Loading News...

Loading News...

VADODARA, January 9, 2026 — An address presumed to belong to BlackRock executed a significant withdrawal of 1,475 BTC (valued at $134.23 million) and 3,878 ETH (valued at $12.09 million) from Coinbase over a seven-hour period, according to data from Onchain Lens. This daily crypto analysis examines the on-chain implications, market structure, and historical parallels to assess whether this move signals a strategic accumulation or a prelude to broader volatility.

Market structure suggests that large-scale withdrawals from centralized exchanges often correlate with reduced immediate liquidity and potential long-term holding strategies. Similar to the 2021 correction, where institutional entities like MicroStrategy and Tesla moved assets off exchanges ahead of price consolidation, this event mirrors a pattern of capital preservation during periods of macroeconomic uncertainty. According to the Federal Reserve's latest minutes, persistent inflation concerns and hawkish monetary policy have increased demand for non-correlated assets, potentially driving institutional interest in Bitcoin and Ethereum as digital gold alternatives. The current withdrawal aligns with a broader trend of decreasing exchange balances, as noted in Glassnode's liquidity maps, which show a 15% reduction in Bitcoin held on major platforms since Q4 2025.

Onchain Lens data indicates that the address, identified through clustering analysis and transaction patterns consistent with BlackRock's known wallets, moved 1,475 BTC and 3,878 ETH from Coinbase to a private custody solution between 02:00 and 09:00 UTC on January 9, 2026. The total value of $146.32 million represents one of the largest single-entity withdrawals in the past month. Withdrawals from exchanges are typically interpreted as a sign of intent to hold assets, as they reduce the immediate supply available for trading. This action follows BlackRock's increased involvement in crypto, including its spot Bitcoin ETF approvals and exploration of tokenized real-world assets on Ethereum.

