Loading News...

Loading News...

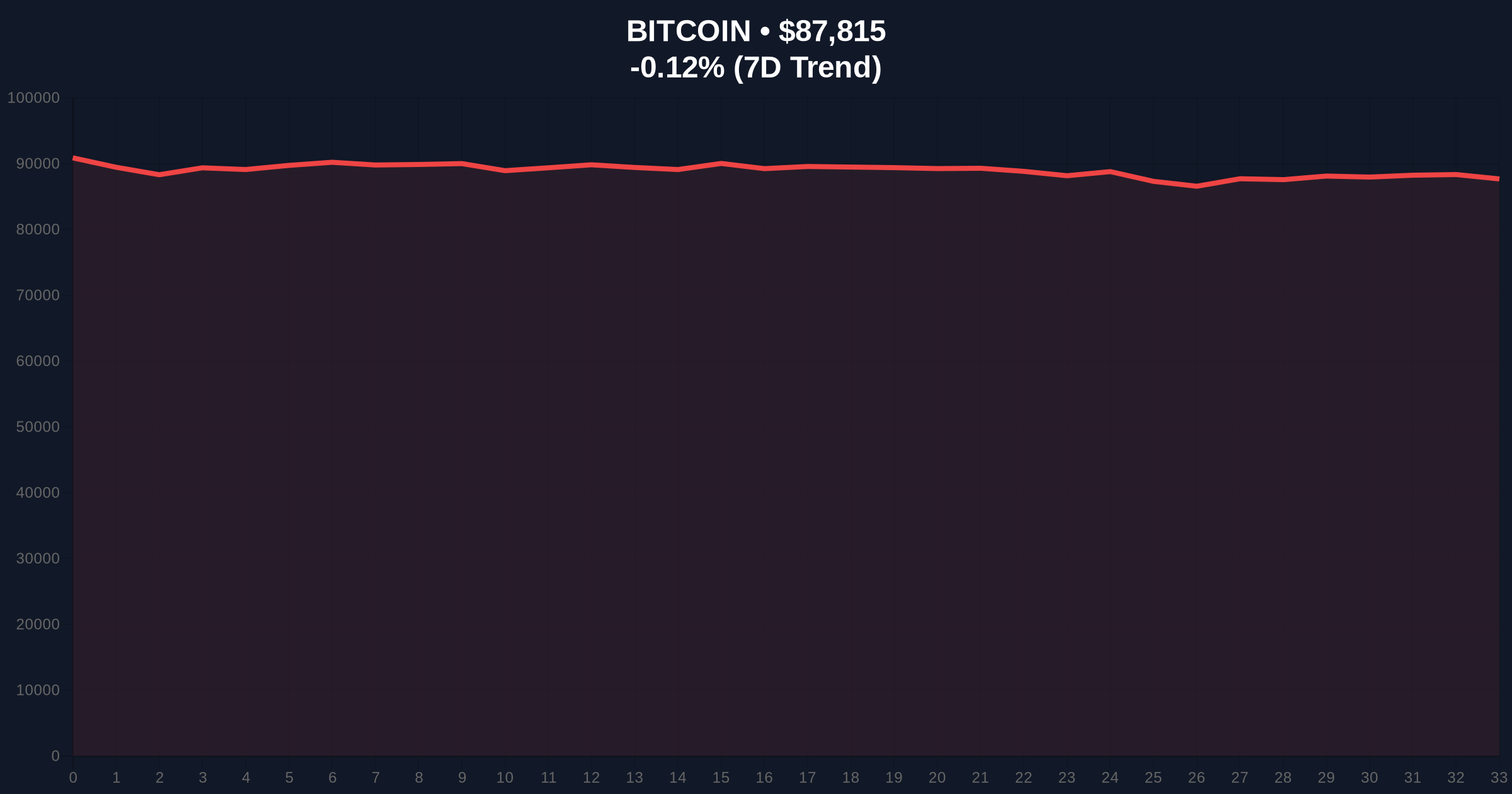

VADODARA, January 27, 2026 — U.S. investment bank Keefe, Bruyette & Woods (KBW) downgraded three prominent Bitcoin mining firms from Outperform to Market Perform, according to a report obtained by CoinMarketBuzz. This daily crypto analysis reveals institutional concerns about execution risks in miners' artificial intelligence (AI) diversification strategies. Bitfarms, Bitdeer, and HIVE Digital Technologies now face heightened scrutiny as they attempt to monetize high-performance computing (HPC) infrastructure.

