Loading News...

Loading News...

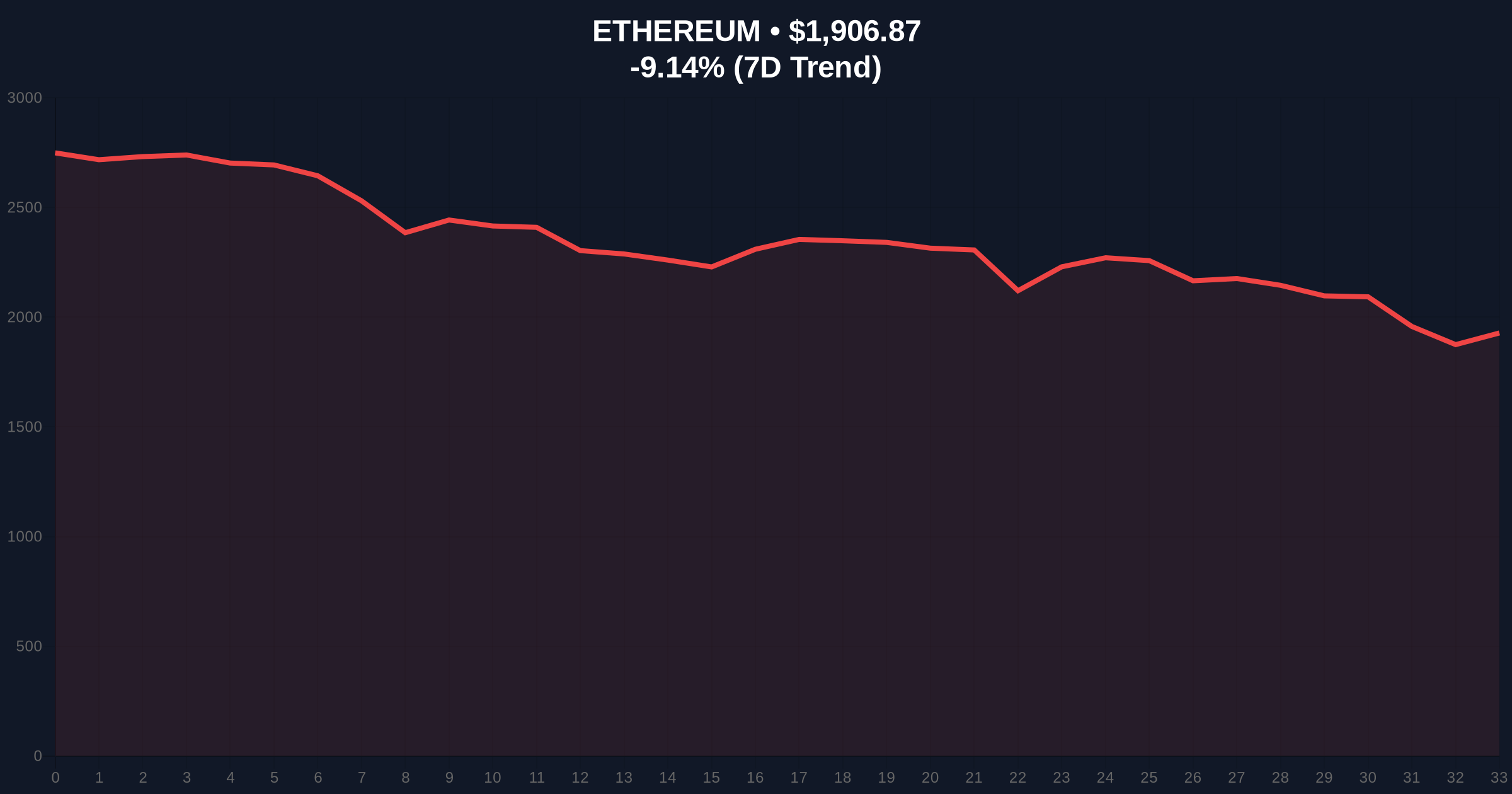

VADODARA, February 6, 2026 — U.S. spot Ethereum ETFs recorded a net outflow of $80.79 million on February 5, marking the second consecutive trading day of capital flight. This daily crypto analysis reveals institutional positioning shifts amid deteriorating market sentiment. According to TraderT data, BlackRock's ETHA saw -$8.51 million in outflows, Fidelity's FETH lost -$55.78 million, and Grayscale's ETHE bled -$27.08 million. Invesco's QETH and Grayscale's ETH (Mini) provided minor inflows of $3.53 million and $7.05 million respectively, failing to offset the broader exodus.

TraderT's flow data reveals a clear institutional rotation. Fidelity's FETH accounted for 69% of the total outflow, suggesting concentrated selling pressure from a single major provider. This pattern mirrors historical liquidity grabs during market stress. The consecutive outflow days indicate a trend rather than isolated profit-taking. Market structure suggests institutions are reallocating capital amid rising volatility. Consequently, this creates a Fair Value Gap (FVG) between ETF NAV and spot price.

Historically, ETF outflows during Extreme Fear periods precede short-term price capitulation. The current 9.16% ETH price decline aligns with this pattern. Underlying this trend is a broader market-wide liquidity crisis, as detailed in our analysis of the market-wide plunge driven by liquidity factors. This mirrors the 2021 cycle when consecutive ETF outflows preceded a 30% correction. In contrast, the 2023-2024 accumulation phase saw consistent inflows despite volatility.

Ethereum currently trades at $1,906.37, down 9.16% in 24 hours. The price sits near the 0.618 Fibonacci retracement level from the October 2025 high. Volume profile analysis shows increased selling volume at the $1,950 resistance zone. The 50-day moving average at $2,150 now acts as dynamic resistance. RSI readings at 28 indicate oversold conditions, but institutional outflows suggest further downside pressure. Market structure suggests a test of the $1,850 support cluster formed by previous order blocks.

| Metric | Value |

|---|---|

| Total ETF Net Outflow (Feb 5) | $80.79M |

| Fidelity FETH Outflow | -$55.78M |

| ETH Current Price | $1,906.37 |

| 24-Hour Price Change | -9.16% |

| Crypto Fear & Greed Index | Extreme Fear (9/100) |

| Consecutive Outflow Days | 2 |

ETF flows serve as a real-time institutional sentiment gauge. The $80.79 million outflow represents capital redeployment from crypto to traditional assets. This impacts Ethereum's market structure by reducing buy-side liquidity. According to the Federal Reserve's monetary policy documentation, such movements often correlate with broader risk-off environments. The outflow creates a supply overhang that must be absorbed before sustainable recovery. Consequently, retail traders face increased volatility from institutional rebalancing.

"The concentrated outflow from Fidelity's product suggests systematic risk management rather than fundamental ETH concerns. Market participants should monitor the $1,850 support level for potential gamma squeeze scenarios if options positioning becomes unbalanced." — CoinMarketBuzz Intelligence Desk

Two technical scenarios emerge from current market structure. The bearish scenario involves breakdown below $1,850 targeting the $1,750 liquidity zone. The bullish scenario requires reclaiming $2,000 to invalidate the downtrend. Historical cycles suggest 12-month recovery patterns after similar outflow events.

The 12-month institutional outlook depends on ETF flow stabilization. If outflows persist beyond three consecutive days, a deeper correction becomes probable. However, post-merge issuance mechanics provide fundamental support absent in previous cycles. The Pectra upgrade's potential efficiency improvements, as outlined in Ethereum's official documentation, could alter long-term valuation models.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.