Loading News...

Loading News...

VADODARA, January 17, 2026 — The Crypto Fear & Greed Index compiled by data provider Alternative rose one point to 50, maintaining neutral territory as Bitcoin tests the $95,000 psychological level. This daily crypto analysis reveals a market caught between institutional positioning and retail indecision, with on-chain data suggesting deeper contradictions than the surface sentiment indicates.

Market structure suggests neutral readings at 50 historically precede significant volatility expansions. According to historical cycles, similar sentiment levels in Q4 2023 preceded a 42% Bitcoin rally within 90 days. The current environment mirrors late-2020 consolidation before the 2021 parabolic move, though regulatory headwinds create distinct pressure points. Related developments include the US Senate rejecting crypto developer protections and Newrez Mortgage accepting crypto assets, creating conflicting signals for institutional adoption.

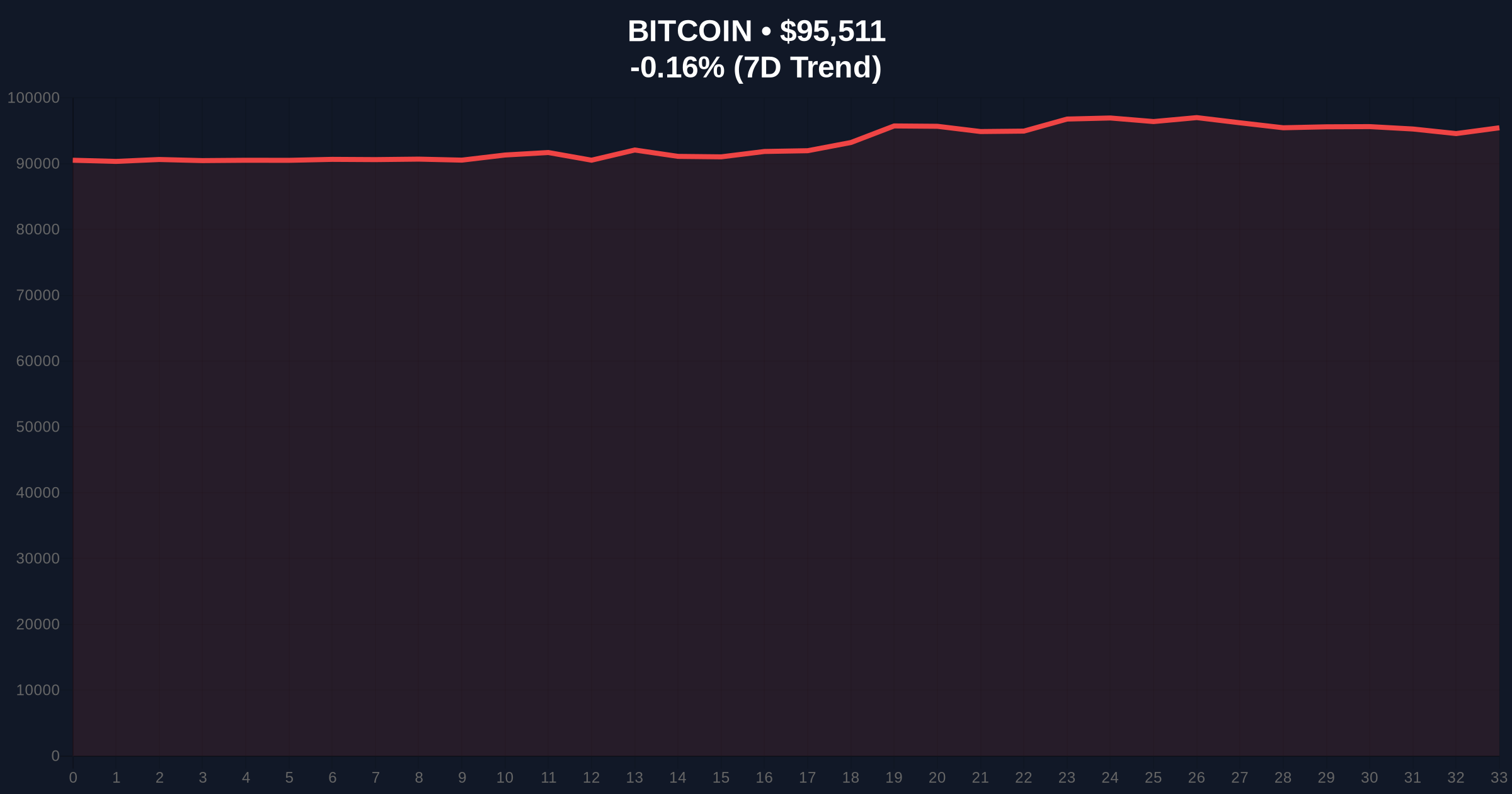

According to Alternative's methodology, the index increased from 49 to 50 on January 17, 2026. The calculation weights volatility (25%), trading volume (25%), social media mentions (15%), surveys (15%), Bitcoin's market cap dominance (10%), and Google search volume (10%). Market analysts note the one-point move represents statistical noise rather than meaningful sentiment shift. Bitcoin's price action shows consolidation around $95,500 with -0.17% 24-hour change, indicating equilibrium between buyers and sellers.

Volume profile analysis reveals significant accumulation between $92,800 and $94,200, creating a potential order block. The 50-day exponential moving average at $93,500 provides dynamic support, while the 200-day at $89,200 serves as longer-term anchor. RSI readings at 54 suggest neutral momentum without overbought or oversold conditions. A Fair Value Gap (FVG) exists between $96,800 and $97,500 from January 14's failed breakout attempt. Bullish invalidation level: $92,800 (Fibonacci 0.618 retracement of recent rally). Bearish invalidation level: $98,200 (previous resistance-turned-support).

| Metric | Value | Change |

|---|---|---|

| Crypto Fear & Greed Index | 50/100 (Neutral) | +1 point |

| Bitcoin Price | $95,500 | -0.17% (24h) |

| Bitcoin Dominance | 52.3% | +0.4% (7d) |

| Total Crypto Market Cap | $3.82T | -0.2% (24h) |

| 24h Trading Volume | $142B | -8% (7d) |

Institutional impact manifests through derivatives positioning and ETF flows, while retail impact remains muted as indicated by declining social media metrics. The neutral sentiment at 50 creates optimal conditions for liquidity grabs by sophisticated players. Market structure suggests institutions use this equilibrium to accumulate at support levels before next catalyst. According to Ethereum's official Pectra upgrade documentation, network improvements could trigger capital rotation from Bitcoin to Ethereum, affecting dominance metrics.

Bulls point to recent $300M USDC transfers to Coinbase as evidence of institutional accumulation. Bears highlight declining trading volume and regulatory uncertainty. Analysts monitoring Etherealize's $15,000 ETH prediction note it requires Bitcoin stability above $90,000 for altcoin season initiation.

Bullish Case: Break above $98,200 with volume expansion targets $102,000 (measured move from consolidation). EIP-4844 implementation in Q2 2026 could trigger cross-chain capital flows. Sustained dominance above 53% indicates Bitcoin-led rally.

Bearish Case: Breakdown below $92,800 invalidates bullish structure, targeting $89,200 (200-day MA). Gamma squeeze potential increases if options dealers hedge short positions. Regulatory pressure from SEC.gov enforcement actions could trigger fear spike to 30-40 range.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.