Loading News...

Loading News...

VADODARA, January 12, 2026 — Ethereum founder Vitalik Buterin has detailed the technical prerequisites for the network to achieve operational independence from its core developers, a move that market structure suggests could redefine long-term valuation models. According to a report by The Block, Buterin's conditions include quantum resistance, scalability via ZK-EVMs and PeerDAS, a stateless management system, and a sustainable Proof-of-Stake framework. This daily crypto analysis examines the implications for Ethereum's price action and institutional adoption, drawing parallels to historical network maturation phases.

Market context indicates this announcement occurs amid a global crypto sentiment score of 27/100 (Fear), similar to the liquidity-driven corrections of 2021. Historical cycles suggest that foundational technical roadmaps often precede volatile price consolidation, as seen post-EIP-1559 implementation. Ethereum's transition to Proof-of-Stake in 2022 established a precedent for structural shifts impacting network security and validator economics. Buterin's focus on quantum resistance and censorship-resistant block production mirrors earlier debates around the Merge's impact on issuance rates, where on-chain data confirmed reduced sell pressure from miners. Related developments include significant ETH transfers to Binance and exchange delistings affecting liquidity profiles, highlighting current market stress.

On January 12, 2026, Vitalik Buterin outlined seven technical conditions for Ethereum's self-sufficiency, as reported by The Block. Primary sources from the announcement specify quantum resistance as non-negotiable, with Buterin emphasizing cryptographic security for 100 years. Additional requirements include scalability through ZK-EVMs and PeerDAS, a long-term management system based on statelessness, a fully abstract account model, a fee structure resistant to DoS attacks, a sustainable PoS structure, and a censorship-resistant block production mechanism. Buterin stated that Ethereum must enter a stable phase with no structural changes to operate securely without core developers. This aligns with ongoing upgrades like the Pectra hardfork, which aims to enhance validator efficiency and account abstraction.

