Loading News...

Loading News...

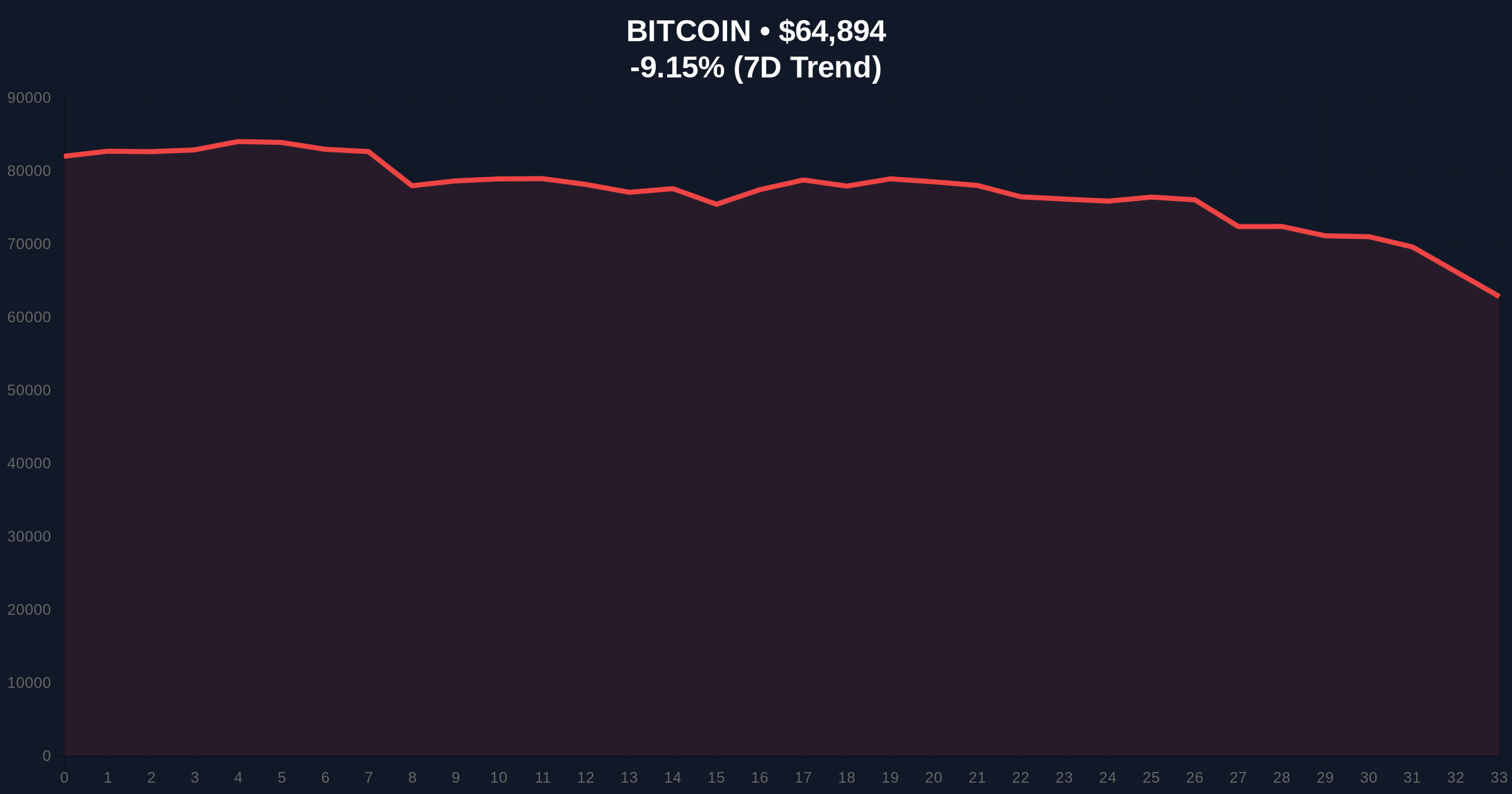

VADODARA, February 6, 2026 — Bitcoin futures markets experienced a historic liquidity grab, with long positions liquidated to the tune of $1.42 billion over 24 hours, marking the largest single-day long liquidation event of 2026. According to on-chain data from major futures platforms, this latest crypto news highlights a severe market correction that saw BTC price drop 8.90% to $64,988, triggering cascading sell-offs across major assets.

