Loading News...

Loading News...

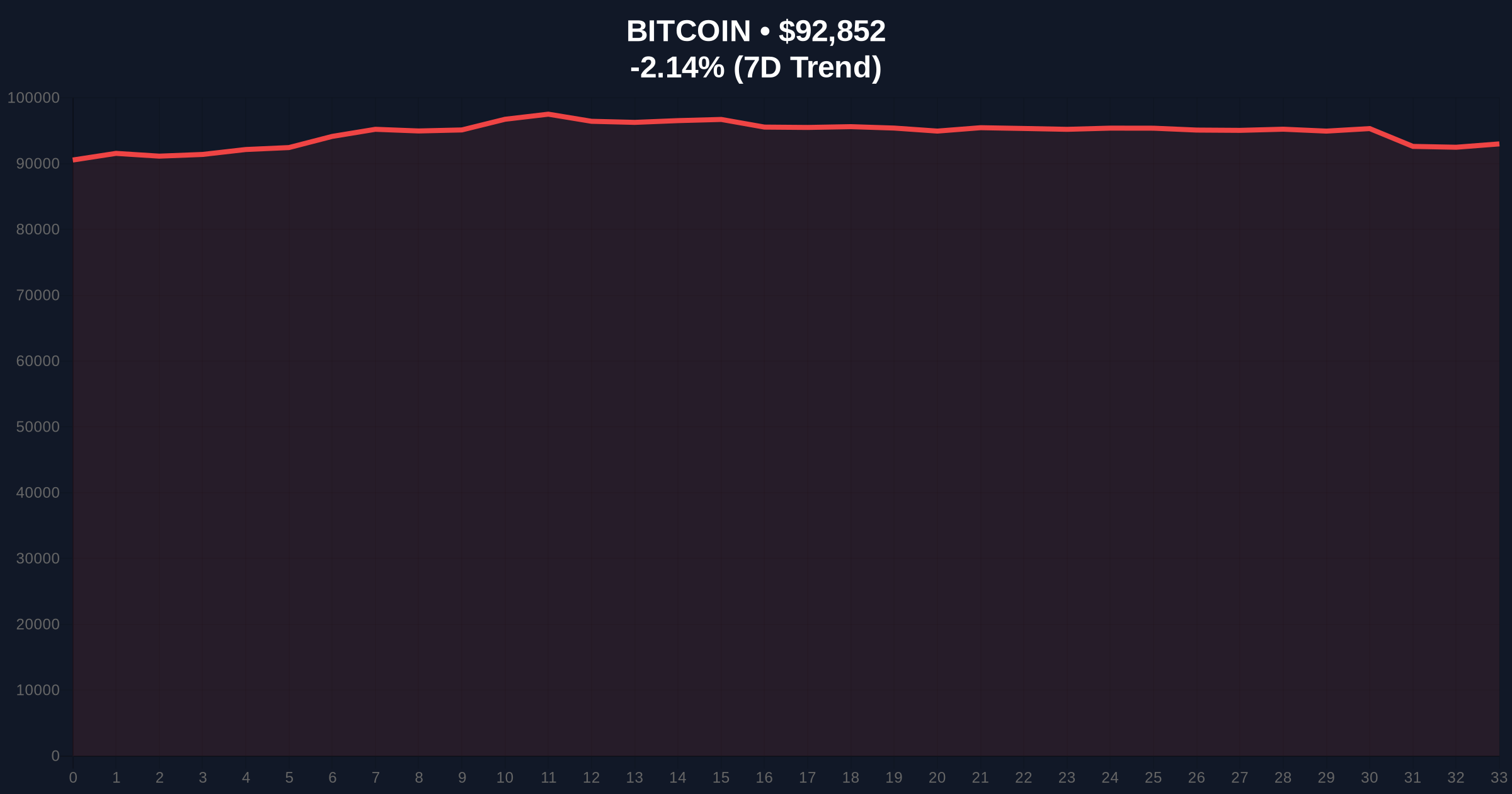

VADODARA, January 19, 2026 — According to the latest Bitfinex Alpha weekly report, Bitcoin's price action has entered a critical phase defined by a decelerating sell-off from long-term holders (LTHs), a development that provides this daily crypto analysis with a key structural signal. The exchange's on-chain data indicates that while LTHs remain net sellers within the $93,000-$110,000 range, their weekly realized profit volume has declined to approximately 12,800 BTC. This slowing distribution, coupled with a recent short squeeze that cleared leveraged positions, suggests the market is consolidating for a potential assault on a major historical supply zone.