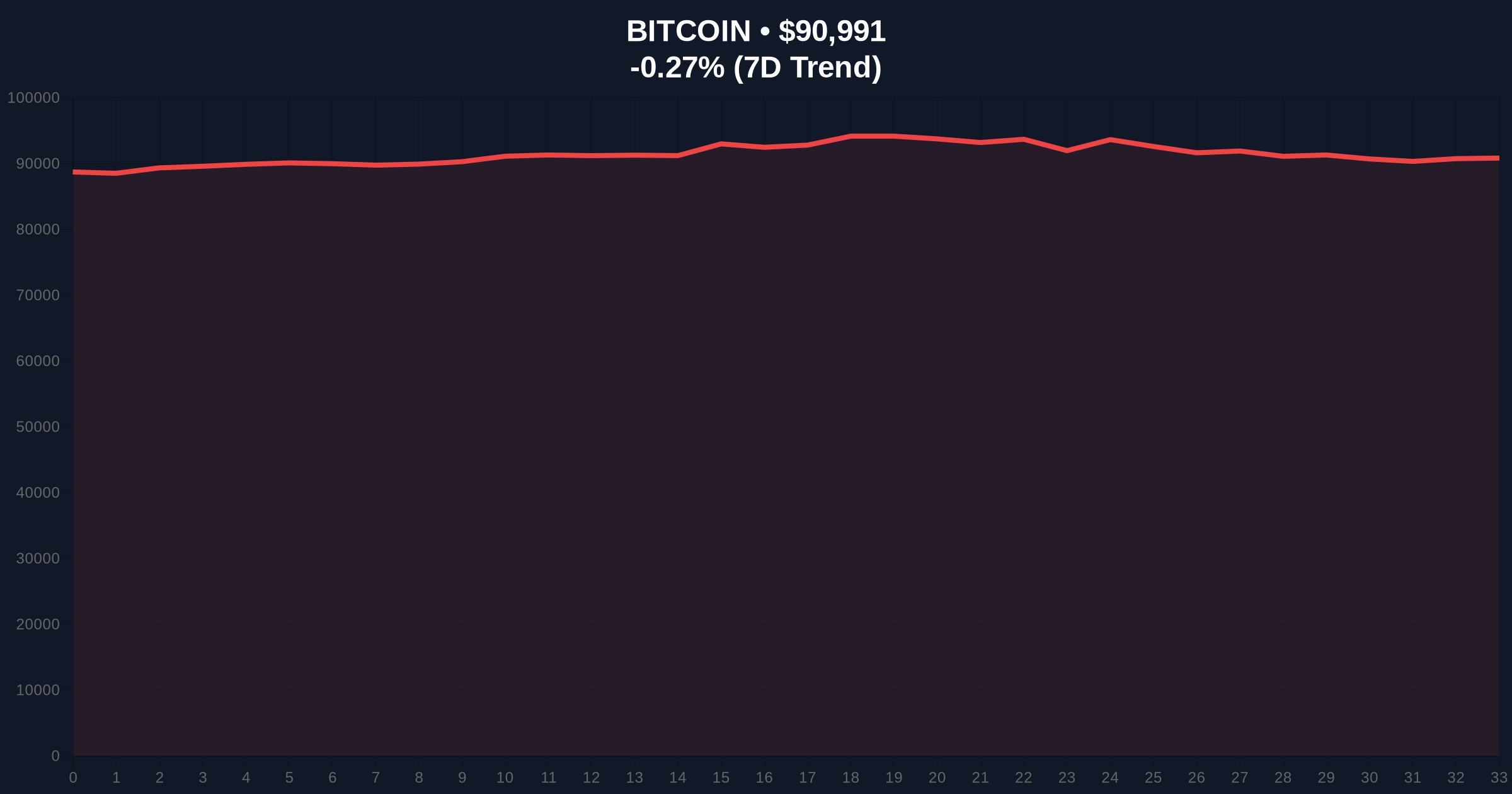

Bitcoin's price action shows a consolidation pattern around the $91,000 level, with the Relative Strength Index (RSI) at 48, indicating neutral momentum. The 50-day moving average at $89,500 serves as a critical support zone, while resistance is established at $93,200, a level that has rejected multiple attempts since December 2025. A Fair Value Gap (FVG) exists between $90,500 and $91,500, suggesting potential for a liquidity grab if price revisits this zone. For Ethereum, the $3,120 level acts as a key Order Block, with volume profile data indicating accumulation below $3,000. Bullish Invalidation for Bitcoin is set at $89,500; a break below could trigger a bearish scenario toward $82,000, aligning with the 0.618 Fibonacci retracement from the 2025 high. Bearish Invalidation is at $93,200; a sustained move above would invalidate the current downtrend structure.

| Metric | Value | Source |

|---|---|---|

| Crypto Fear & Greed Index | 27/100 (Fear) | Alternative.me |

| Bitcoin Current Price | $91,014 | CoinMarketCap |

| Bitcoin 24h Trend | -0.29% | CoinMarketCap |

| BTC Withdrawn | 1,475 BTC ($134.23M) | Onchain Lens |

| ETH Withdrawn | 3,878 ETH ($12.09M) | Onchain Lens |

Institutional impact is significant: large withdrawals reduce exchange liquidity, potentially increasing volatility during high-demand periods, as seen in the 2021 Gamma Squeeze events. For retail, this signals a divergence between institutional accumulation and retail fear, with the Crypto Fear & Greed Index at 27/100 indicating heightened risk aversion. The move may also reflect anticipation of regulatory developments, such as the SEC's stance on capital formation, which could influence long-term custody strategies. Historically, similar withdrawals have preceded periods of price stabilization, as reduced sell-side pressure from exchanges supports higher valuations over a 5-year horizon.

Market analysts on X/Twitter are divided: bulls highlight this as a bullish signal for long-term holding, while bears caution it could be a prelude to over-the-counter (OTC) sales that bypass public markets. One quant trader noted, "The volume profile suggests accumulation, but watch for a break of the $89.5k level—that's the real test." Sentiment aligns with broader discussions on US market structure reforms, which could shape institutional participation.

Bullish Case: If Bitcoin holds above $89,500 and institutional inflows continue, a retest of $95,000 is plausible by Q1 2026, driven by reduced exchange supply and positive ETF flows. Ethereum could target $3,500 if the Pectra upgrade enhances scalability.Bearish Case: A break below $89,500 could trigger a liquidation cascade toward $82,000, exacerbated by macroeconomic headwinds like rising interest rates. Ethereum might revisit $2,800 if network activity declines.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.