Loading News...

Loading News...

VADODARA, February 10, 2026 — Bitcoin currently behaves more like a tech stock than gold. This latest crypto news comes from a formal institutional analysis by Grayscale Investments. Zach Pandl, head of research at the U.S. digital asset manager, authored the report. Market structure suggests this correlation shift impacts near-term volatility expectations.

According to the report cited by CoinDesk, Pandl identified a critical market phase. Bitcoin possesses long-term store-of-value qualities. These include a limited supply cap and decentralized network architecture. However, its price action remains tethered to market risk appetite. This sensitivity persists until widespread adoption occurs.

Consequently, Bitcoin currently moves in tandem with growth stocks. It does not function as a traditional hedge asset. Pandl's analysis directly challenges the "digital gold" narrative. The report cites specific market mechanics driving this correlation. Future developments could alter this dynamic. Clear stablecoin regulations represent one catalyst. Asset tokenization frameworks provide another.

, continued blockchain infrastructure innovation may reduce volatility. This includes layer-2 scaling solutions and post-merge issuance changes. Lower volatility could decouple Bitcoin from tech stock movements. The analysis provides a data-backed framework for institutional allocators.

Historically, Bitcoin exhibited periods of low correlation with traditional assets. The 2017 bull run demonstrated this independence. In contrast, the 2021 cycle showed increasing correlation with Nasdaq futures. Underlying this trend is institutional adoption. Spot Bitcoin ETF approvals accelerated capital flows.

Market analysts note parallel developments. For instance, Michael Saylor's corporate holding strategy reinforces long-term conviction. Simultaneously, Autozi's $1.87B discounted purchase signals institutional accumulation during fear. These actions contrast with the tech-stock correlation thesis.

Related Developments:

