Loading News...

Loading News...

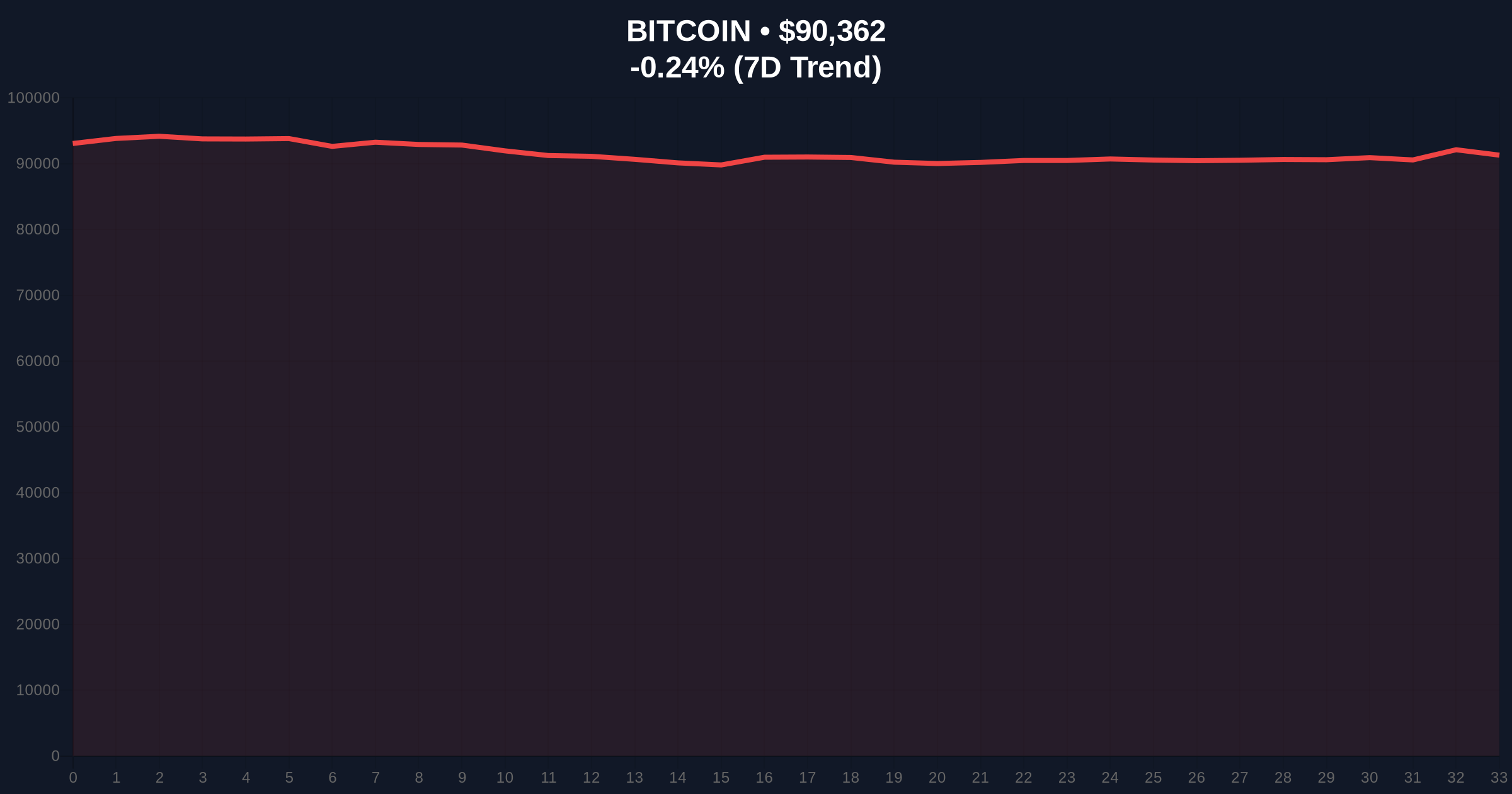

VADODARA, January 12, 2026 — Bitcoin's price action continues its upward trajectory to $90,386, yet on-chain data from CryptoQuant reveals a stark divergence: short-term holders are selling at a loss, with the Spent Output Profit Ratio (SOPR) below one for approximately 70 days. This daily crypto analysis examines the historical precedent where such fear among retail investors has often preceded significant rallies, presenting a potential buying opportunity for contrarian strategies.

