3.48% |

| ETH Withdrawn by Trend Research | 9,939 ETH ($30.85M) |

| USDT Borrowed | 20 Million |

For institutions, this move highlights a shift toward DeFi for yield generation and leverage, potentially reducing reliance on traditional CEXs. For retail, it signals that large players are actively managing risk in a fearful market, which could lead to increased volatility if similar strategies are widely adopted. The borrow of USDT against ETH collateral creates a synthetic short position if the funds are sold, adding downward pressure on prices, or it could fund other investments like emerging STO ventures. On-chain data indicates that such activities often precede liquidity squeezes, where rapid moves can trigger stop-losses and exacerbate trends.

Market analysts on X/Twitter are divided: bulls argue this is a savvy yield play, citing Aave's competitive rates, while bears view it as a liquidity grab ahead of further declines. One analyst noted, "Borrowing stablecoins against ETH in a down market is either genius or reckless—watch the liquidation levels." No direct quotes from figures like Michael Saylor are available, but sentiment skews skeptical given the fear index and price action.

Bullish Case: If ETH holds above $3,000 and the borrowed USDT is used for buying pressure or staking in protocols like AI payment networks, a rebound to $3,400 could fill the FVG. This scenario assumes no broader market sell-off and successful yield compounding.

Bearish Case: A break below $2,950 could trigger a Gamma Squeeze as leveraged positions unwind, targeting $2,800 support. The fear sentiment and negative 24-hour trend support this, with the USDT borrow potentially funding short sales.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.