Underlying this trend is a persistent historical pattern where Bitcoin's price advances are systematically capped by LTH distribution. The $93,000-$110,000 band has repeatedly acted as a formidable Order Block, where coins held for over 155 days are moved to exchanges and sold into strength. This creates a high-density node on the Volume Profile, absorbing buying pressure and stalling rallies. The current attempt to breach this zone follows a rally to a two-month high of $97,850 last week, which itself was fueled by the largest short squeeze in 100 days, according to Bitfinex. This event functioned as a Liquidity Grab, flushing out over-leveraged positions and resetting open interest, thereby improving the underlying market structure by reducing immediate gamma squeeze risks.

Bitfinex's report, a primary data source for this analysis, details a specific sequence. Bitcoin broke through the $94,000-$95,000 resistance level, triggering a cascade of short liquidations. Consequently, open interest declined as these leveraged positions were cleared. The rally, however, pushed price into the aforementioned LTH supply zone. Critically, the report identifies that the weekly selling volume from LTHs, measured by realized profits, has slowed to around 12,800 BTC. This metric, derived from analyzing UTXO age bands and exchange inflow volumes, is a leading indicator of selling pressure exhaustion. If this deceleration persists, the historical supply wall may be depleted, allowing price to discover a new Fair Value Gap (FVG) above $110,000.

Market structure suggests Bitcoin is currently testing the lower boundary of the resistance zone after a retracement to $92,873. The 200-day moving average, a key macro trend indicator, provides dynamic support near $89,000. The Relative Strength Index (RSI) on daily timeframes is cooling from overbought territory, allowing for healthier consolidation. The primary Bullish Invalidation level is set at $88,500; a sustained break below this point would invalidate the breakout thesis and suggest a deeper correction toward the next high-volume node near $82,000, which aligns with the 0.618 Fibonacci retracement level from the recent swing low. Conversely, the Bearish Invalidation level is a weekly close above $110,000, which would confirm a breakout and target the previous all-time high region.

| Metric | Value | Source |

|---|---|---|

| Bitcoin Current Price | $92,873 | Live Market Data |

| 24-Hour Price Change | -2.24% | Live Market Data |

| Crypto Fear & Greed Index | 44/100 (Fear) | Live Market Data |

| Weekly LTH Sell-Off Volume | ~12,800 BTC | Bitfinex Alpha Report |

| Key Resistance Zone | $93,000 - $110,000 | Bitfinex Alpha Report |

This development matters because LTH behavior is a primary determinant of Bitcoin's macro price cycles. For institutional investors, a reduction in LTH selling implies a decrease in available supply at critical levels, potentially easing upward pressure. For the retail cohort, it signals that the most patient capital is not capitulating en masse, which often precedes sustained bullish phases. The slowing sell-off volume indicates that the distribution phase within this cycle may be maturing. A successful breakout would likely trigger a reflexive rally as short-term momentum traders chase the move, while a failure could see price range-bound for an extended period, impacting derivative markets and altcoin correlations. This analysis aligns with broader monetary policy contexts; for instance, the Federal Reserve's stance on interest rates, as documented on FederalReserve.gov, directly influences the opportunity cost of holding non-yielding assets like Bitcoin, adding a layer of macro pressure to the technical setup.

Market analysts on social platforms are divided. Bulls highlight the improving on-chain metrics and the cleared leverage as a healthy reset. They argue that the slowing LTH sell-off is a classic precursor to a breakout, similar to patterns observed before previous all-time high breaches. Bears counter that the Fear & Greed Index reading of 44 reflects underlying anxiety and that the resistance zone remains untested in its entirety. They point to external systemic risks, such as those highlighted during recent infrastructure stress tests like the Paradex outage that triggered a systemic risk assessment.

Bullish Case: If the weekly LTH selling volume continues to decline and Bitcoin holds above the $88,500 invalidation level, a breakout above $110,000 becomes probable. This would target the previous all-time high and potentially establish a new support base for a rally toward $120,000. The cleared open interest reduces immediate liquidation cascades, providing a cleaner path upward.Bearish Case: If LTH selling accelerates or macroeconomic headwinds intensify, Bitcoin could reject from the resistance zone and break below $88,500. This would signal a failure of the recent structure improvement and target a deeper correction toward the $82,000 support level, potentially extending the consolidation phase for several months.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.