Market structure suggests this scenario mirrors the 2021 correction phase, where short-term holder SOPR remained depressed during consolidation before a breakout. According to historical cycles, similar divergences between price and sentiment have acted as liquidity grabs, shaking out weak hands before institutional accumulation. The current environment, with Bitcoin testing key psychological levels, echoes past patterns where retail fear provided fuel for sustained upward moves. Related developments include digital asset funds experiencing weekly outflows and uncertainty around Bitcoin's political hedge narrative, adding layers to the market's complexity.

According to an analysis by CryptoQuant contributor gaah_im, the Short-Term Holder SOPR has stayed below one for about 70 days, indicating that individual investors are consistently realizing losses. This metric, which tracks the profit/loss ratio of coins moved by holders with a lifespan of less than 155 days, shows persistent fear despite Bitcoin's price rally. The analyst noted that historically, such a divergence—where prices rise while retail sentiment remains negative—has presented buying opportunities, as it often signals capitulation before a broader market move.

On-chain data indicates Bitcoin is currently trading at $90,386, with a 24-hour trend of -0.22%, reflecting minor consolidation. Key support levels include the $88,500 zone, which aligns with a Fibonacci retracement level from the recent high, and the $85,000 order block where significant volume profile accumulation occurred. Resistance is noted at $92,000, a previous fair value gap (FVG) that needs to be filled for bullish continuation. The RSI on daily charts hovers near 60, suggesting neutral momentum without overbought conditions. Bullish invalidation is set at $85,000; a break below this level would negate the positive divergence thesis. Bearish invalidation lies at $95,000, where a breakout could trigger a gamma squeeze in options markets.

| Metric | Value | Source |

|---|---|---|

| Bitcoin Current Price | $90,386 | Live Market Data |

| 24-Hour Trend | -0.22% | Live Market Data |

| Market Rank | #1 | Live Market Data |

| Crypto Fear & Greed Index | 27/100 (Fear) | Live Market Data |

| Short-Term Holder SOPR Below 1 Duration | ~70 days | CryptoQuant |

This divergence matters because it highlights a disconnect between retail behavior and institutional price action, often a precursor to market shifts. For institutional investors, sustained SOPR below one suggests retail capitulation, reducing sell-side pressure and creating a favorable environment for accumulation. Retail impact is heightened fear, potentially leading to missed opportunities if sentiment doesn't align with macro trends. The Federal Reserve's monetary policy, as detailed on FederalReserve.gov, influences liquidity flows, making such on-chain signals critical for timing entries in volatile markets.

Market analysts on X/Twitter are divided: bulls argue this SOPR pattern echoes 2020-2021 cycles where fear preceded rallies, while bears point to external pressures like regulatory gamma squeezes highlighted in recent Dubai DIFC developments. No direct quotes from figures like Michael Saylor are available, but sentiment leans toward cautious optimism, with many noting the need to monitor order blocks for confirmation.

Bullish Case: If Bitcoin holds above $88,500 and SOPR reverts above one, historical patterns indicate a rally toward $100,000 could unfold, driven by institutional inflows and reduced retail selling. This scenario assumes no major black swan events, such as network fragility issues seen in altcoin networks.

Bearish Case: A break below $85,000 invalidates the bullish thesis, potentially leading to a test of $80,000 support. This could occur if macroeconomic factors, like interest rate hikes, exacerbate fear, pushing SOPR further into negative territory.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.