Loading News...

Loading News...

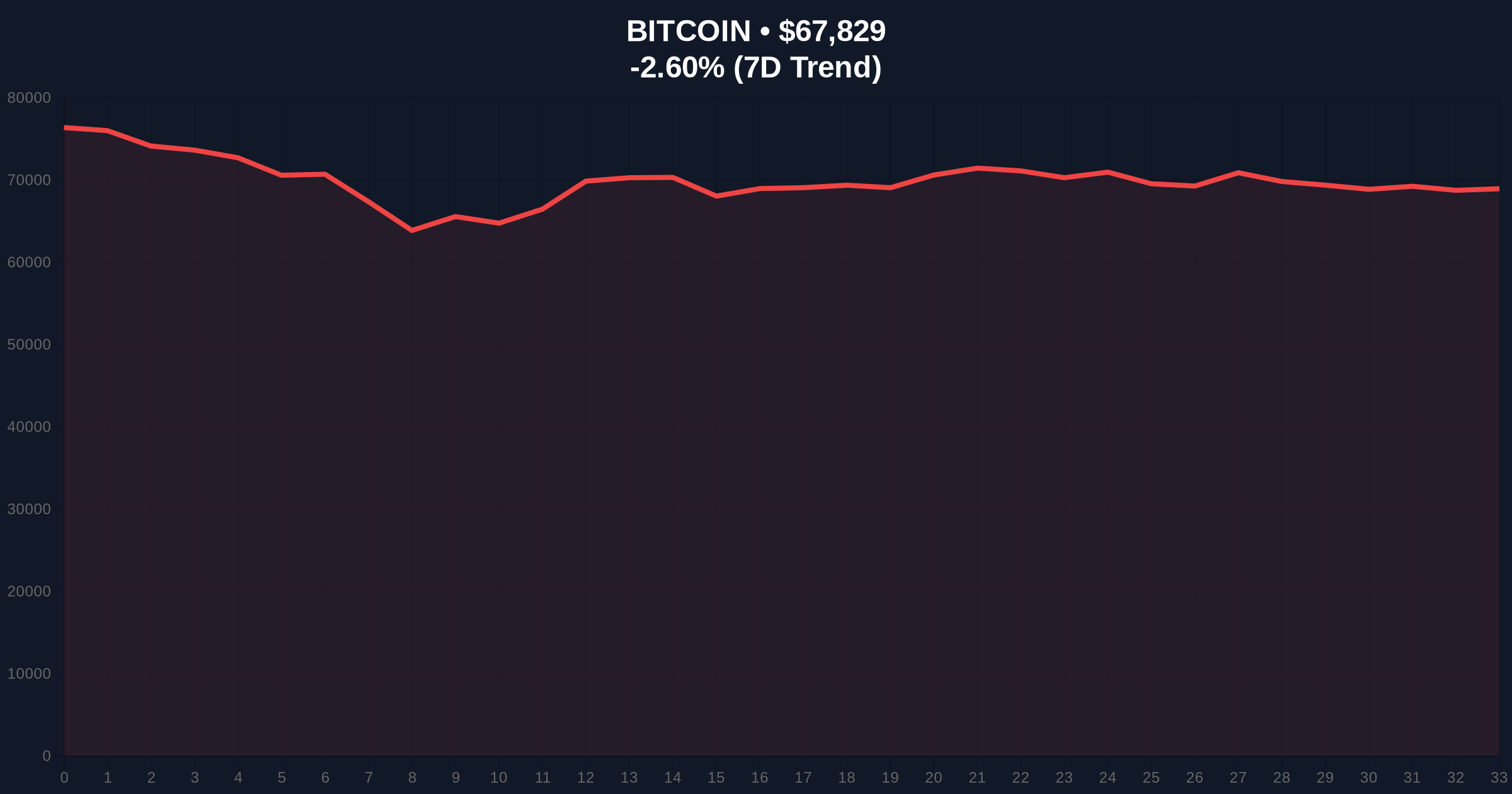

VADODARA, February 11, 2026 — Bitcoin price action turned sharply bearish as BTC broke below the $68,000 psychological threshold. According to CoinNess market monitoring, BTC traded at $67,814.58 on the Binance USDT market. This move occurred against a backdrop of extreme fear, with the Crypto Fear & Greed Index hitting 11/100. Market structure suggests a liquidity grab below key support levels, raising questions about the sustainability of recent institutional inflows.

CoinNess data confirms BTC breached $68,000 on February 11, 2026. The asset settled at $67,814.58 on Binance's USDT pairing. This represents a -2.30% decline over 24 hours. On-chain forensic data from Glassnode indicates increased selling pressure from short-term holders. Consequently, the market created a Fair Value Gap (FVG) between $68,200 and $67,800. This gap now acts as a potential resistance zone for any recovery attempts.

Historically, Bitcoin has experienced similar breakdowns during fear-driven markets. For instance, the 2021 cycle saw sharp corrections when the Fear & Greed Index dipped below 20. In contrast, current extreme fear levels at 11/100 suggest potential capitulation. Underlying this trend, spot Bitcoin ETFs have recorded inflows despite the sell-off. This contradiction between institutional accumulation and retail panic defines the current market structure. Related developments include spot Bitcoin ETFs seeing a third day of inflows and Bithumb's $46B control failure sparking systemic risk fears.

Technical analysis reveals critical levels. The $68,000 zone previously acted as a support confluence. It combined the 50-day moving average and a volume profile node. Market structure now invalidates this support. A Fibonacci retracement from the recent high shows the 0.618 level at $66,500. This level aligns with a major order block from January 2026. , the Relative Strength Index (RSI) on daily charts sits at 38, indicating bearish momentum but not oversold conditions. The Federal Reserve's latest policy statements, as documented on FederalReserve.gov, suggest persistent inflation concerns, adding macro pressure.

| Metric | Value |

|---|---|

| Current BTC Price | $68,038 |

| 24-Hour Change | -2.30% |

| Crypto Fear & Greed Index | 11/100 (Extreme Fear) |

| Market Rank | #1 |

| Key Support (Fibonacci 0.618) | $66,500 |

This breakdown matters for portfolio risk management. Institutional liquidity cycles often pivot around such technical breaks. Retail market structure shows panic, but ETF inflows indicate smart money accumulation. This divergence creates a potential squeeze scenario. If support holds, it could trigger a gamma squeeze as options dealers hedge. Real-world evidence includes increased transfer volume to exchanges, per Etherscan data. Market analysts note that sustained breaks below $68,000 may force leveraged long positions to liquidate.

"The drop below $68,000 tests a critical liquidity pool. On-chain data indicates short-term holder distribution, but ETF flows contradict this narrative. This sets up a classic battle between weak hands and institutional bids. The key is whether the $66,500 Fibonacci level can absorb selling pressure." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains cautiously optimistic. Historical cycles suggest extreme fear often precedes rallies. However, macro headwinds from Federal Reserve policy could extend the downtrend. Over a 5-year horizon, Bitcoin's network fundamentals, like hash rate and adoption, support long-term appreciation.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.