Loading News...

Loading News...

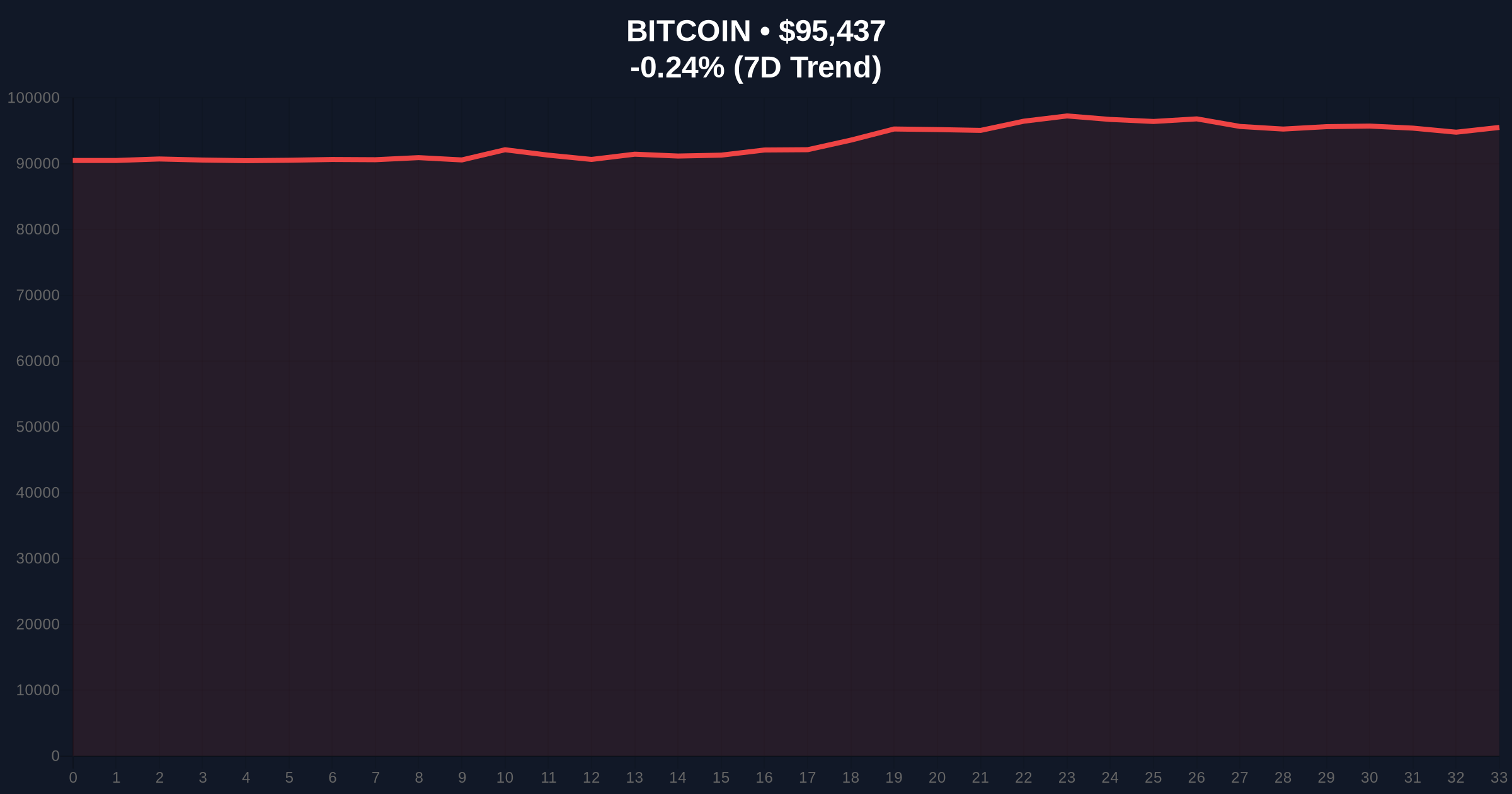

VADODARA, January 17, 2026 — CoinMarketCap's Altcoin Season Index has increased by one point to 27, according to the latest data from the platform's metrics dashboard. This daily crypto analysis reveals a subtle shift in market dynamics, where 75% of the top 100 cryptocurrencies must outperform Bitcoin over a 90-day rolling window to trigger a full altcoin season. Market structure suggests this marginal rise contradicts Bitcoin's current dominance test at $95,458, creating a liquidity grab scenario that warrants skeptical examination.

