Loading News...

Loading News...

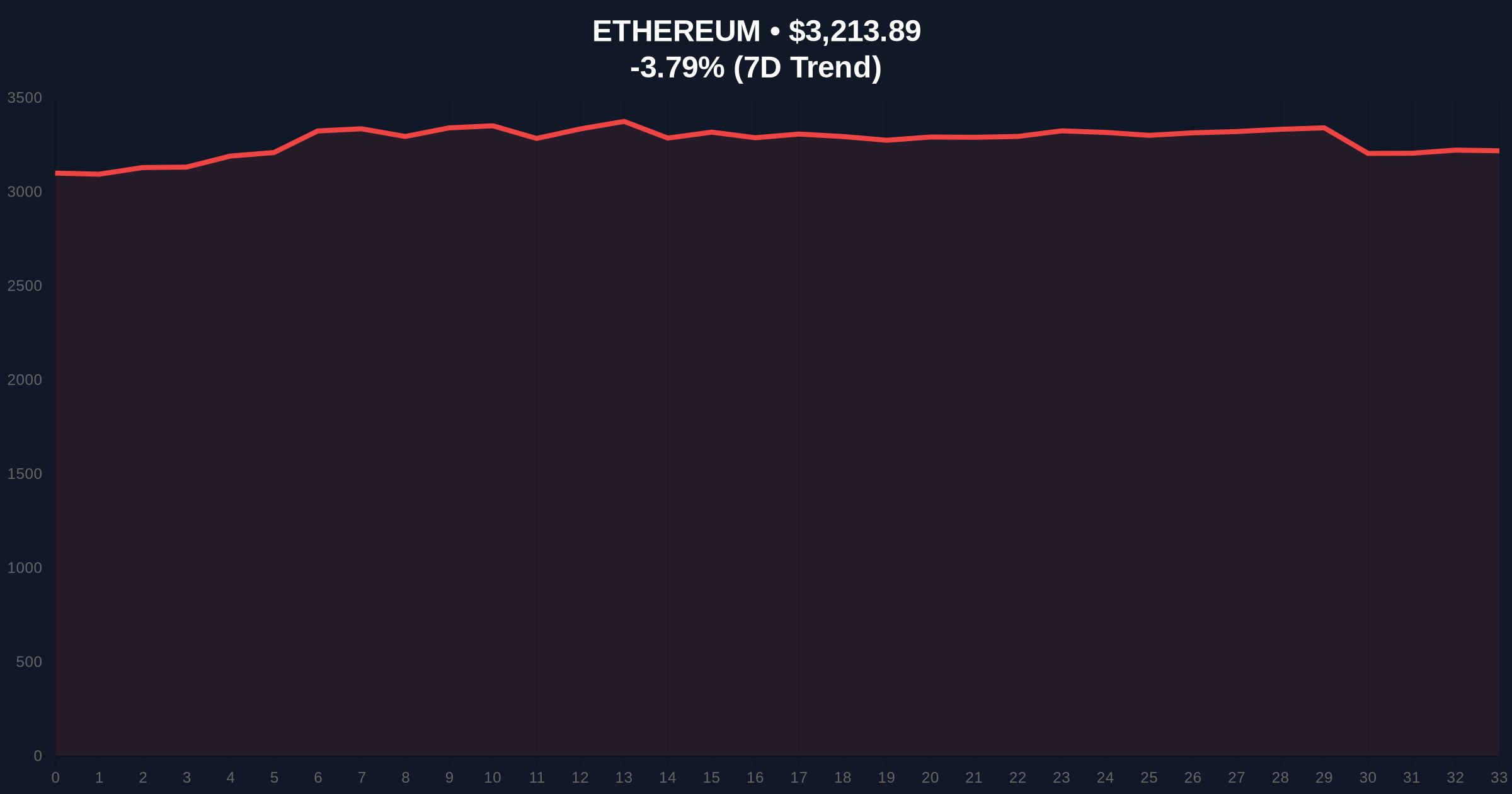

VADODARA, January 19, 2026 — Ethereum staking participation has reached a critical inflection point, with approximately 30% of the total ETH supply now locked in validation contracts according to Solid Intel data. This daily crypto analysis reveals a fundamental network strengthening occurring simultaneously with a 3.83% price decline to $3,214.79, creating a divergence between on-chain fundamentals and spot market sentiment that warrants forensic examination.

