Loading News...

Loading News...

VADODARA, December 31, 2025 — The Ethereum mainnet recorded an unprecedented 2.2 million daily transactions this week, marking an all-time high while average transaction fees collapsed to 17 cents. This surge in network activity occurs against a backdrop of extreme fear in global crypto markets, with the Fear & Greed Index registering 21/100. According to on-chain data, this divergence between fundamental network strength and market sentiment creates a significant Fair Value Gap that quantitative analysts are monitoring closely. This latest crypto news highlights Ethereum's evolving utility despite broader market headwinds.

Market structure suggests this transaction surge mirrors patterns observed during the 2021 bull market, when Ethereum's London hard fork (EIP-1559) similarly decoupled network activity from price action. Historical data indicates that previous transaction ATHs in 2021 and 2023 preceded substantial price appreciation within 3-6 months, though current market conditions differ substantially. The extreme fear sentiment reading of 21/100 represents the most pessimistic market psychology since the 2022 bear market bottom, creating what technical analysts describe as a potential liquidity grab scenario. Similar to the 2021 correction, network fundamentals are strengthening while speculative interest remains suppressed, potentially setting the stage for a mean reversion event.

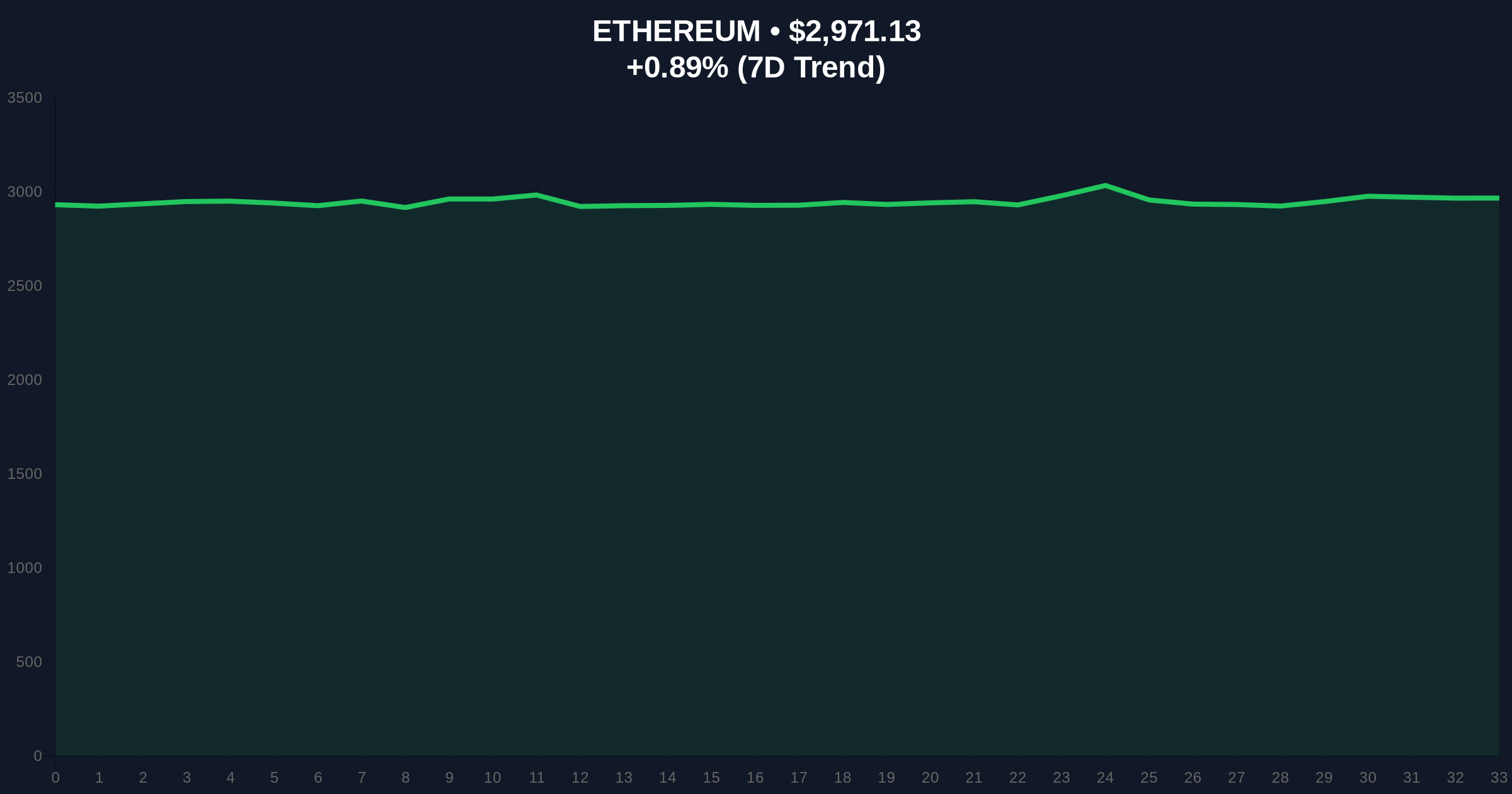

According to data from Cointelegraph, the Ethereum mainnet processed 2.2 million transactions in a single day this week, surpassing the previous record of approximately 1.9 million set in 2021. Simultaneously, average transaction fees dropped to 17 cents, representing an 85% reduction from the $1.15 average observed during the 2021 transaction peak. Network efficiency improvements this year following the Pectra and Fusaka upgrades have enabled this throughput expansion while maintaining fee stability. The current Ethereum price of $2,971.2 reflects a modest 0.90% 24-hour gain despite the record network activity, indicating a potential decoupling between utility metrics and speculative valuation.

On-chain data indicates Ethereum is currently testing a critical Fibonacci support level at $2,850, which represents the 0.618 retracement from the 2024 high. The daily RSI reading of 42 suggests neutral momentum with bearish bias, while the 50-day moving average at $3,150 provides immediate resistance. Volume profile analysis reveals significant accumulation between $2,800 and $2,900, creating what technical analysts identify as an order block that must hold for bullish continuation. Market structure suggests a break below the $2,800 level would invalidate the current accumulation pattern and potentially trigger a gamma squeeze to the downside. The Bullish Invalidation level is established at $2,750, while the Bearish Invalidation level sits at $3,250, representing the next major resistance zone.

