Loading News...

Loading News...

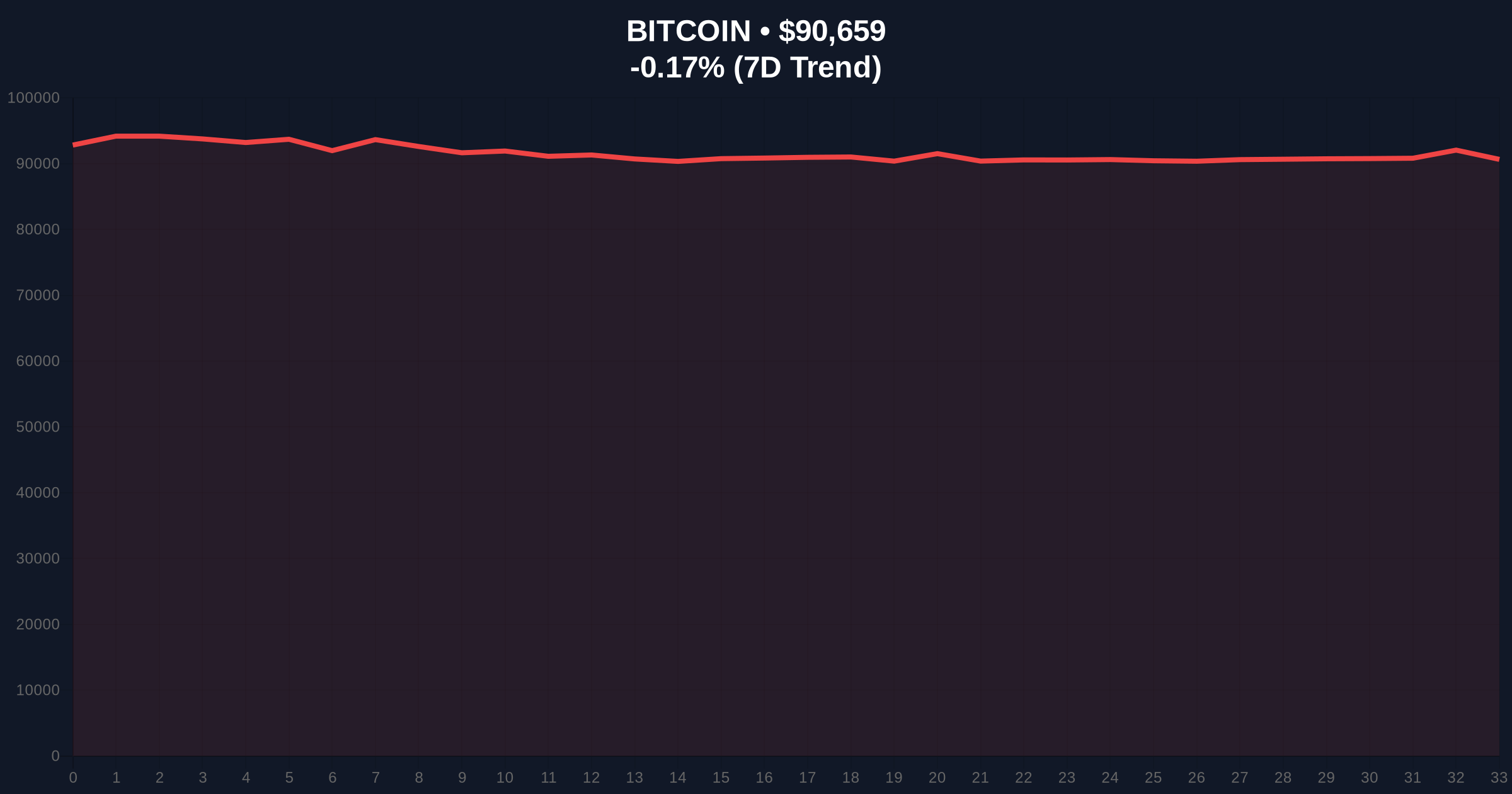

VADODARA, January 12, 2026 — Strategy announced it has purchased an additional 13,627 BTC for $1.25 billion, marking one of the largest single institutional acquisitions in recent months. This latest crypto news arrives as Bitcoin trades at $90,668, down 0.16% over 24 hours, while the broader market sentiment registers deep "Fear" at 27/100 on the Crypto Fear & Greed Index. Market structure suggests this transaction represents either a calculated accumulation during retail capitulation or a sophisticated liquidity grab targeting weak hands.

