Loading News...

Loading News...

VADODARA, February 3, 2026 — U.S. spot Bitcoin ETFs snapped a five-day outflow streak with $562.62 million in net inflows on February 2. This daily crypto analysis reveals a critical liquidity shift. TraderT data confirms the reversal. BlackRock and Fidelity led the charge. Market structure suggests institutional accumulation amid retail panic.

According to data compiled by TraderT, U.S. spot Bitcoin ETFs recorded $562.62 million in net inflows on February 2. This marks the first positive flow in five trading days. The inflows were not uniform. BlackRock's IBIT attracted $142.72 million. Fidelity's FBTC saw $153.35 million. Bitwise's BITB added $96.5 million. Ark Invest's ARKB gained $65.07 million. Invesco's BTCO contributed $10.09 million. VanEck's HODL brought in $24.34 million. Grayscale's Mini BTC secured $67.24 million. The data indicates concentrated buying from top-tier issuers.

Historically, ETF inflow reversals after sustained outflows often precede local price bottoms. This pattern mirrors the January 2024 cycle. In contrast, the current Extreme Fear sentiment score of 17/100 creates a contrarian signal. Underlying this trend is a classic liquidity grab. Institutions appear to be buying the dip while retail sentiment remains negative. The five-day outflow streak represented a Fair Value Gap (FVG) that is now being filled.

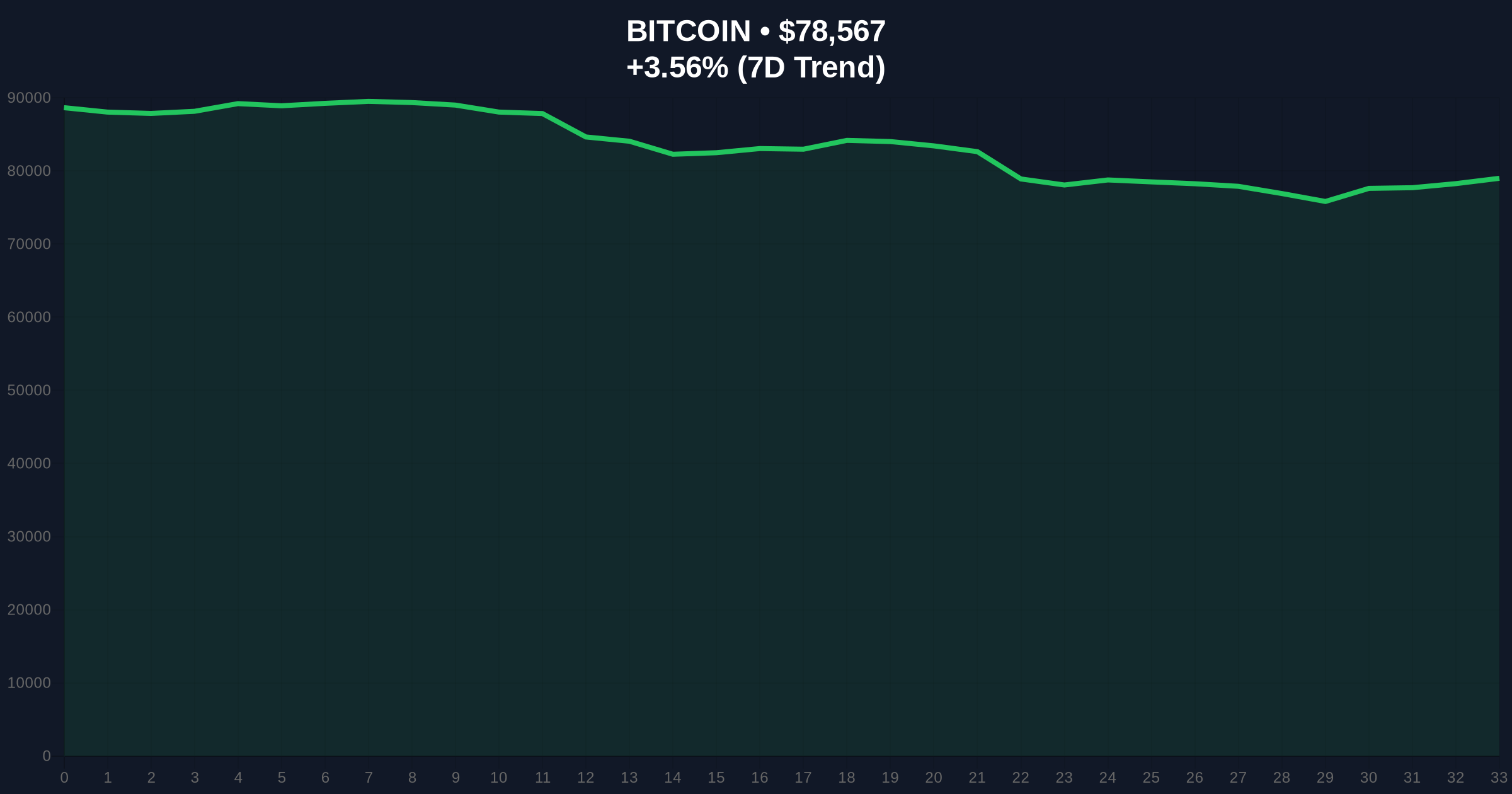

Related developments in this fear-driven market include Bitcoin's recent price action below $78,000 and DBS Bank's accumulation of 25,000 ETH, highlighting broader institutional activity.

Bitcoin currently trades at $78,578. The 24-hour trend shows a 3.57% increase. On-chain data indicates strong support at the Fibonacci 0.618 retracement level of $75,000. This level aligns with a high-volume node on the Volume Profile. The RSI sits at 42, suggesting neutral momentum. The 50-day moving average at $81,200 acts as immediate resistance. Market structure suggests this ETF inflow is testing that Order Block. A break above could trigger a short squeeze.

| Metric | Value |

|---|---|

| Net ETF Inflows (Feb 2) | $562.62M |

| Bitcoin Current Price | $78,578 |

| 24-Hour Price Change | +3.57% |

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) |

| Days Since Last Net Inflow | 5 |

This matters for portfolio allocation. ETF flows directly impact Bitcoin's liquid supply. According to the SEC's official ETF monitoring framework, sustained inflows can reduce exchange reserves. That creates upward pressure on price. Institutional liquidity cycles often lead retail moves by 2-3 weeks. The current inflow suggests smart money is positioning for a reversal. Retail market structure remains fearful. This divergence typically resolves with a violent move up.

The $562 million inflow is a significant liquidity grab. It occurred precisely when the Fear & Greed Index hit extreme levels. This is not coincidence. It's institutional accumulation. The key level to watch is $75,000. If that holds, we likely saw the local bottom.

— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios. The bullish case requires breaking the $81,200 resistance. That would confirm a trend reversal. The bearish case depends on holding the $75,000 support. A break below invalidates the current accumulation thesis.

The 12-month institutional outlook remains positive. ETF inflows support a structural bid. This aligns with the 5-year horizon of increasing Bitcoin adoption. However, macro factors like Federal Reserve policy could introduce volatility. The current inflow provides a cushion against immediate downside.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.