Loading News...

Loading News...

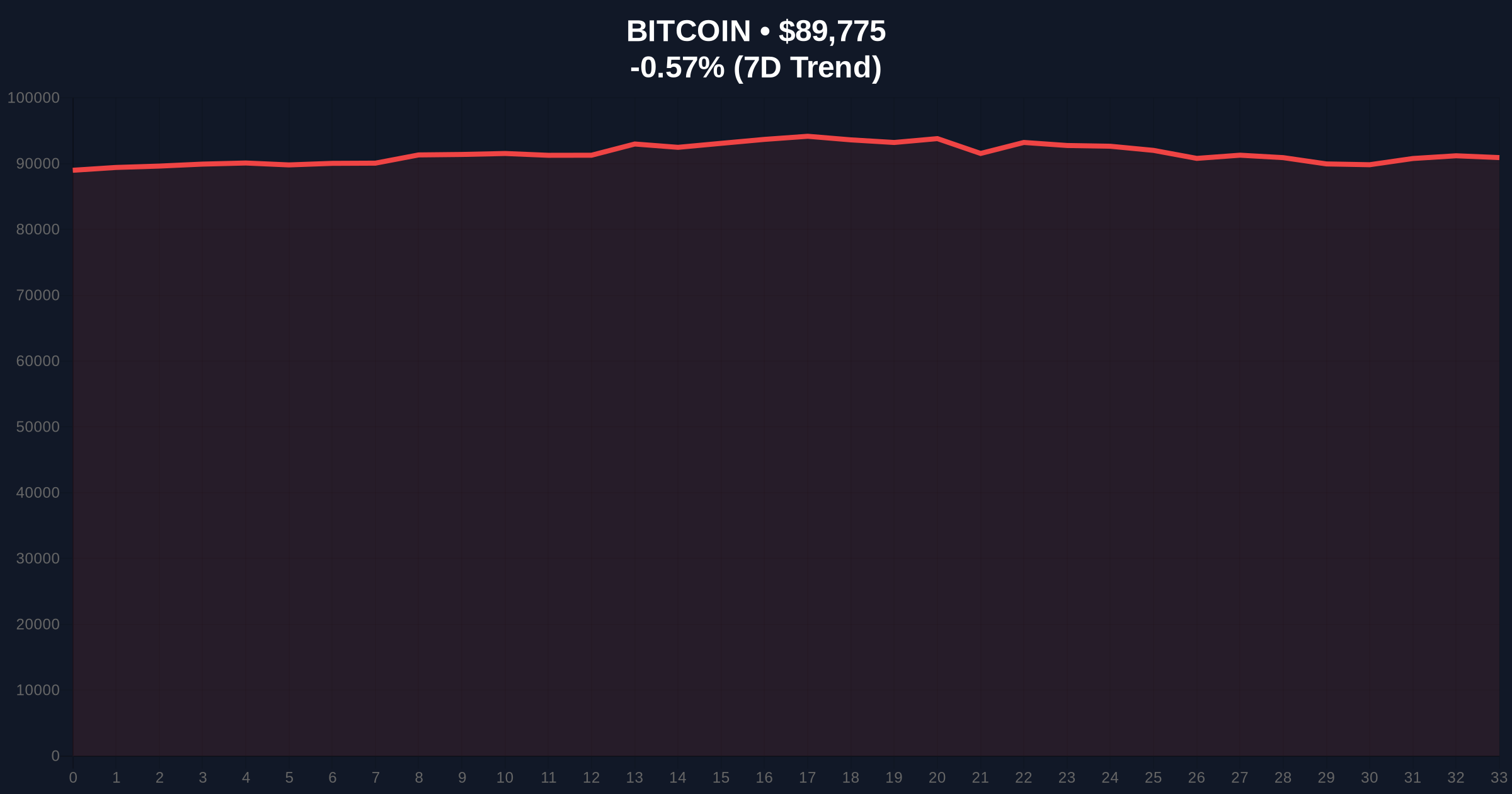

VADODARA, January 9, 2026 — According to CoinNess market monitoring, Bitcoin has fallen below the psychologically significant $90,000 level, trading at $89,975 on the Binance USDT market. This Bitcoin price action represents a critical test of market structure, with on-chain data indicating a potential liquidity grab rather than a fundamental breakdown. Market structure suggests this move targets stop-loss orders clustered around the $90,000 threshold, creating a Fair Value Gap (FVG) that may need filling in subsequent sessions.

