Loading News...

Loading News...

VADODARA, January 28, 2026 — Bitcoin miners across the United States have executed a strategic operational pivot, temporarily halting mining operations to sell electricity back to power grids during a severe winter storm. According to DL News analysis, this shift generated profit margins up to 150% higher than standard mining revenue. Consequently, the Bitcoin network hashrate plunged to a seven-month low of 663 EH/s, while mining stocks like TeraWulf and Iren surged 15% and 18% respectively over five days. This daily crypto analysis examines the structural implications of miners acting as dynamic grid assets.

Scott Norris, chief mining officer at Bitcoin hashrate tokenization firm Omnes, provided specific data points to DL News. Miners sold power to the grid for 20 cents per kWh during peak demand periods. This compared directly to an estimated 8 cents per kWh earned from mining operations at current Bitcoin prices. The price differential created what market technicians term a "Liquidity Grab" opportunity. Miners capitalized on extreme weather conditions that strained national power infrastructure. Underlying this trend is the fundamental flexibility of Bitcoin mining hardware, which can redirect energy consumption within minutes.

Historically, Bitcoin miners have operated as pure price-takers in energy markets. This event marks a significant evolution toward becoming price-makers. In contrast to the 2021 Texas grid crisis where miners simply shut down, 2026 miners actively participated in demand-response programs. This mirrors broader energy market trends documented by the U.S. Energy Information Administration regarding flexible load management. , the hashrate drop to 663 EH/s represents the lowest level since June 2025, creating a potential supply shock. Related developments include recent Federal Reserve commentary affecting market sentiment and upcoming Ethereum scalability tests that could alter competitive dynamics.

