Loading News...

Loading News...

VADODARA, February 5, 2026 — Consensys founder Joseph Lubin executed a significant DeFi transaction. On-chain data reveals a leveraged borrowing move against Ethereum collateral. This latest crypto news highlights institutional behavior during extreme market stress.

An address presumed to belong to Joseph Lubin deposited 15,000 ETH into Sky. Sky is the rebranded MakerDAO protocol. The collateral was worth $31.43 million at transaction time. According to Onchain Lens, the address subsequently borrowed 4.1 million DAI.

The address currently holds 137,908 ETH. That position is valued at $287.29 million. It maintains an outstanding loan of 107.77 million DAI. Market structure suggests this is a strategic liquidity grab. The loan-to-value (LTV) ratio remains conservative at approximately 14%.

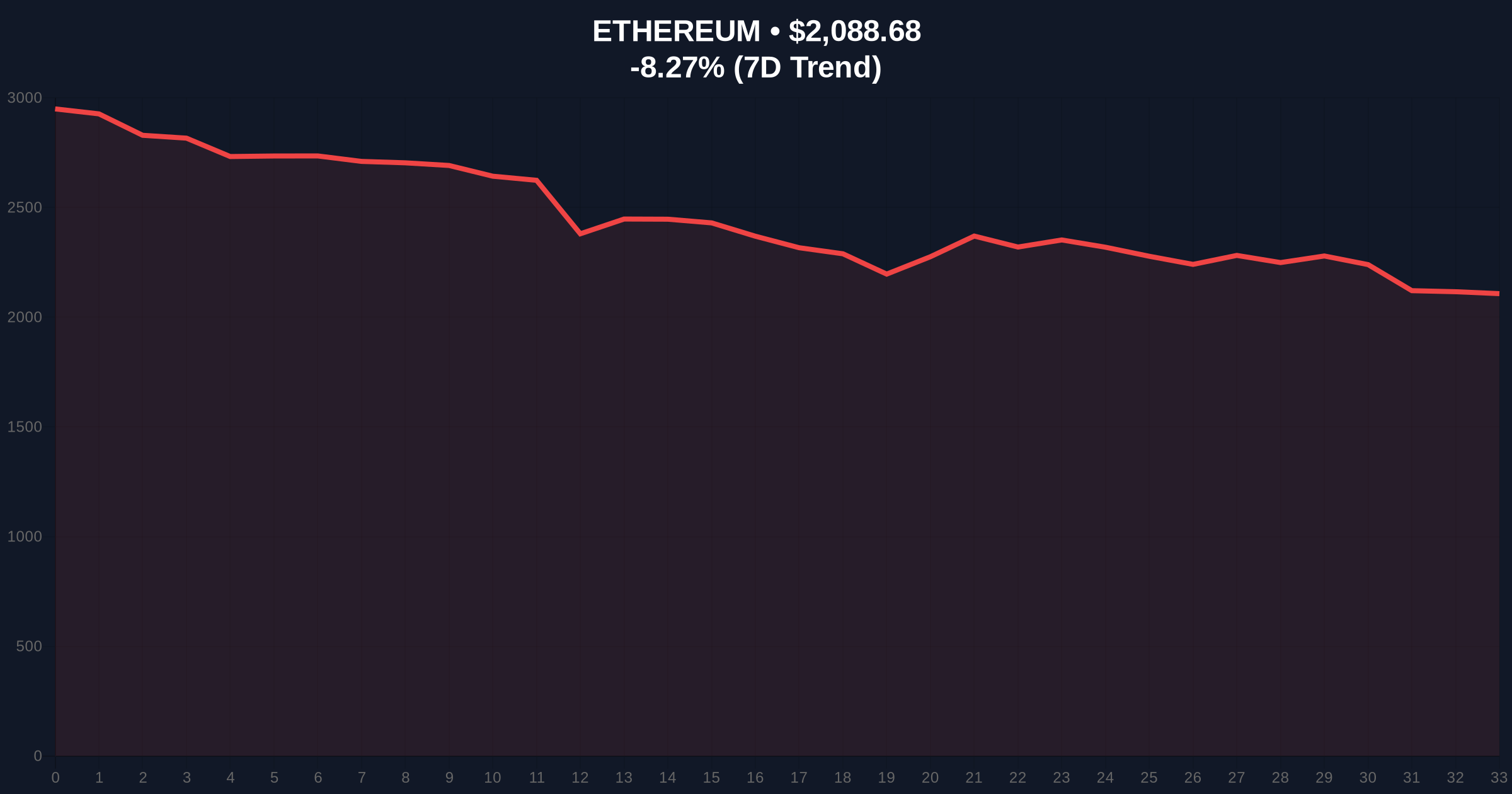

Ethereum price action shows a -8.37% 24-hour decline. This drop coincides with a Global Crypto Fear & Greed Index score of 12. Historically, founder-level transactions precede volatility compression phases. In contrast, retail sentiment often diverges from institutional moves.

Underlying this trend is a broader DeFi liquidity recalibration. The transaction mirrors patterns from the 2022 bear market. Back then, large holders used overcollateralized loans for operational capital. Consequently, this move may signal preparation for upcoming network upgrades like the Pectra hardfork.

Related Developments:

Ethereum's current price is $2,086.35. The asset faces immediate resistance at the 50-day moving average of $2,150. Critical support lies at the Fibonacci 0.618 retracement level of $2,050. A break below this creates a Fair Value Gap (FVG) down to $1,980.

On-chain forensic data confirms accumulation near these levels. The Volume Profile shows high node density at $2,100. This indicates a potential order block. Market analysts watch the RSI, currently at 38, for oversold signals. Post-merge issuance rates remain stable at approximately 0.25% annually.

| Metric | Value |

|---|---|

| Global Crypto Fear & Greed Index | 12/100 (Extreme Fear) |

| Ethereum (ETH) Current Price | $2,086.35 |

| ETH 24-Hour Change | -8.37% |

| ETH Market Rank | #2 |

| Lubin Collateral Value (Transaction) | $31.43M |

| DAI Borrowed | 4.1M |

This transaction matters for institutional liquidity cycles. Large ETH holders often borrow against collateral instead of selling. This preserves price stability during downturns. The move provides real-world evidence of sophisticated capital management.

It impacts retail market structure by setting a precedent. Retail traders may misinterpret such moves as bearish signals. However, conservative LTV ratios indicate long-term confidence. The Ethereum Foundation's roadmap for scalability upgrades supports this thesis.

Market structure suggests this is a tactical deployment of capital, not a distress signal. The 14% LTV is extremely conservative. It indicates liquidity needs for operational expenses or strategic investments without triggering taxable events or market sell pressure. Historical cycles show similar behavior before major network upgrades.

— CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains cautiously optimistic. Upcoming Ethereum upgrades like EIP-4844 for proto-danksharding could drive adoption. This aligns with a 5-year horizon focused on scalability and reduced fees.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.