Loading News...

Loading News...

VADODARA, January 15, 2026 — Citrea, a Bitcoin zero-knowledge rollup project, has launched its dollar-pegged stablecoin ctUSD, according to CoinDesk. This latest crypto news marks a strategic liquidity grab within Bitcoin's Layer 2 ecosystem, with the stablecoin backed 1:1 by short-term U.S. Treasury bills and cash, issued by MoonPay. Market structure suggests this move could recalibrate on-chain liquidity profiles and test existing support levels amid current greed sentiment.

The launch occurs against a backdrop of accelerating Bitcoin Layer 2 development, following the activation of OP_CAT in Taproot upgrades which enabled more complex smart contract functionality. Historically, stablecoin deployments on emerging chains have served as liquidity anchors, often preceding significant capital inflows. Underlying this trend is a broader institutional push for yield-generating assets within crypto-native frameworks, mirroring the 2021 DeFi summer but with enhanced regulatory clarity. Consequently, ctUSD enters a market where competing stablecoins like USDT and USDC dominate, but Bitcoin-specific solutions remain nascent. Related developments include Coinbase's recent perpetual futures listings and Bitmine's large ETH acquisition, both indicating aggressive liquidity positioning.

On January 15, 2026, Citrea officially launched ctUSD, a stablecoin pegged to the U.S. dollar and backed by short-term Treasury bills and cash reserves. According to CoinDesk, the stablecoin is issued by MoonPay and designed to serve as the primary liquidity standard within the Citrea ecosystem. This deployment leverages zero-knowledge rollup technology to enable scalable transactions on Bitcoin's base layer, utilizing zk-SNARKs for privacy and efficiency. The 1:1 backing with Treasuries aligns with recent regulatory guidance from the SEC.gov on asset-backed tokens, providing a compliance framework that may reduce counterparty risk. Market analysts note this could attract institutional capital seeking yield in a low-rate environment, similar to traditional money market funds but on-chain.

