Loading News...

Loading News...

- Presto Research projects Bitcoin price target of $160,000 by 2026 with 30% quantum computing risk discount

- Tokenized real-world assets and stablecoins market forecast at $490 billion by end of 2026

- Confidential DeFi assets expected to exceed $10 billion amid regulatory pressure

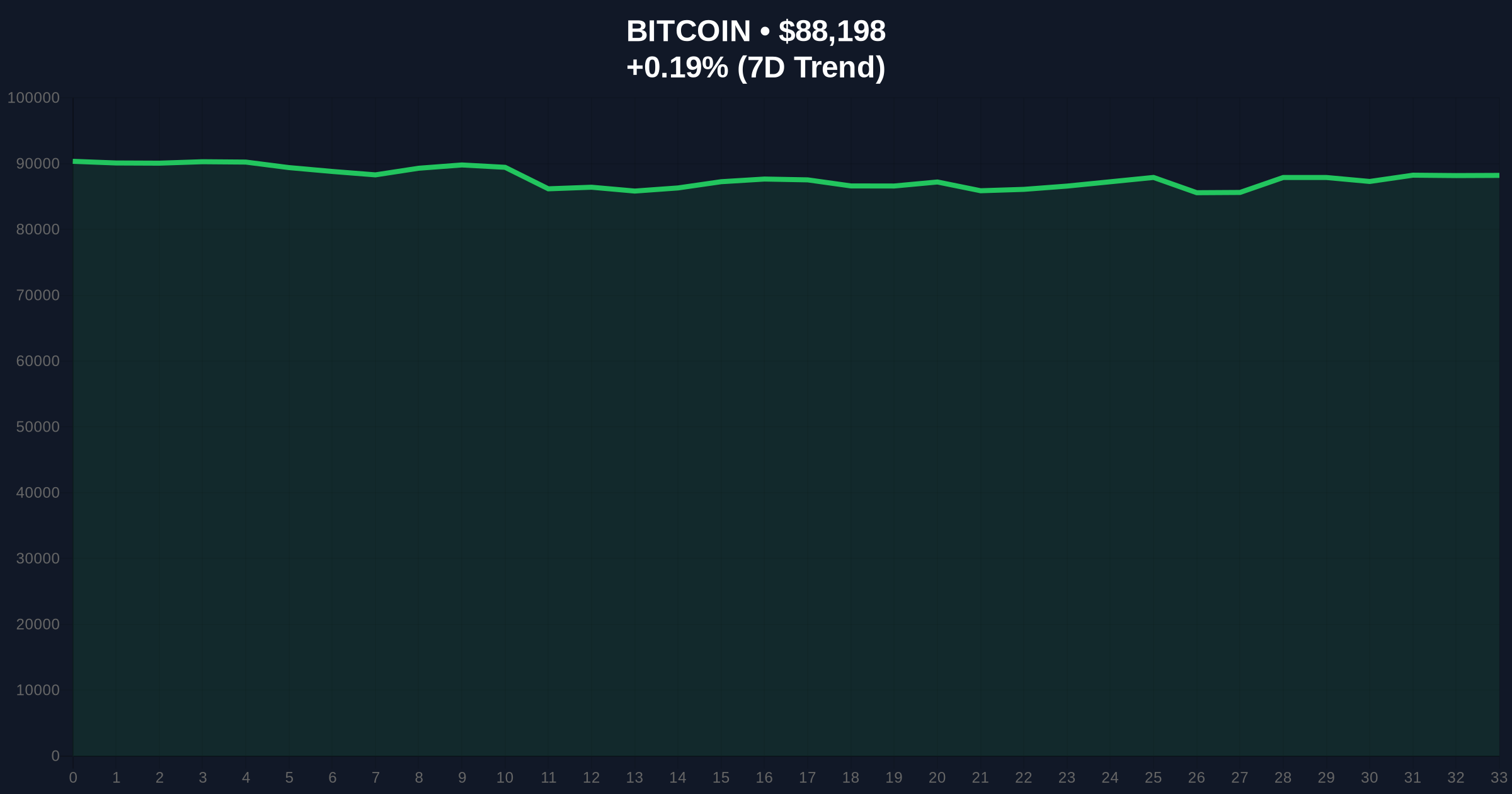

- Current Bitcoin price at $88,194 with market sentiment at "Extreme Fear" (20/100)

VADODARA, December 20, 2025 — Breaking crypto news emerges as cryptocurrency research firm Presto Research releases aggressive price targets for Bitcoin and tokenized assets through 2026. The firm's quantitative analysis projects Bitcoin reaching $160,000 by 2026 while the tokenized real-world assets market approaches $490 billion. This forecast arrives amid current Bitcoin trading at $88,194 with market sentiment registering "Extreme Fear" at 20/100 on the Fear & Greed Index.