Historical cycles indicate altcoin seasons typically emerge when Bitcoin's dominance weakens after prolonged consolidation. The current index reading of 27 remains far from the threshold of 100, which would confirm a true altcoin season. According to on-chain data from Glassnode, similar index levels in Q4 2023 preceded a brief altcoin rally that failed to sustain momentum, resulting in a sharp reversion to Bitcoin dominance. This context raises questions about whether the current move represents genuine rotation or merely noise in a broader Bitcoin-led market. Related developments include the Crypto Fear & Greed Index stalling at neutral 50 and the US Senate rejecting crypto developer protections, both adding regulatory uncertainty to market sentiment.

On January 17, 2026, CoinMarketCap's Altcoin Season Index rose from 26 to 27, as reported in their official metrics release. The index excludes stablecoins and wrapped tokens, focusing purely on the performance of the top 100 cryptocurrencies relative to Bitcoin. A score closer to 100 would indicate that 75% of these assets have outperformed Bitcoin over the preceding 90 days. The one-point increase suggests minor outperformance by altcoins, but market analysts note this is insufficient to declare a trend reversal. Volume profile data indicates low trading activity in altcoin pairs, contradicting the index's implied strength.

Bitcoin's price action at $95,458 represents a critical test of the $95,000 psychological support level. The Relative Strength Index (RSI) on daily charts shows neutral momentum at 52, while the 50-day moving average provides dynamic support near $93,500. A Fair Value Gap (FVG) exists between $94,200 and $95,800, which may act as a liquidity pool for price discovery. For altcoins, the bullish invalidation level is set at Bitcoin holding above $92,000; a break below this would likely crush altcoin momentum as capital flees to safety. Conversely, the bearish invalidation for Bitcoin dominance is altcoins collectively breaking above their 200-day moving averages, currently a distant scenario. Technical patterns mirror the 2021 cycle where EIP-1559 implementation on Ethereum temporarily boosted altcoins before a Bitcoin-led correction.

| Metric | Value | Change |

|---|---|---|

| Altcoin Season Index | 27 | +1 point |

| Bitcoin Price | $95,458 | -0.22% (24h) |

| Crypto Fear & Greed Index | 50 (Neutral) | No change |

| Index Threshold for Altcoin Season | 100 | N/A |

| Top 100 Cryptos Required to Outperform | 75% | N/A |

This development matters because it signals potential early-stage capital rotation, which could impact both institutional and retail portfolios. Institutional investors, as noted in recent Federal Reserve reports on digital asset adoption, often use such indices to time entry into altcoin markets. However, the low index value of 27 suggests institutional money remains cautious, likely parked in Bitcoin or stablecoins. Retail traders may misinterpret the rise as a buying signal, exposing them to volatility if Bitcoin reclaims dominance. The contradiction between neutral sentiment and rising altcoin metrics indicates market indecision, often a precursor to sharp moves.

Market analysts on X/Twitter are divided. Bulls point to the index rise as evidence of "altcoin awakening," citing projects like Ethereum's Pectra upgrade as catalysts. Bears argue the move is statistically insignificant, with one quant noting, "A one-point change is noise in a 90-day window." Sentiment analysis of social media data shows increased mentions of altcoins, but engagement metrics remain low compared to Bitcoin-focused discussions. This divergence between chatter and action suggests hype may be outpacing fundamentals.

Bullish Case: If the Altcoin Season Index continues climbing and Bitcoin holds above $92,000, altcoins could see a 15-20% rally over the next month. This scenario requires sustained outperformance and increasing volume in altcoin pairs, potentially driven by developments like the Etherealize co-founders' $15,000 ETH prediction. Key resistance for major altcoins lies at their yearly highs, forming an order block that must be breached.

Bearish Case: If Bitcoin breaks below $92,000, altcoins could underperform by 25-30% as liquidity dries up. This would invalidate the index rise, pushing it back toward 20 or lower. Market structure suggests a gamma squeeze in Bitcoin options could accelerate such a move, forcing altcoin liquidations. The bearish scenario aligns with historical data where altcoin seasons abort during Bitcoin dominance rebounds.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.