KBW's research team executed simultaneous downgrades for Bitfarms (NASDAQ: BITF), Bitdeer (NASDAQ: BTDR), and HIVE Digital (TSXV: HIVE). The bank acknowledged positive aspects of their AI and HPC hosting pivots. However, KBW's analysis identified significant monetization timeline uncertainties. Consequently, the downgrade reflects a recalibration of risk-adjusted return expectations. Market structure suggests these moves precede potential capital reallocation away from pure-play mining operations.

According to the KBW report, execution risks stem from several factors. These include unproven revenue models in competitive AI infrastructure markets. , substantial capital expenditure requirements create balance sheet pressure. The downgrade occurred amid Bitcoin trading at $87,787, representing a -0.16% 24-hour decline. This price action indicates neutral-to-negative sentiment toward mining-adjacent news.

Historically, mining stock downgrades correlate with Bitcoin price consolidation phases. The 2021-2022 cycle witnessed similar analyst actions during hash rate migration periods. In contrast, current downgrades focus on business model diversification rather than pure mining economics. Underlying this trend is the post-halving environment where miners seek alternative revenue streams.

Market analysts note parallels with traditional energy sector transitions. Mining companies repurposing infrastructure face analogous challenges to oil firms diversifying into renewables. The KBW action suggests institutional patience for monetization timelines is thinning. This development coincides with broader market fear, measured at 29/100 on the Crypto Fear & Greed Index.

Related Developments: This institutional reassessment occurs alongside other market shifts, including stablecoin market share redistribution and altcoin liquidity pressures that reflect broader capital rotation patterns.

Bitcoin's current technical posture reveals critical levels for mining economics. The $87,787 trading price sits above the 200-day moving average at approximately $84,500. However, the Relative Strength Index (RSI) at 52 indicates neutral momentum. More importantly, the Fibonacci 0.618 retracement level from the 2025 high sits at $85,000, creating a confluence support zone.

Mining profitability calculations using Bitcoin's official difficulty adjustment algorithm show marginal pressure at current prices. The KBW downgrade potentially accelerates a liquidity grab if Bitcoin breaks below $85,000. On-chain data from Glassnode indicates miner outflow volumes remain elevated, suggesting some operators are already hedging position risks. This creates a Fair Value Gap (FVG) between current valuations and future AI revenue projections.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 29/100 (Fear) | High risk aversion environment |

| Bitcoin Current Price | $87,787 | -0.16% 24h change |

| Fibonacci Key Support | $85,000 (0.618 level) | Critical mining profitability zone |

| RSI (Daily) | 52 | Neutral momentum |

| Mining Stocks Downgraded | 3 (BITF, BTDR, HIVE) | KBW Market Perform rating |

The KBW downgrade matters because it signals institutional reassessment of mining business models. AI infrastructure monetization requires different expertise than Bitcoin mining. Execution risks include technology integration challenges and customer acquisition timelines. Consequently, capital allocation decisions may shift toward pure-play AI companies or diversified miners with proven track records.

Market structure suggests this could accelerate industry consolidation. Smaller miners without AI capabilities face increased competitive pressure. The downgrade also impacts Bitcoin's security budget indirectly. If mining revenues decline due to stock price depreciation, hash rate growth could slow. This creates network security considerations that blockchain architects monitor closely.

"KBW's downgrade reflects realistic timeline expectations for AI monetization. Mining companies face a classic innovator's dilemma: balancing core Bitcoin revenue with speculative AI investments. The Market Perform rating suggests these stocks will track sector averages rather than outperform during this transition phase." — CoinMarketBuzz Intelligence Desk

Two primary scenarios emerge from current market structure. The bullish case requires successful AI revenue generation within 12-18 months. The bearish scenario involves prolonged monetization delays and capital expenditure overruns.

The 12-month institutional outlook remains cautiously optimistic about AI diversification. However, execution timelines will determine capital flows. Historical cycles suggest first-mover advantages in infrastructure repurposing, but also highlight the risks of premature pivots during core business volatility.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.