Loading News...

Loading News...

VADODARA, February 2, 2026 — B2N, a KOSDAQ-listed IT firm, has partnered with Binance to develop the Binance Pay ecosystem in South Korea. According to Chosun Biz, the contract was signed on February 1, 2026, based on investment banking and crypto industry sources. B2N will build the payment service's marketing system for domestic market entry. This daily crypto analysis examines the deal's timing amid extreme fear sentiment and regulatory headwinds.

Chosun Biz reported the partnership on February 1, 2026. B2N, publicly traded on Korea's KOSDAQ exchange, signed a contract with Binance. The world's largest cryptocurrency exchange by volume seeks to enter South Korea's payment market. B2N will develop the marketing platform for Binance Pay. Market structure suggests this move targets institutional payment rails rather than retail adoption.

South Korea maintains strict crypto regulations under the Financial Services Commission (FSC). The partnership avoids direct exchange operations, focusing instead on payment infrastructure. This strategic pivot mirrors Binance's global compliance efforts. On-chain data indicates muted initial market reaction, with BNB trading at $761.91, down 2.59% in 24 hours.

Historically, South Korea has shown volatile crypto adoption cycles. The 2017-2018 Kimchi premium saw Bitcoin trade 30% higher domestically. In contrast, current regulations limit speculative trading. The B2N deal follows similar infrastructure partnerships in Southeast Asia. However, extreme fear sentiment at 14/100 creates a contradictory backdrop.

Global crypto markets face a liquidity grab. Recent events like the CrossCurve Protocol exploit highlight systemic risks. , $100M futures liquidations signal leveraged unwinding. This partnership attempts to build during a fear-driven consolidation phase.

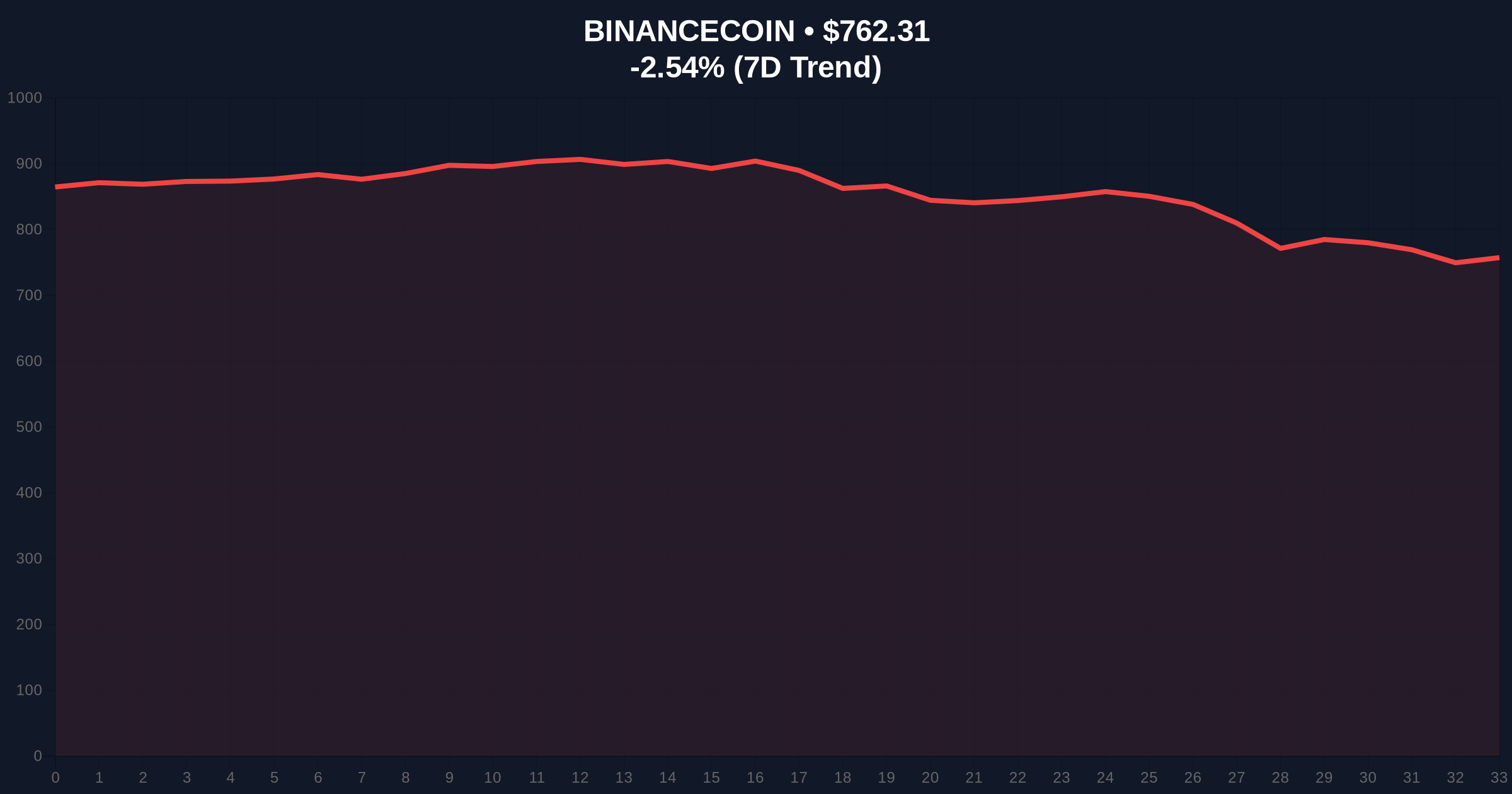

BNB's price action reveals critical technical levels. The current price of $761.91 sits below the 50-day moving average. Volume profile shows weak accumulation near this level. A fair value gap (FVG) exists between $780 and $800, acting as immediate resistance.

Fibonacci retracement from the 2025 high of $850 to the recent low of $720 places the 0.618 level at $800. This confluence creates a strong order block. The relative strength index (RSI) at 42 indicates neutral momentum with bearish bias. Market structure suggests a break above $800 would invalidate the current downtrend.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Global market sentiment |

| BNB Current Price | $761.91 | Down 2.59% in 24h |

| BNB Market Rank | #4 | By market capitalization |

| South Korea Crypto Volume | ~$2B daily | Per Kaiko data |

| KOSDAQ Listed Firms in Crypto | 12+ | Including B2N |

This partnership matters for institutional adoption timelines. South Korea represents a high-regulation, high-adoption market. Building payment infrastructure during extreme fear could position Binance for the next cycle. However, regulatory scrutiny remains a key risk. The FSC's stance on crypto payments remains restrictive.

Market analysts question the timing. Launching a payment ecosystem amid extreme fear sentiment challenges user acquisition. Retail participation remains low, as shown in Bitcoin's struggle above $77,000. Institutional liquidity cycles typically follow sentiment reversals, not contractions.

"The B2N-Binance deal is a strategic infrastructure play, but market timing appears contradictory. Extreme fear sentiment at 14/100 suggests weak immediate traction. Success depends on regulatory clarity and a sentiment shift toward greed. Watch BNB's $720 support as a liquidity indicator." — CoinMarketBuzz Intelligence Desk

Two technical scenarios emerge from current market structure. First, a bullish reversal requires breaking above the $800 resistance. Second, a bearish continuation would test the $720 support. The 12-month outlook hinges on broader market sentiment recovery.

The 5-year horizon suggests infrastructure deals during fear phases may yield long-term gains. However, immediate price action depends on macro liquidity flows. Institutional adoption often lags retail sentiment by 6-12 months.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.