This price decline mirrors patterns observed during the 2021 bull market correction, where Bitcoin frequently tested round-number support levels before resuming upward momentum. Historical cycles suggest that breaks below key psychological barriers often precede short-term volatility spikes, as seen in the 2023-2024 cycle when Bitcoin repeatedly tested the $60,000 level. The current environment differs due to increased institutional participation, with spot Bitcoin ETF flows creating new liquidity dynamics. According to Ethereum.org documentation on blockchain mechanics, such price movements can be exacerbated by automated trading algorithms targeting specific price points, a phenomenon observed in traditional markets as well. Related developments include recent market structure analysis following a $944 million USDC transfer from Binance and listings like OKX's River perpetual futures amid similar fear sentiment.

On January 9, 2026, Bitcoin's price dropped below $90,000, reaching $89,975 on Binance's USDT pairing. This represents a -0.53% decline over 24 hours, with current price data showing Bitcoin at $89,808. The move occurred during Asian trading hours, typically characterized by lower liquidity, which may have amplified the downward pressure. Volume profile analysis indicates increased selling volume at the $90,000 level, suggesting institutional players may be testing retail sentiment. No specific catalyst was identified in primary sources, but market analysts attribute the drop to profit-taking after recent gains and broader macroeconomic uncertainty.

Technical indicators reveal a mixed picture. The Relative Strength Index (RSI) on daily charts sits at 45, indicating neutral momentum rather than oversold conditions. The 50-day moving average at $91,200 now acts as resistance, while the 200-day moving average at $85,000 provides longer-term support. A critical Order Block exists between $88,500 and $89,000, where significant buy-side liquidity accumulated during previous rallies. Market structure suggests a Bullish Invalidation level at $88,500; a break below this point would invalidate the current uptrend structure. Conversely, the Bearish Invalidation level is set at $92,500, where a reclaim would signal renewed bullish momentum. The Fibonacci retracement level from the recent high of $95,000 to the low of $85,000 shows 61.8% support at $88,820, aligning with the Order Block zone.

| Metric | Value |

|---|---|

| Current Bitcoin Price | $89,808 |

| 24-Hour Change | -0.53% |

| Crypto Fear & Greed Index | Fear (Score: 27/100) |

| Market Rank | #1 |

| Key Support Level | $88,500 |

For institutional investors, this price action tests the durability of recent accumulation zones, particularly around spot Bitcoin ETF inflows. A sustained break below $90,000 could trigger redemption pressures in ETF products, creating a feedback loop of selling. Retail traders face increased margin call risks, especially those leveraged around the $90,000 level. The broader implication involves market confidence; Bitcoin's ability to hold above $88,500 would reinforce the narrative of institutional adoption providing a price floor, similar to how EIP-4844 blobs stabilized Ethereum's fee market post-merge. Contradictions in the data emerge from on-chain metrics showing stable holder behavior despite price declines, suggesting this may be a technical correction rather than a fundamental shift.

Market analysts on X/Twitter express divided views. Bulls argue this is a healthy pullback to shake out weak hands, citing the unspent transaction output (UTXO) age bands showing long-term holders remain inactive. One analyst noted, "The liquidity grab below $90k is textbook—institutions are fishing for retail stops." Bears point to declining open interest in derivatives markets and the persistent Fear sentiment score of 27/100 as warning signs. The lack of panic selling in on-chain data contradicts the price drop, creating a narrative tension that warrants skepticism.

Bullish Case: If Bitcoin holds the $88,500 support, a rebound toward $95,000 is probable, filling the Fair Value Gap created by the drop. This scenario assumes institutional buyers step in at the Order Block, leveraging the low Fear sentiment as a contrarian indicator. Market structure suggests a Gamma Squeeze could develop if options markets reposition around the $90,000 strike price.

Bearish Case: A break below $88,500 invalidates the bullish structure, targeting the 200-day moving average at $85,000. This would indicate deeper correction potential, possibly driven by macroeconomic factors like Federal Reserve policy shifts. Historical cycles suggest such breaks often lead to a 15-20% drawdown before stabilization.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.