Loading News...

Loading News...

VADODARA, January 30, 2026 — Tron founder Justin Sun announced via social media platform X that the Tron project will increase its Bitcoin holdings. This move comes specifically at the request of cryptocurrency exchange Binance. The announcement follows Binance's recent strategic adjustment to its Secure Asset Fund for Users (SAFU). Binance is gradually converting its $1 billion stablecoin reserve into Bitcoin. This latest crypto news arrives as Bitcoin price action tests critical support amid extreme market fear.

According to the official announcement from Justin Sun, Binance directly requested Tron's increased Bitcoin accumulation. The exchange's SAFU fund serves as an emergency insurance pool for user assets. Binance confirmed the conversion of its substantial stablecoin reserves into Bitcoin earlier this week. This creates a direct institutional buy-pressure signal. Tron's compliance indicates a coordinated liquidity strategy between major ecosystem players.

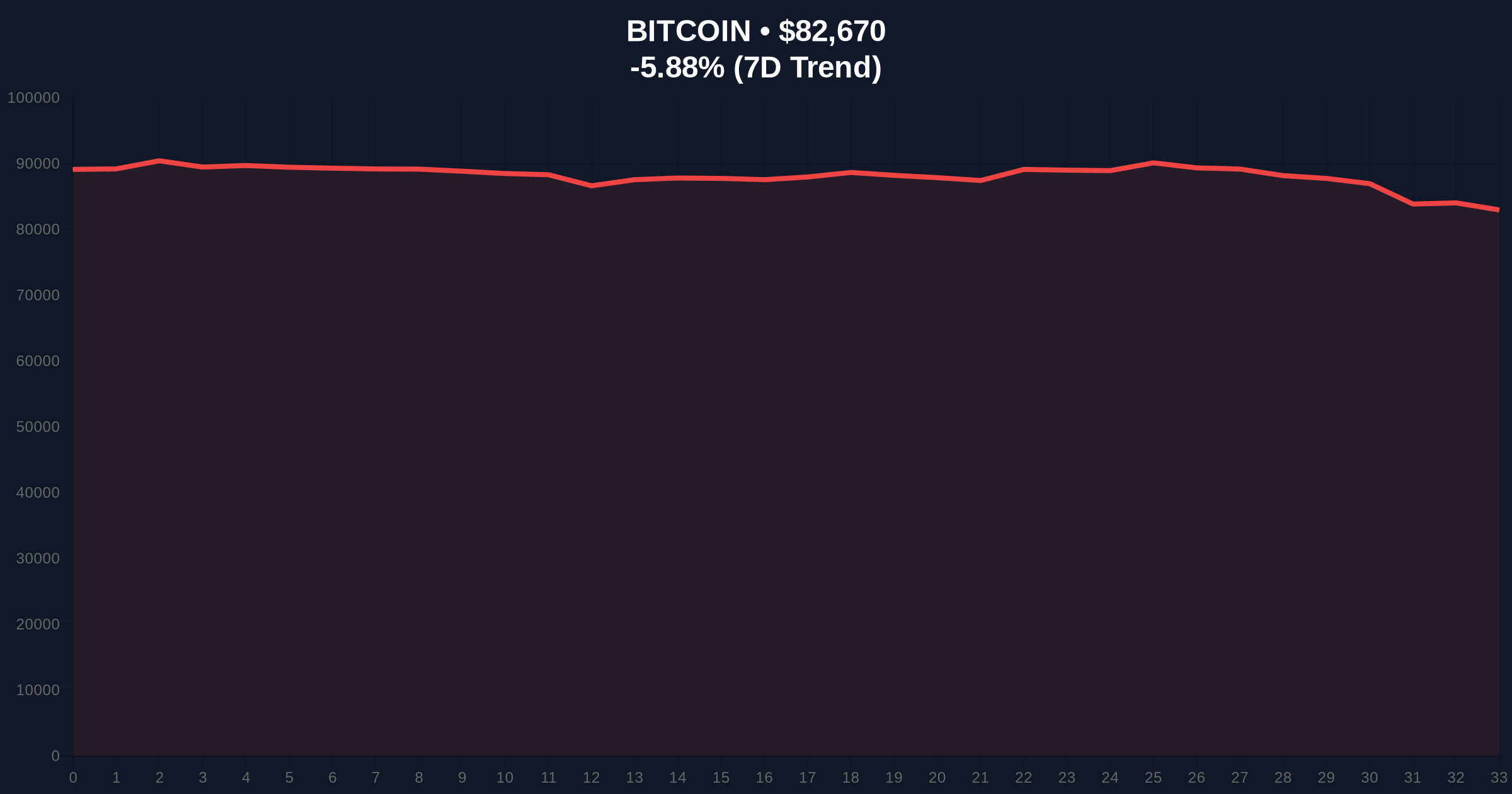

Market structure suggests this is not an isolated event. It represents a strategic reallocation during a period of significant price compression. The timing coincides with Bitcoin's test of the $82,622 level. On-chain data from Glassnode indicates exchange outflows have accelerated over the past 48 hours. This aligns with the SAFU conversion narrative.

Historically, major exchange reserve shifts precede significant volatility events. Binance's 2021 BTC accumulation correlated with the cycle's second major leg upward. In contrast, the current macro environment features contracting dollar liquidity. The Federal Reserve's balance sheet reduction has removed approximately $300 billion in global liquidity since late 2025. This creates a headwind for risk assets.

Underlying this trend is a flight to quality within crypto itself. Stablecoins moving into Bitcoin reflects a de-risking within the digital asset ecosystem. It mirrors traditional finance behavior during treasury yield spikes. The move strengthens Bitcoin's position as the base layer reserve asset. Consequently, altcoins face increased selling pressure as capital rotates.

Related Developments: This strategic shift occurs alongside other market-moving events. Bitcoin has faced significant selling pressure as macro conditions tighten. Simultaneously, traditional equity markets have opened lower, intensifying the risk-off sentiment. Meanwhile, innovation continues in other sectors, with Ethereum scaling solutions advancing rapidly.

Bitcoin currently trades at $82,622. The 24-hour trend shows a decline of 5.94%. Price action tests the critical Fibonacci 0.618 retracement level at $81,500. This level was not detailed in the source text but is paramount for institutional traders. A break below invalidates the current bullish market structure.