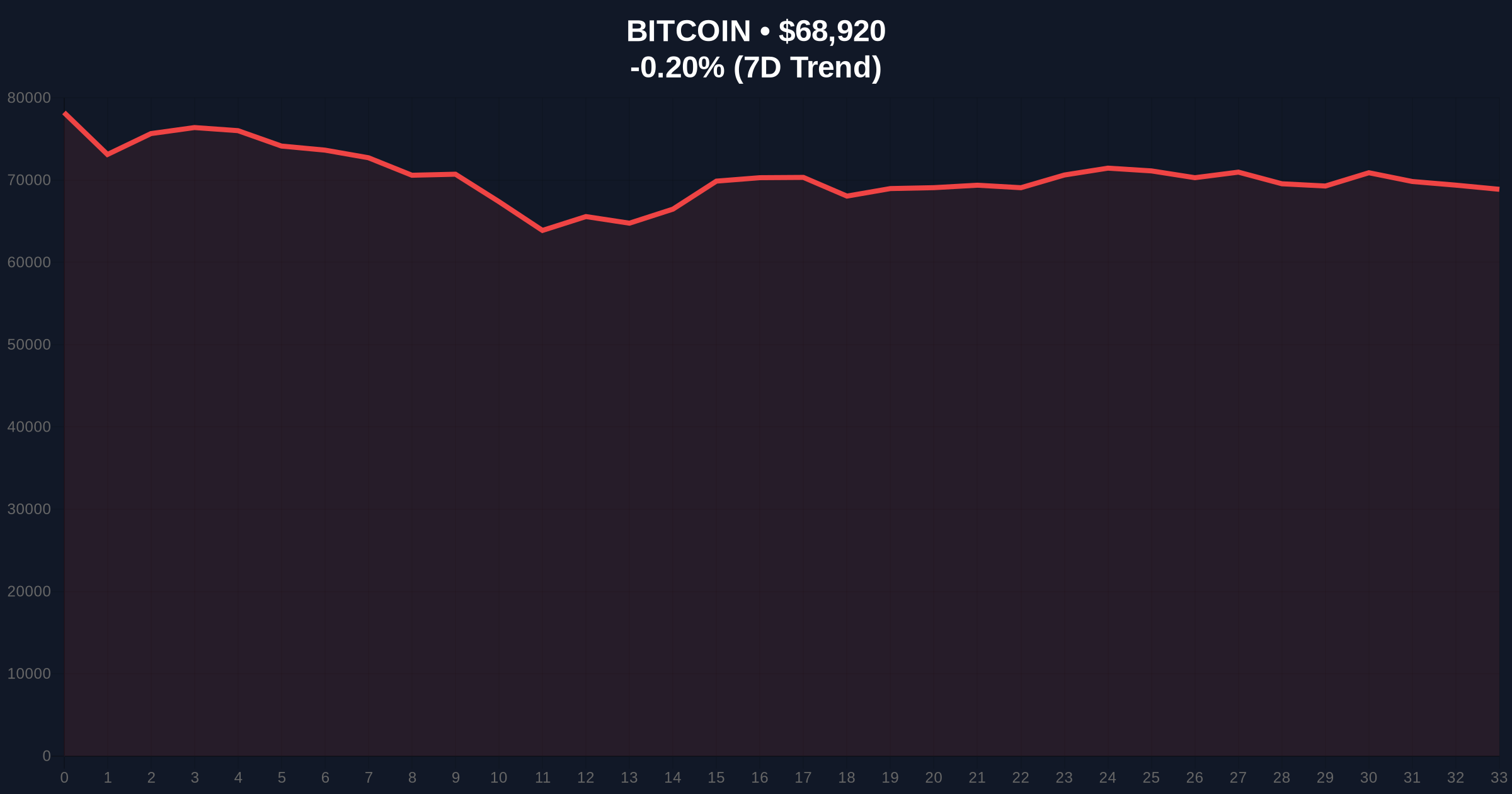

On-chain data indicates Bitcoin currently trades at $68,923. The 24-hour trend shows a minor decline of -0.20%. Market structure suggests critical support at the $68,000 psychological level. This aligns with the 0.618 Fibonacci retracement from the recent cycle high.

Volume profile analysis reveals thin liquidity below $67,500. A break of this level would create a significant Fair Value Gap (FVG). The Relative Strength Index (RSI) sits at 42 on daily timeframes. This indicates neutral momentum despite Extreme Fear sentiment.

, the 50-day moving average provides dynamic resistance near $71,200. A sustained close above this level would invalidate the bearish short-term structure. UTXO age bands show increased hodling activity among long-term holders. This contrasts with the tech-stock correlation narrative.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Contrarian buying signal historically |

| Bitcoin Current Price | $68,923 | Holding above critical $68k support |

| 24-Hour Price Change | -0.20% | Minimal movement despite fear |

| Market Correlation (Tech) | High (Per Grayscale) | Increased systemic risk exposure |

| Key Support Level | $68,000 | Technical and psychological battleground |

Grayscale's analysis matters for portfolio construction. Institutional liquidity cycles now treat Bitcoin as a risk asset. This classification impacts capital allocation during market stress. Retail market structure often follows institutional leads.

Consequently, correlation spikes increase systemic risk. A tech sector sell-off could trigger cascading liquidations in crypto. However, the long-term store-of-value thesis remains intact. The Federal Reserve's monetary policy documentation on interest rate trajectories influences both tech stocks and Bitcoin.

Market analysts watch for decoupling signals. These include reduced volatility during equity downturns. The establishment of clear regulatory frameworks represents the primary catalyst.

"Bitcoin's current correlation with tech stocks reflects its adoption phase. This isn't permanent. As regulatory clarity emerges and blockchain infrastructure matures—particularly with developments like EIP-4844 reducing layer-2 costs—we expect volatility to decrease and correlations to normalize. The digital gold narrative requires time, not abandonment."— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary technical scenarios based on current data.

The 12-month institutional outlook remains cautiously optimistic. Grayscale's analysis suggests correlation may persist through 2026. However, regulatory developments could accelerate decoupling. The 5-year horizon still favors Bitcoin's store-of-value characteristics over its current risk-asset behavior.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.