Market structure suggests a coordinated deleveraging event unfolded on February 5-6, 2026. Per the source data from Coinness, estimated liquidation volumes for major crypto perpetual futures revealed Bitcoin dominated with $1.42 billion liquidated, of which 84.41% were long positions. Ethereum followed with $580 million liquidated (79.11% longs), and Solana saw $186 million liquidated (88.71% longs). This data indicates a broad-based unwinding of leveraged bullish bets, not isolated to a single asset.

Consequently, the high percentage of long liquidations points to a classic gamma squeeze scenario, where forced selling amplified downward momentum. Underlying this trend, open interest metrics likely contracted sharply, reducing overall market leverage but creating significant Fair Value Gaps (FVGs) on lower timeframes. The event's timing aligns with a breakdown below key moving averages, exacerbating the liquidation cascade.

Historically, liquidation events of this magnitude often precede major trend reversals or capitulation phases. For instance, the 2021 bull market saw similar long liquidation spikes during the May 2021 correction, where Bitcoin shed over 50% from its all-time high. In contrast, the current event occurs amid broader macroeconomic headwinds, including potential Federal Reserve policy shifts, which have increased correlation between crypto and traditional risk assets.

, this liquidation spike mirrors patterns observed during the 2018 bear market, where sustained selling pressure led to prolonged downtrends. However, today's market benefits from deeper institutional liquidity and ETF adoption, potentially cushioning the fall. Related developments include increased regulatory scrutiny, as seen in Illinois's proposed Bitcoin reserve bill, which could influence long-term demand dynamics.

Technical analysis reveals critical levels that defined this event. Bitcoin broke below its 50-day and 200-day exponential moving averages, triggering stop-loss orders clustered around $68,000. The sell-off accelerated through a key Order Block at $66,500, leading to the liquidation cascade. On-chain data from Glassnode indicates a surge in UTXO (Unspent Transaction Output) age bands moving to younger coins, signaling panic selling by recent buyers.

, the Relative Strength Index (RSI) plunged into oversold territory below 30, suggesting a potential short-term bounce. However, volume profile analysis shows significant selling volume at $65,000-$67,000, establishing this zone as a future resistance area. A critical Fibonacci retracement level from the 2025 low to the 2026 high sits at $62,500 (0.618 level), which now acts as a major support test. If this level fails, it could invalidate the broader bullish structure.

| Metric | Value |

|---|---|

| Bitcoin 24h Long Liquidations | $1.42B |

| BTC Long Liquidation Ratio | 84.41% |

| Current Bitcoin Price | $64,988 |

| 24h Price Change | -8.90% |

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) |

This event matters because it represents a significant reset in market leverage, which can reduce volatility and set the stage for healthier price discovery. Institutional liquidity cycles often pivot after such flush-outs, as seen in post-ETF adoption phases. Retail market structure, however, faces heightened risk, with many leveraged positions wiped out, potentially leading to decreased participation in the short term.

Real-world evidence includes increased implied volatility, nearing levels last seen during the FTX collapse, as detailed in our analysis of Bitcoin implied volatility. Additionally, capitulation indicators have hit two-year highs, fueling the extreme fear sentiment captured by the current Fear & Greed Index. This environment tests the resilience of long-term holders and could accelerate regulatory discussions around futures market oversight.

Market structure suggests this liquidation event was inevitable given the overleveraged conditions in perpetual futures markets. The high long ratio indicates excessive bullish sentiment that needed correction. We view this as a necessary cleanse, though it introduces near-term downside risk until support levels are reclaimed. Historical cycles show that such events often mark local bottoms, but confirmation requires on-chain accumulation signals.

— CoinMarketBuzz Intelligence Desk

Based on current market structure, two data-backed technical scenarios emerge. First, a bullish reversal could occur if Bitcoin holds above the Fibonacci 0.618 support at $62,500 and reclaims the $68,000 resistance zone. This would signal that the liquidation flush has exhausted selling pressure. Second, a bearish continuation might unfold if support breaks, targeting the next major level at $58,000, based on volume profile voids.

The 12-month institutional outlook hinges on macroeconomic factors, including Federal Reserve policy and ETF inflows. If liquidity conditions improve, as hinted by potential state-level adoption like Illinois's Bitcoin reserve proposal, Bitcoin could see a recovery toward previous highs. However, sustained fear may prolong consolidation, aligning with a 5-year horizon where such events are viewed as volatility spikes in a maturing asset class.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.