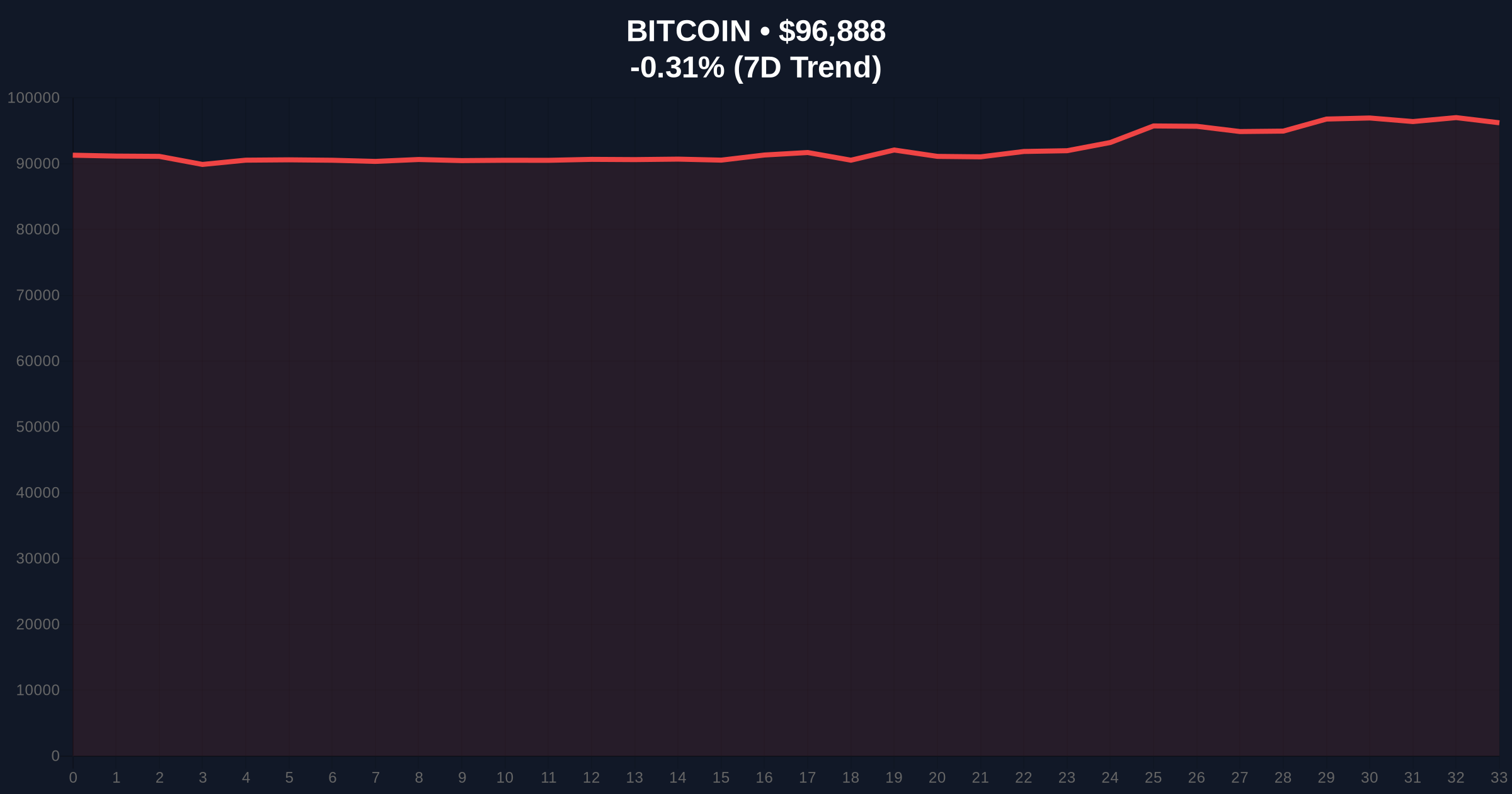

Bitcoin's price action shows consolidation around $96,850, with a 24-hour trend of -0.35%. Volume profile analysis indicates thinning liquidity above $98,500, creating a potential Fair Value Gap (FVG) that may need filling. The Relative Strength Index (RSI) sits at 58, suggesting neutral momentum without overbought conditions. A critical order block exists at $95,200, coinciding with the 50-day moving average, which has acted as dynamic support in recent weeks. Bullish invalidation is set at $95,200; a break below this level would signal weakening demand and potential retest of lower supports near $92,000. Bearish invalidation rests at $99,800, where a sustained move above could trigger a gamma squeeze towards all-time highs. On-chain data from Glassnode indicates increased UTXO age bands for coins held 3-6 months, suggesting accumulation phases that may support upward pressure if ctUSD adoption drives net inflows.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 61/100 (Greed) | Elevated risk appetite, potential for volatility |

| Bitcoin Current Price | $96,850 | Consolidation near key resistance |

| 24-Hour Price Trend | -0.35% | Minor correction within range |

| Market Rank | #1 | Dominance intact amid altcoin flows |

| Stablecoin Backing | 1:1 U.S. Treasuries & Cash | Reduced counterparty risk vs. algorithmic models |

This development matters because it introduces a regulated, yield-bearing stablecoin directly into Bitcoin's Layer 2 stack, potentially altering capital efficiency and liquidity dynamics. For institutions, ctUSD offers a compliant on-ramp for Treasury exposure without traditional custody hurdles, as outlined in FederalReserve.gov monetary policy reports on digital asset integration. For retail users, it provides a stable medium of exchange within Citrea's ecosystem, reducing volatility exposure in DeFi applications. The long-term impact hinges on adoption rates; high usage could siphon liquidity from competing chains, reinforcing Bitcoin's modular scalability thesis. Conversely, low uptake may highlight fragmentation risks in multi-chain stablecoin markets.

Market sentiment on X/Twitter is cautiously optimistic, with analysts highlighting the strategic timing amid greed sentiment. One commentator noted, "ctUSD's Treasury backing is a smart hedge against inflation, but the real test is whether it can capture meaningful TVL." Others point to potential regulatory scrutiny, given MoonPay's role as issuer and existing SEC frameworks. Bulls argue this could catalyze a liquidity grab similar to early Ethereum DeFi phases, while bears warn of oversaturation in stablecoin markets. Overall, the tone reflects a wait-and-see approach, with focus on initial adoption metrics and on-chain flow data.

Bullish Case: If ctUSD achieves rapid adoption, driving net inflows into Bitcoin's Layer 2, Bitcoin could break above $99,800 resistance, targeting $105,000 as momentum accelerates. This scenario assumes sustained greed sentiment and no major macroeconomic shocks, with the stablecoin acting as a liquidity sink that reduces selling pressure. Historical cycles suggest such developments often precede 15-20% rallies over 3-6 months.

Bearish Case: If ctUSD fails to gain traction or faces regulatory hurdles, Bitcoin may reject at current levels, breaking below $95,200 support and testing $92,000. This would indicate weakening market structure and potential deleveraging, especially if greed sentiment reverts to fear. A drop below the 200-day moving average near $89,500 could signal a deeper correction phase.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.