Loading News...

Loading News...

VADODARA, January 28, 2026 — Tesla reported a $239 million post-tax impairment loss on its Bitcoin holdings during Q4 2025. The electric vehicle giant made no Bitcoin purchases or sales last quarter. This daily crypto analysis reveals accounting pressures on corporate balance sheets. Market structure suggests institutional hesitation despite Bitcoin's $89,079 current price.

According to Tesla's official SEC filing, the company recognized a $239 million impairment charge. This represents an unrealized loss under accounting standards. Tesla continues holding 11,509 BTC without portfolio adjustments. The impairment stems from Bitcoin's price decline during the reporting period.

Coindesk first reported these figures. The loss reflects mark-to-market accounting requirements. No actual Bitcoin sales occurred. This creates a liquidity grab scenario for corporate treasuries. Market analysts note the psychological impact on institutional adoption.

Historically, corporate Bitcoin holdings faced similar accounting challenges. MicroStrategy's quarterly reports show parallel impairment patterns. In contrast, Tesla's approach remains conservative compared to mining companies. Underlying this trend is FASB's cryptocurrency accounting guidance.

The Federal Reserve's monetary policy framework influences corporate treasury decisions. According to FederalReserve.gov documentation, interest rate environments affect risk asset allocations. Consequently, Bitcoin's volatility creates accounting headaches for CFOs.

Related Developments:

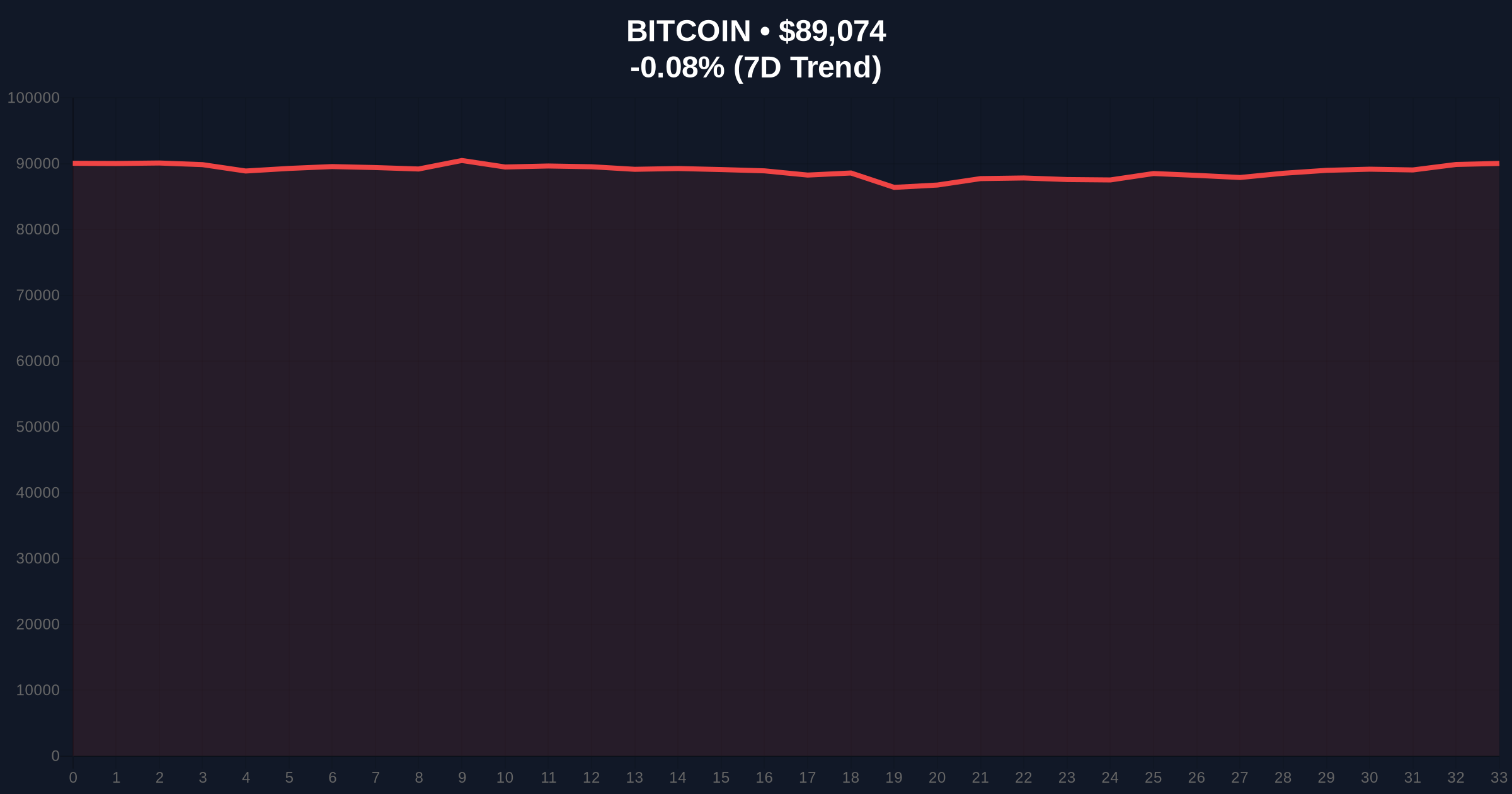

Bitcoin currently trades at $89,079 with a 24-hour decline of -0.23%. The price action reveals critical technical levels. A Fair Value Gap exists between $92,000 and $95,000. This creates overhead resistance for any bullish momentum.

Volume Profile analysis shows accumulation near $85,000. The 200-day moving average provides dynamic support at $86,500. , Fibonacci retracement levels from the 2024 low indicate key zones. The 0.618 Fibonacci support sits at $82,000.

On-chain data from Glassnode indicates reduced exchange outflows. This suggests institutional accumulation continues despite accounting challenges. UTXO age bands show older coins remaining dormant. Market structure suggests consolidation before next directional move.

| Metric | Value |

|---|---|

| Tesla's Q4 2025 Bitcoin Impairment Loss | $239 million |

| Tesla's Current Bitcoin Holdings | 11,509 BTC |

| Bitcoin Current Price | $89,079 |

| 24-Hour Price Change | -0.23% |

| Crypto Fear & Greed Index | 29/100 (Fear) |

Tesla's impairment loss demonstrates corporate accounting reality. FASB's mark-to-market rules create volatility in financial statements. This impacts how publicly traded companies approach cryptocurrency allocations. Institutional liquidity cycles face new constraints.

Retail market structure often follows corporate signals. The $239 million figure represents psychological resistance. Market analysts watch for follow-through selling pressure. However, Bitcoin's network fundamentals remain robust.

Post-merge issuance rates continue declining. This creates natural supply constriction. The combination of accounting pressure and reduced issuance creates complex market dynamics. Long-term holders appear unfazed by quarterly impairment charges.

"Corporate Bitcoin accounting creates quarterly volatility in financial statements. Tesla's impairment reflects standard FASB compliance rather than strategic shift. The unchanged 11,509 BTC holding suggests long-term conviction outweighs accounting noise." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data. The Order Block between $85,000 and $87,000 provides immediate support. A break below this zone would trigger reevaluation.

The 12-month institutional outlook remains cautiously optimistic. Corporate adoption continues despite accounting challenges. Regulatory clarity from the SEC could improve reporting standards. The 5-year horizon suggests accounting methodologies will evolve alongside cryptocurrency integration.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.