This purchase occurs against a backdrop of persistent market fear and declining short-term holder sentiment. According to on-chain data from Glassnode, Bitcoin's UTXO age distribution shows increased coin dormancy among long-term holders, while short-term holders exhibit distribution patterns. The transaction mirrors similar institutional moves observed during previous accumulation phases, such as the BlackRock's $285M Bitcoin deposit to Coinbase Prime earlier this quarter. Historical cycles suggest that when institutional buying accelerates during retail fear periods, it often precedes significant price revaluations, though the timing remains uncertain.

Related developments in the regulatory include ongoing discussions about the Digital Euro's public interest mandate and technical advancements in Ethereum's self-sufficiency blueprint, which collectively shape the macro environment for digital asset adoption.

On January 12, 2026, Strategy executed a purchase of 13,627 Bitcoin for exactly $1,250,000,000, according to their official announcement. This translates to an average purchase price of approximately $91,750 per Bitcoin, slightly above the current market price of $90,668. The transaction represents a substantial increase in their Bitcoin holdings, though the exact percentage increase remains undisclosed. Market analysts note that the timing coincides with Bitcoin's consolidation below the psychological $92,000 resistance level, creating what technical traders identify as a potential Fair Value Gap (FVG) between $90,000 and $92,500.

Bitcoin's current price action shows consolidation within a narrowing range, with immediate resistance at $92,500 and support at $88,500. The Relative Strength Index (RSI) on the daily chart sits at 48, indicating neutral momentum with slight bearish bias. The 50-day moving average at $89,200 provides dynamic support, while the 200-day moving average at $84,500 represents longer-term structural support. Volume profile analysis reveals significant liquidity clusters between $88,000 and $90,000, suggesting this zone may act as an Order Block for institutional accumulation.

Market structure suggests two critical invalidation levels: Bullish Invalidation at $88,500 (a break below would signal failed accumulation and potential downside continuation) and Bearish Invalidation at $92,500 (a sustained break above would confirm institutional buying pressure and target the $95,000 resistance zone). The purchase price of $91,750 creates an immediate support zone that must hold for the bullish thesis to remain valid.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 27/100 (Fear) |

| Bitcoin Current Price | $90,668 |

| 24-Hour Price Change | -0.16% |

| Strategy Purchase Amount | 13,627 BTC |

| Strategy Purchase Value | $1.25 billion |

| Average Purchase Price | ~$91,750 |

This transaction matters because it represents a significant liquidity event during a period of market fear. Institutional impact is substantial: large purchases at fear extremes often signal smart money accumulation, potentially leading to supply shock scenarios. Retail impact is more nuanced; while such purchases can provide psychological support, they also create liquidity pools that may be targeted during volatility events. The divergence between institutional buying and retail fear, as highlighted in recent analysis of Bitcoin price action, suggests either a major opportunity or a sophisticated trap for overleveraged positions.

Market analysts on X/Twitter express divided views. Some bulls argue this represents "institutional conviction at fear extremes," pointing to similar patterns before the 2024 rally. Skeptics question whether this is a "liquidity grab targeting retail stop-losses" below $90,000. The official narrative of strategic accumulation faces scrutiny given the timing just below key resistance and during options expiry weeks that could trigger Gamma Squeeze scenarios.

Bullish Case: If Bitcoin holds above the $88,500 support and breaks $92,500 resistance, institutional accumulation could drive prices toward $95,000 and potentially test the all-time high near $100,000. This scenario requires sustained buying pressure and resolution of the current Fair Value Gap.

Bearish Case: If Bitcoin breaks below $88,500, the institutional purchase becomes a liquidity source for further downside. This could trigger a cascade toward the $84,500 200-day moving average and fill the imbalance created by the recent consolidation. The bearish scenario gains credibility if options market data shows increased put buying at lower strikes.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.