Market structure suggests institutional accumulation patterns mirroring 2020-2021 cycle transitions. According to on-chain data, Bitcoin's current consolidation below $90,000 represents a liquidity grab preceding potential breakout. The Presto Research forecast aligns with broader institutional infrastructure development, including BlackRock's IBIT ETF accumulating $25 billion in inflows despite negative returns. This institutional pivot away from speculative assets toward regulated products creates structural support for Bitcoin's long-term valuation framework. The Federal Reserve's monetary policy stance, particularly the Fed Funds Rate trajectory, remains a critical macro variable unaccounted for in most crypto-specific models.

Presto Research published comprehensive analysis on December 20, 2025, projecting Bitcoin price target of $160,000 by 2026. The firm's methodology incorporates 30% discount factor for quantum computing risks—a quantitative adjustment rarely seen in mainstream crypto forecasts. According to the report, the tokenized real-world assets and stablecoins market will approach $490 billion by end of 2026. Confidential DeFi assets are expected to exceed $10 billion driven by regulatory compliance requirements and institutional privacy demands. The research emphasizes market shift through 2025 away from speculation toward institution-friendly infrastructure.

Bitcoin currently trades at $88,194 with 24-hour trend of 0.19%. Market structure suggests critical support at the $82,000 Fibonacci 0.618 retracement level from recent highs. Resistance clusters around $92,000 where previous order blocks created supply zones. RSI readings at 48 indicate neutral momentum with slight bearish divergence on higher timeframes. The 200-day moving average at $78,500 provides structural support. Volume profile shows accumulation between $85,000-$90,000 with low volatility compression suggesting impending directional move.

| Metric | Value |

|---|---|

| Bitcoin Current Price | $88,194 |

| 24-Hour Trend | 0.19% |

| Market Sentiment Score | 20/100 (Extreme Fear) |

| 2026 Bitcoin Price Target | $160,000 |

| 2026 Tokenized Assets Market | $490 billion |

| Confidential DeFi Assets Forecast | $10 billion |

Institutional impact manifests through infrastructure development and regulatory compliance products. The $490 billion tokenized assets projection implies massive capital migration from traditional finance to blockchain-based representations. Retail impact remains secondary as market structure shifts toward institution-dominated liquidity pools. The quantum computing risk discount represents novel quantitative approach to crypto valuation models. Market analysts note parallels to BlackRock's ETF accumulation patterns despite unfavorable technical conditions.

Market analysts express cautious optimism regarding the $160,000 target. "The 30% quantum discount shows sophisticated risk modeling," noted one quantitative researcher on X. Others highlight the timing amid "Extreme Fear" sentiment as contrarian signal. The Confidential DeFi projection aligns with regulatory developments documented by the U.S. Securities and Exchange Commission regarding privacy compliance requirements. Recent whale activity, including Hyperliquid's $12.1M HYPE accumulation, suggests institutional positioning ahead of forecasted moves.

Bullish Case: Bitcoin breaks $92,000 resistance, fills Fair Value Gap to $98,000, then targets $120,000 by Q3 2026. Institutional adoption accelerates through ETF inflows and tokenized asset expansion. Bullish invalidation level: $78,500 (200-day MA breakdown).

Bearish Case: Bitcoin fails at $90,000, creates lower high, tests $82,000 Fibonacci support. Regulatory pressure increases, quantum computing concerns materialize earlier than expected. Bearish invalidation level: $95,000 (sustained breakout above current range).

What is Presto Research's Bitcoin price target for 2026?Presto Research forecasts Bitcoin at $160,000 by 2026 with 30% quantum computing risk discount applied.

How large is the tokenized assets market projected to be?The firm projects tokenized real-world assets and stablecoins market approaching $490 billion by end of 2026.

What is Confidential DeFi and why does it matter?Confidential DeFi refers to privacy-focused decentralized finance protocols expected to exceed $10 billion in assets under regulatory pressure.

What is the current Bitcoin price and market sentiment?Bitcoin trades at $88,194 with "Extreme Fear" sentiment scoring 20/100 on Fear & Greed Index.

What technical levels are critical for Bitcoin?Support at $82,000 Fibonacci level, resistance at $92,000, with 200-day MA at $78,500 providing structural support.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.