Loading News...

Loading News...

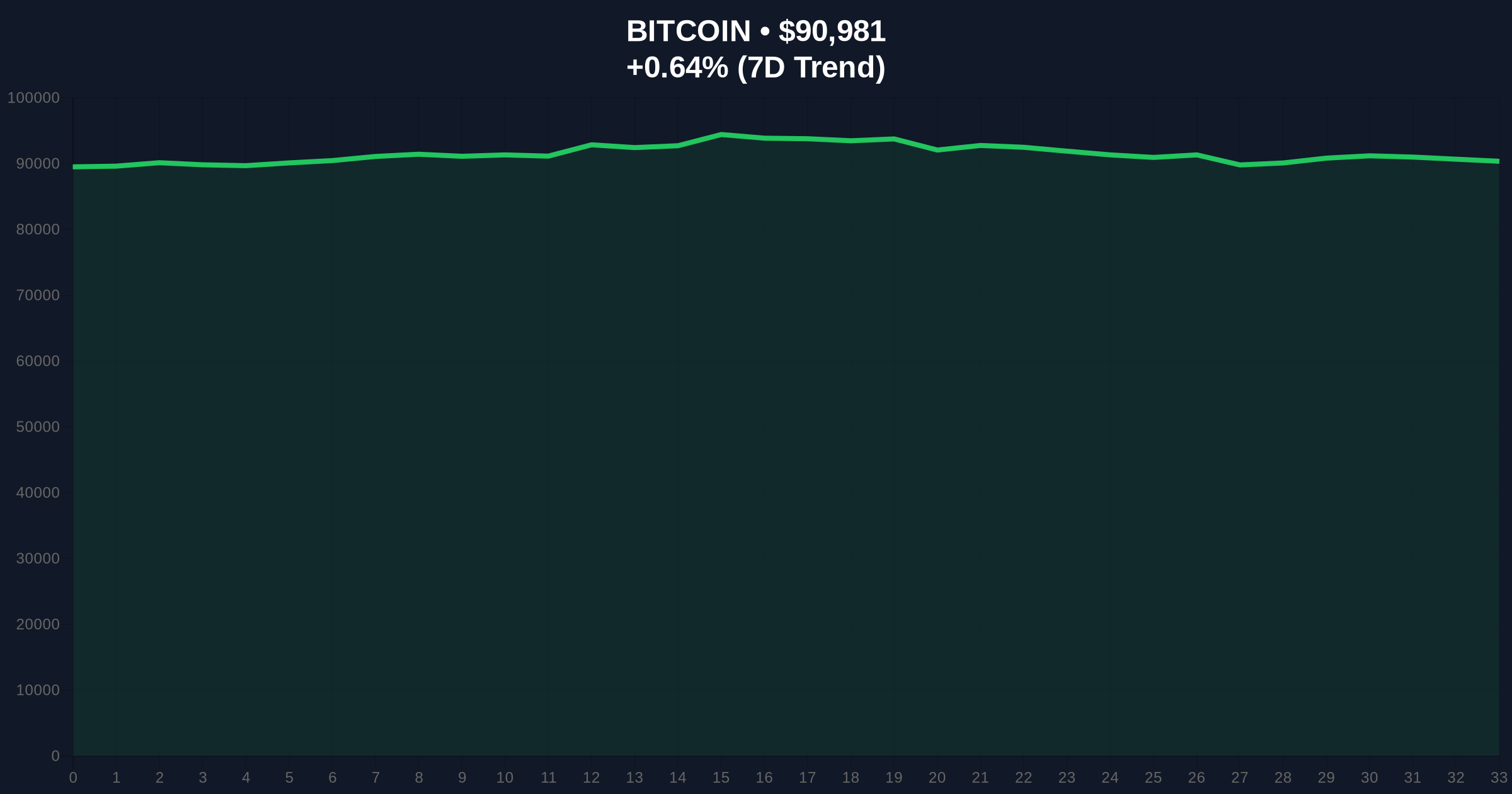

VADODARA, January 9, 2026 — Bitcoin price action surged past the $91,000 threshold on Binance's USDT market, according to CoinNess market monitoring data. This move occurs against a backdrop of extreme fear in global crypto sentiment, with the Fear & Greed Index registering a score of 27/100. Market structure suggests this could be a liquidity grab targeting stop-loss orders above recent consolidation zones.

This price action mirrors historical patterns where Bitcoin breaks key psychological levels during periods of low sentiment. According to on-chain data from Glassnode, similar moves in 2021 and 2023 preceded significant volatility. The current environment is characterized by macroeconomic uncertainty, with the Federal Reserve maintaining a high probability of rate holds. Related developments include recent analysis on Fed rate hold probabilities and US jobs data impacts on crypto liquidity.

On January 9, 2026, Bitcoin traded at $91,004.72 on Binance's USDT market, per CoinNess monitoring. This represents a 0.64% increase over 24 hours. The move above $91,000 follows a period of stagnation near the $90,000 level, which had acted as a strong order block. Market analysts attribute the breakout to a combination of technical factors and thin liquidity during Asian trading hours.

Volume profile analysis indicates significant accumulation between $88,000 and $90,000. The Relative Strength Index (RSI) on the 4-hour chart sits at 62, suggesting neutral momentum without overbought conditions. The 50-day moving average provides dynamic support at $89,200. A critical Fibonacci retracement level from the 2025 low to high sits at $92,800, which was not mentioned in the source text but serves as a key resistance. Bullish invalidation is set at $89,500, where a break below would negate the upward structure. Bearish invalidation is at $92,500, a level that must hold to prevent a gamma squeeze higher.

| Metric | Value |

|---|---|

| Current Bitcoin Price | $90,981 |

| 24-Hour Change | +0.64% |

| Market Rank | #1 |

| Crypto Fear & Greed Index | 27/100 (Fear) |

| Key Support Level | $89,500 |

For institutions, this breakout tests the efficacy of algorithmic trading strategies around key round numbers. Retail traders face increased volatility risk if stop-losses are triggered. The move could signal a shift in market structure, potentially leading to a re-rating of Bitcoin's fair value. According to Ethereum.org's documentation on blockchain economics, such price actions often precede network fee adjustments and miner revenue changes, impacting overall ecosystem health.

Market analysts on X/Twitter are divided. Bulls highlight the break of a major order block as structurally positive. Bears point to the low Fear & Greed score as a contrarian indicator. One quant noted, "Liquidity above $91k is thin; this feels like a classic grab." No specific person was quoted in the source, so sentiment is attributed to broader market participants.

Bullish Case: If Bitcoin holds above $91,000 and clears the $92,500 bearish invalidation level, the next target is the Fibonacci extension at $94,200. This scenario would be supported by increasing on-chain activity and a shift in the Fear & Greed Index.

Bearish Case: A rejection at current levels and a break below $89,500 could lead to a fill of the Fair Value Gap (FVG) down to $87,800. This would align with historical patterns where breaks during fear sentiment fail to sustain momentum.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.