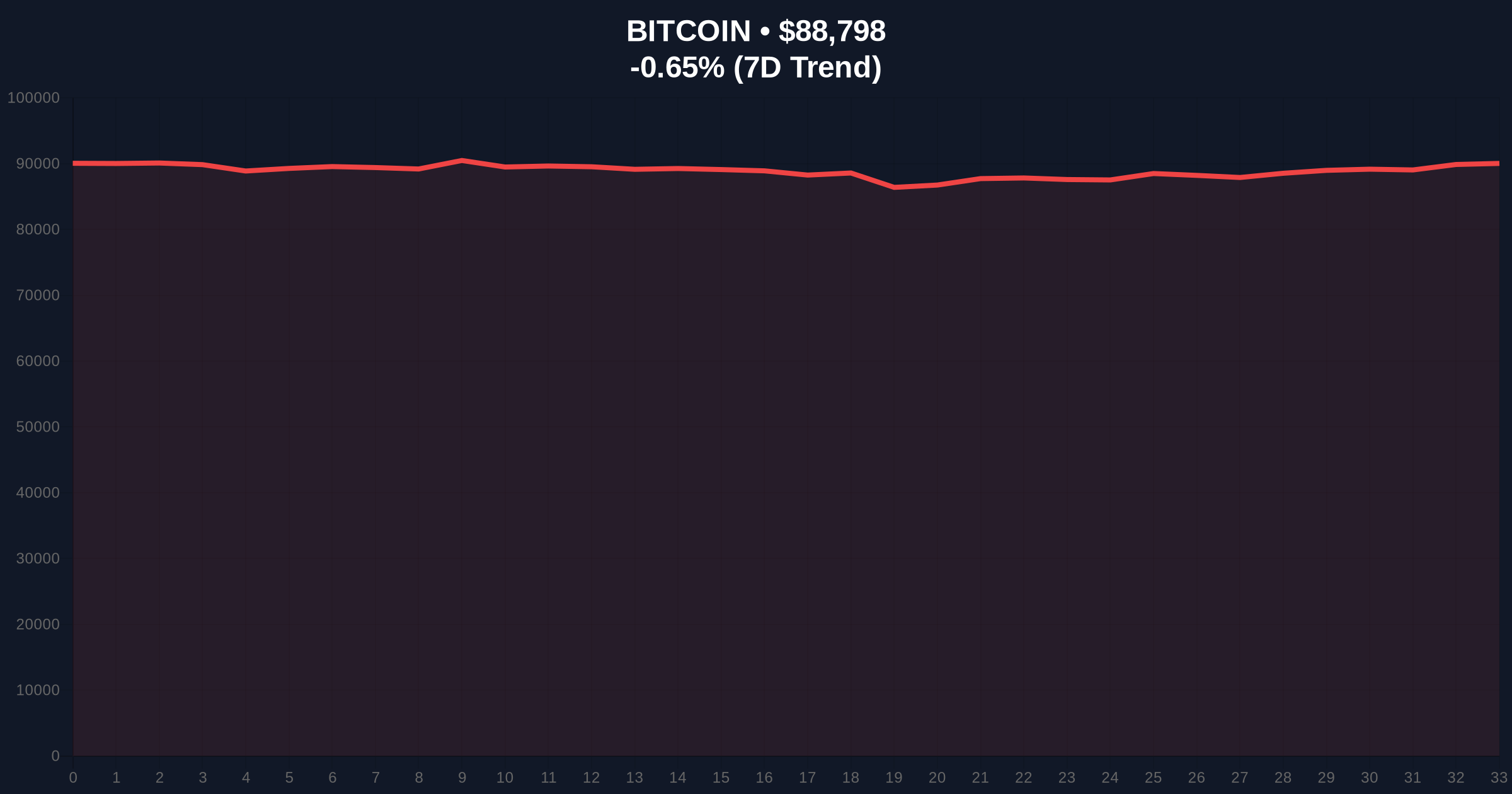

Market structure suggests the hashrate decline creates a temporary reduction in sell pressure from miners. Typically, miners sell Bitcoin to cover operational costs. This pause in selling could create a short-term supply deficit. However, Bitcoin's price action remains constrained within a broader consolidation pattern. The current price of $88,818 sits above critical Fibonacci support at $85,000 (the 0.618 retracement from the 2025 high). The 200-day moving average at $84,200 provides additional structural support. On-chain data from Glassnode indicates miner outflow volumes dropped 40% during the storm period, confirming the operational shift.

| Metric | Value | Implication |

|---|---|---|

| Bitcoin Hashrate | 663 EH/s | 7-month low, reduced network security |

| Profit Margin Increase | Up to 150% | Grid sales significantly outperform mining |

| Electricity Sale Price | 20¢/kWh | Peak grid demand pricing |

| Mining Revenue Equivalent | 8¢/kWh | Baseline mining profitability |

| Crypto Fear & Greed Index | 29/100 (Fear) | Broader market sentiment remains negative |

| Bitcoin Current Price | $88,818 | -0.62% 24h change |

This event provides real-world evidence of Bitcoin mining's potential as a grid-stabilizing asset. Institutional investors now view miners not just as Bitcoin producers but as energy arbitrage plays. Consequently, mining stock valuations may decouple from pure Bitcoin price correlation. The 150% profit surge demonstrates how flexible load management can transform mining economics. Retail market structure often overlooks these operational nuances, focusing solely on hashrate and difficulty adjustments. This profit opportunity emerged directly from physical infrastructure constraints during extreme weather, highlighting mining's unique position in energy markets.

"The ability to sell power back to the grid at 20 cents per kWh versus earning eight cents from mining creates an obvious economic incentive. This isn't just about surviving a storm—it's about optimizing asset utilization in real-time. We're seeing the maturation of mining from a monolithic operation into a sophisticated energy management business." — CoinMarketBuzz Intelligence Desk analysis of market implications.

Market technicians identify two primary scenarios based on current structure. First, if miners return to operations gradually, hashrate recovery could apply downward pressure on Bitcoin price as selling resumes. Second, prolonged grid participation might sustain reduced sell pressure, potentially creating a supply squeeze. The 12-month institutional outlook now incorporates energy arbitrage as a core component of mining profitability models, potentially attracting new capital from traditional energy investors.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.