The staking ratio's ascent to 30% represents the culmination of a three-year trend accelerated by Ethereum's transition to proof-of-stake consensus. Historical cycles suggest that staking thresholds above 25% typically correlate with reduced liquid supply volatility, as evidenced by post-merge issuance mechanics detailed in Ethereum's official documentation. Underlying this trend is the cumulative effect of validator rewards compounding at approximately 4% APR, creating a structural sink for ETH tokens. This development occurs alongside other market movements, including Bitcoin's consolidation near $93,000 and Injective's deflationary tokenomics vote, indicating broader ecosystem maturation beyond simple price speculation.

According to Solid Intel's on-chain analytics, the staked ETH quantity reached an all-time high of precisely 30% of the total circulating supply as of January 18, 2026. CoinMarketCap data confirms ETH trading at $3,214.79 with a 3.83% decline during the same reporting period. Market structure suggests this price action represents a liquidity grab below the $3,300 psychological level, where significant resting bids were likely clustered. The simultaneous occurrence of record staking and price decline creates a Fair Value Gap between network security valuation and market pricing that may resolve through either price appreciation or validator exit pressure.

Volume profile analysis indicates concentrated liquidity between $3,100 and $3,250, with the current price sitting at the upper boundary of this order block. The 200-day moving average at $3,050 provides additional confluence for support. RSI readings at 42 suggest neutral momentum rather than oversold conditions, indicating room for further downside. Bullish Invalidation is set at $3,350—a break above this level would invalidate the current corrective structure and target the $3,500 resistance zone. Bearish Invalidation rests at $3,100; sustained trading below this level would confirm a deeper correction toward the $2,900 Fibonacci support derived from the 0.618 retracement of the November-December rally.

| Metric | Value | Source |

|---|---|---|

| Staked ETH Percentage | 30% | Solid Intel |

| ETH Current Price | $3,214.69 | CoinMarketCap |

| 24-Hour Price Change | -3.76% | CoinMarketCap |

| Crypto Fear & Greed Index | 44/100 (Fear) | Alternative.me |

| Market Capitalization Rank | #2 | CoinMarketCap |

For institutional portfolios, the 30% staking threshold reduces liquid supply by approximately 36 million ETH, creating structural scarcity that could amplify price movements during demand surges. However, this also introduces systemic risk through the validator exit queue mechanism—during market stress, a surge in unstaking requests could create selling pressure with a 27-day delay, potentially exacerbating downturns. Retail traders face increased opportunity cost for liquid ETH holdings, as staking yields now compete more aggressively with trading returns. The Federal Reserve's monetary policy decisions, particularly regarding interest rates, will influence this calculus as staking APRs are weighed against traditional yield alternatives.

Market analysts on X/Twitter highlight the divergence between network fundamentals and price action. One quantitative researcher noted, "The staking ratio increase suggests long-term holder conviction, but the price decline indicates short-term liquidity preference shifting to other assets." Bulls point to the reduced sell pressure from staked tokens, while bears emphasize the potential for validator profit-taking if prices approach all-time highs. The sentiment remains bifurcated, with technical traders focusing on the $3,100 support test and fundamental analysts emphasizing the network security implications of increased stake.

Bullish Case: If the $3,100 support holds and staking continues to accelerate, reduced liquid supply could catalyze a gamma squeeze above $3,350. This scenario would target the $3,500 resistance zone by Q1 2026, with potential extension to $3,800 if Bitcoin ETF inflows resume as detailed in recent Bitcoin leverage analysis.

Bearish Case: A break below $3,100 would invalidate the current support structure, triggering stop-loss orders and targeting the $2,900 Fibonacci level. Sustained fear sentiment could push staking yields higher as price declines, creating a negative feedback loop that tests the $2,700 volume gap from October 2025.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.