Loading News...

Loading News...

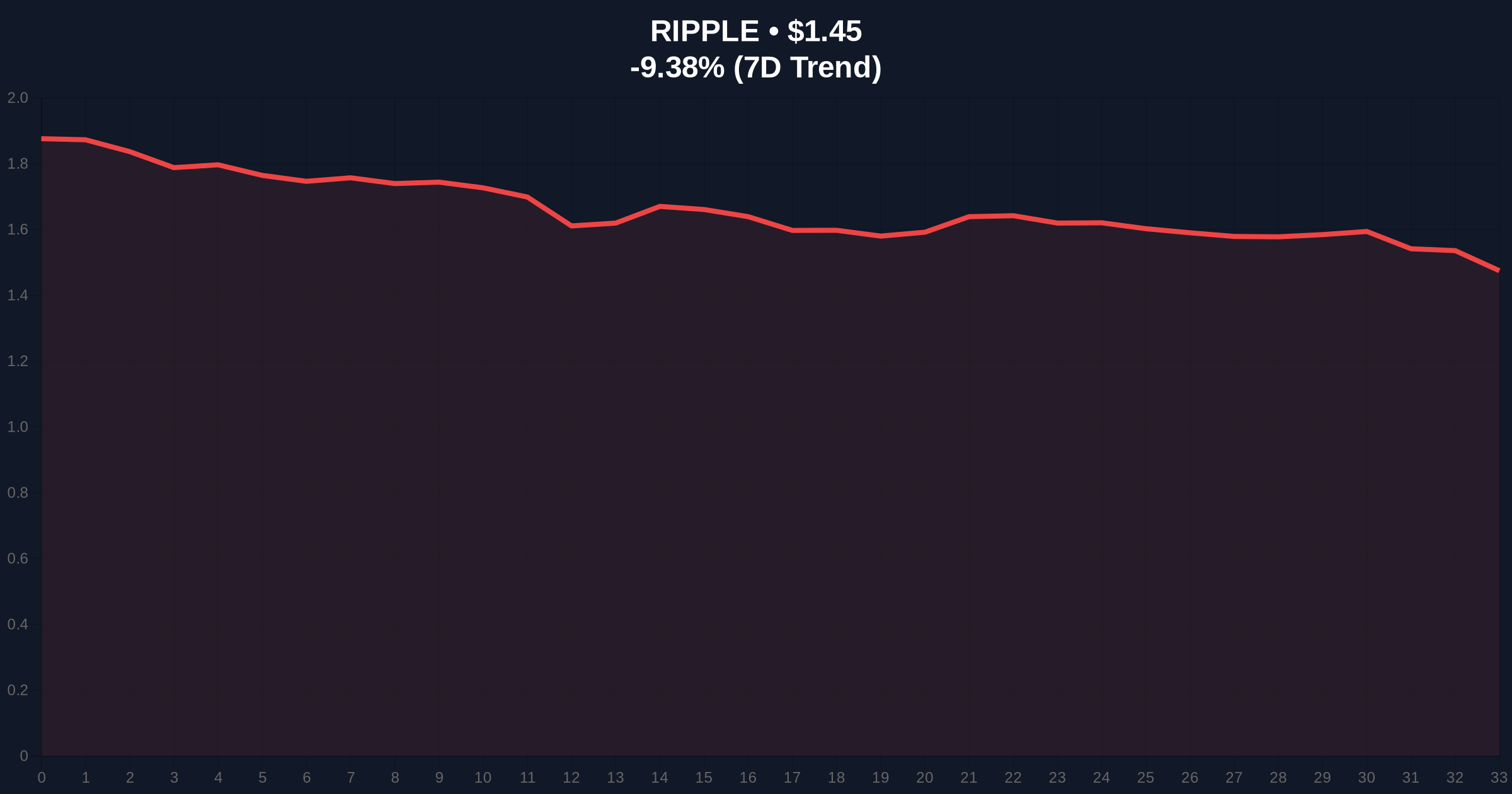

VADODARA, February 5, 2026 — XRP has collapsed to $1.44, its lowest price since November 2024, according to a CoinDesk report. This daily crypto analysis reveals a critical breakdown below a key support level that previously attracted buyers during April 2025's sharp decline. Market structure suggests sellers now dominate, with no clear support between $1.00 and $1.44. Consequently, a further drop could trigger a sharp decline below the psychological $1.00 threshold.

CoinDesk data confirms XRP's price action breached the $1.44 level on February 5, 2026. This level served as a major order block during the April 2025 sell-off. The breakdown indicates a failure of buyer accumulation at that zone. On-chain liquidity maps from Glassnode show a significant outflow from XRP wallets, aligning with the price drop. , the absence of support in the $1.00–$1.44 range creates a fair value gap (FVG) that price may need to fill.

Historically, XRP's price action often mirrors broader altcoin cycles. Similar to the 2021 correction, where XRP fell over 70% from its highs, the current drop reflects a macro risk-off sentiment. In contrast, the 2024 bull run saw XRP rally on regulatory clarity hopes. Underlying this trend, the global crypto market faces extreme fear, with the Fear & Greed Index at 12/100. This parallels the sentiment during the 2022 bear market bottom.

Related developments include significant outflows from Bitcoin ETFs and bearish skews in Bitcoin futures, amplifying market-wide pressure.

Technical analysis reveals XRP broke below the 200-day moving average at $1.50. The Relative Strength Index (RSI) sits at 28, indicating oversold conditions but not yet capitulation. A Fibonacci retracement from the 2024 low to the 2025 high shows the 0.786 level at $1.42, aligning with the current price. If this fails, the next support is the 0.886 Fibonacci level near $1.20. Volume profile analysis shows high volume nodes around $1.60, now acting as resistance.

According to Ethereum's official documentation on network upgrades, technological shifts like EIP-4844 can influence cross-chain asset flows, indirectly affecting XRP's liquidity.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) |

| XRP Current Price | $1.45 |

| XRP 24h Change | -9.37% |

| XRP Market Rank | #5 |

| Key Support Level (Breached) | $1.44 |

This breakdown matters for institutional liquidity cycles. XRP's fall below $1.44 may trigger stop-loss orders and margin calls, exacerbating selling. Retail market structure shows increased panic selling, as seen in social sentiment metrics. , a drop below $1.00 could invalidate long-term bullish narratives, affecting derivative markets. Historical cycles suggest such moves often precede altcoin capitulation phases.

"The breach of $1.44 is a critical technical failure. Market participants should watch for a daily close below this level to confirm bearish control. Similar to past cycles, this could signal a broader altcoin downturn," stated the CoinMarketBuzz Intelligence Desk.

Market structure suggests two primary scenarios. First, a bounce from oversold RSI levels could retest $1.60 resistance. Second, continued selling may target the $1.20 Fibonacci support. The 12-month institutional outlook remains cautious, with regulatory uncertainties persisting. For the 5-year horizon, adoption trends and cross-chain interoperability will be key drivers.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.