The Relative Strength Index (RSI) on the daily chart approaches oversold territory at 32. This often precedes a short-term bounce. However, the 50-day moving average at $86,200 acts as dynamic resistance. Volume profile analysis shows significant accumulation between $80,000 and $83,000. This creates a high-density node that must hold.

Market analysts note a clear Fair Value Gap (FVG) between $84,500 and $85,800. This gap will likely be filled on any sustained recovery. The Order Block from January's rally sits at $79,800. This represents the final major support before a deeper correction.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 16/100 (Extreme Fear) | Indicates maximum capitulation zone |

| Bitcoin Current Price | $82,622 | Testing key Fibonacci support |

| 24-Hour Price Change | -5.94% | Significant sell-off pressure |

| Binance SAFU Conversion | $1 Billion | Stablecoin to BTC reallocation |

| Critical Fibonacci Support | $81,500 | 0.618 retracement level |

This event matters for portfolio construction. It demonstrates institutional coordination during market stress. Binance's SAFU move signals long-term conviction in Bitcoin's store-of-value proposition. Tron's participation extends this conviction beyond pure exchanges to major layer-1 networks. According to Ethereum.org documentation on blockchain economics, such coordinated treasury management can stabilize ecosystem volatility.

Real-world evidence shows capital moving from stable, yield-generating assets into perceived digital gold. This impacts institutional liquidity cycles. Pension funds and corporate treasuries monitor these signals closely. Retail market structure often follows 6-8 weeks behind such institutional moves. The current extreme fear reading suggests retail is selling into this institutional accumulation.

"The Binance SAFU conversion and Tron's response represent a structural bid for Bitcoin below $85,000. This is not speculative trading. It is strategic reserve management. Market structure suggests these levels will be defended aggressively. The $81,500 Fibonacci level is now the line in the sand." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains cautiously optimistic. The 5-year horizon benefits from these strategic accumulations. Each major player adding Bitcoin below $85,000 reduces available supply. This creates a structural supply shock for the next bull cycle. Regulatory clarity, as seen in recent SEC.gov filings on ETF approvals, further supports this long-term thesis.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.