| Metric | Value |

|---|---|

| Daily Transactions (ATH) | 2.2 million |

| Average Transaction Fee | 17 cents |

| Current ETH Price | $2,971.2 |

| 24-Hour Price Change | +0.90% |

| Fear & Greed Index | 21/100 (Extreme Fear) |

For institutional investors, this transaction surge validates Ethereum's utility thesis despite regulatory uncertainty. The network's ability to process 2.2 million daily transactions at 17-cent fees demonstrates scalability improvements that reduce operational costs for enterprise applications. Retail traders face a different calculus: extreme fear sentiment typically precedes buying opportunities, but technical indicators suggest caution until key support levels hold. The divergence between network fundamentals and market psychology creates what quantitative analysts describe as a potential Fair Value Gap that could resolve through either price appreciation or sentiment normalization. This development matters for the 5-year horizon because it demonstrates Ethereum's continued evolution toward becoming global settlement infrastructure, as outlined in the Ethereum Foundation's roadmap.

Market analysts on social platforms are divided on the implications. Some bulls point to the transaction ATH as evidence of "real usage growth that will eventually translate to price appreciation," while bears emphasize the extreme fear sentiment and regulatory headwinds. One prominent quantitative analyst noted, "Network activity at ATHs while price stagnates suggests either massive undervaluation or impending distribution." The community is particularly focused on whether this transaction surge represents organic growth or temporary activity spikes, with on-chain analysts examining wallet behavior patterns for clues.

Bullish Case: If Ethereum holds the Fibonacci support at $2,850 and breaks above the $3,250 resistance, technical analysis suggests a retest of the $3,800 level within Q1 2026. The transaction ATH combined with improving network efficiency could trigger a sentiment reversal from extreme fear to neutral, potentially catalyzing a 25-30% upward move. Continued adoption of layer-2 solutions and successful implementation of future upgrades like EIP-4844 could provide additional fundamental support.

Bearish Case: A break below the $2,750 Bullish Invalidation level would confirm distribution patterns and potentially trigger a decline toward $2,400. The extreme fear sentiment could persist if regulatory developments worsen, particularly regarding stablecoin policy as highlighted in recent warnings from industry leaders. In this scenario, the transaction ATH might represent a local maximum rather than sustainable growth, with network activity declining as market conditions deteriorate.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.