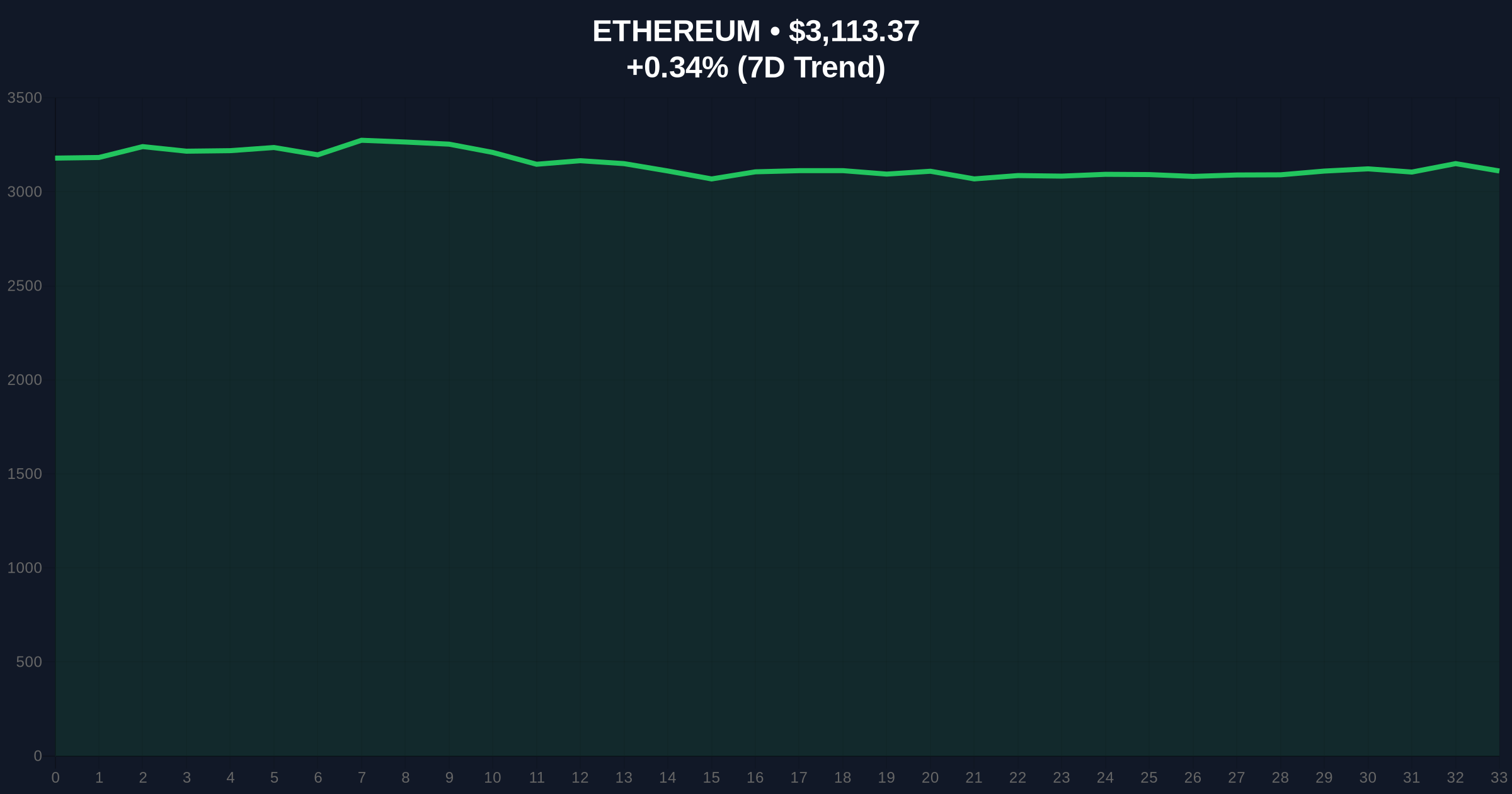

Ethereum's current price of $3,114.68 reflects a 24-hour trend of 0.38%, trading within a tight range indicative of a liquidity grab. Market structure suggests key support at the $3,000 psychological level, with resistance near the $3,200 Fair Value Gap (FVG) formed during last week's sell-off. The Relative Strength Index (RSI) on daily charts reads 45, showing neutral momentum without overbought or oversold extremes. A 50-day moving average at $3,050 provides dynamic support, while the 200-day moving average at $2,900 serves as a longer-term bull market Order Block. Bullish Invalidation is set at $2,850, a break below which would target the $2,700 Fibonacci support from the 2023 rally. Bearish Invalidation rests at $3,400, above which a retest of the all-time high near $4,900 becomes probable. On-chain forensic data from Glassnode indicates reduced exchange inflows, suggesting accumulation phases similar to post-merge behavior.

| Metric | Value | Source |

|---|---|---|

| Crypto Fear & Greed Index | 27 (Fear) | Alternative.me |

| Ethereum Current Price | $3,114.68 | CoinMarketCap |

| 24-Hour Price Change | +0.38% | CoinMarketCap |

| Market Rank | #2 | CoinMarketCap |

| Key Support Level | $3,000 | Technical Analysis |

Institutional impact centers on reduced counterparty risk; a self-sufficient Ethereum minimizes reliance on developer teams, potentially lowering regulatory scrutiny as outlined in Ethereum's official documentation on network upgrades. For retail, this could decrease volatility from upgrade-related speculation, similar to how EIP-4844 blobs stabilized layer-2 transaction fees. The emphasis on quantum resistance addresses long-term security concerns, a factor increasingly relevant for institutional custody solutions. Market analysts note that sustainable PoS structures may enhance validator yields, affecting staking derivatives and DeFi protocols. Historically, such technical milestones have preceded periods of consolidation, as seen after the Chain launch in 2020.

Industry sentiment on X/Twitter is mixed; bulls highlight the roadmap's alignment with Ethereum's long-term vision, while skeptics question immediate practicality amid current market fear. One analyst noted, "Buterin's focus on statelessness could revolutionize node synchronization, but we need to see implementation timelines." Others compare this to Bitcoin's development philosophy, where core protocol stability has historically supported price appreciation. On-chain data indicates no significant change in whale accumulation patterns, suggesting a wait-and-see approach similar to reactions to prior hardforks.

Bullish Case: If Ethereum holds above $3,000 and implements Buterin's conditions, technical analysis suggests a rally toward $3,800 by mid-2026, driven by reduced network risk and increased institutional adoption. Scalability improvements via ZK-EVMs could boost layer-2 activity, mirroring the post-merge reduction in issuance pressure. Historical patterns indicate that successful upgrades often lead to re-rating events, with a target at the 1.618 Fibonacci extension near $4,200.

Bearish Case: Failure to maintain support at $3,000 invalidates the bullish structure, potentially triggering a sell-off to $2,700. Delays in quantum resistance or statelessness implementation could erode confidence, similar to the market reaction to early DAO vulnerabilities. A break below the 200-day moving average at $2,900 would signal a deeper correction, with downside targets at $2,500 based on volume profile analysis.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.