Loading News...

Loading News...

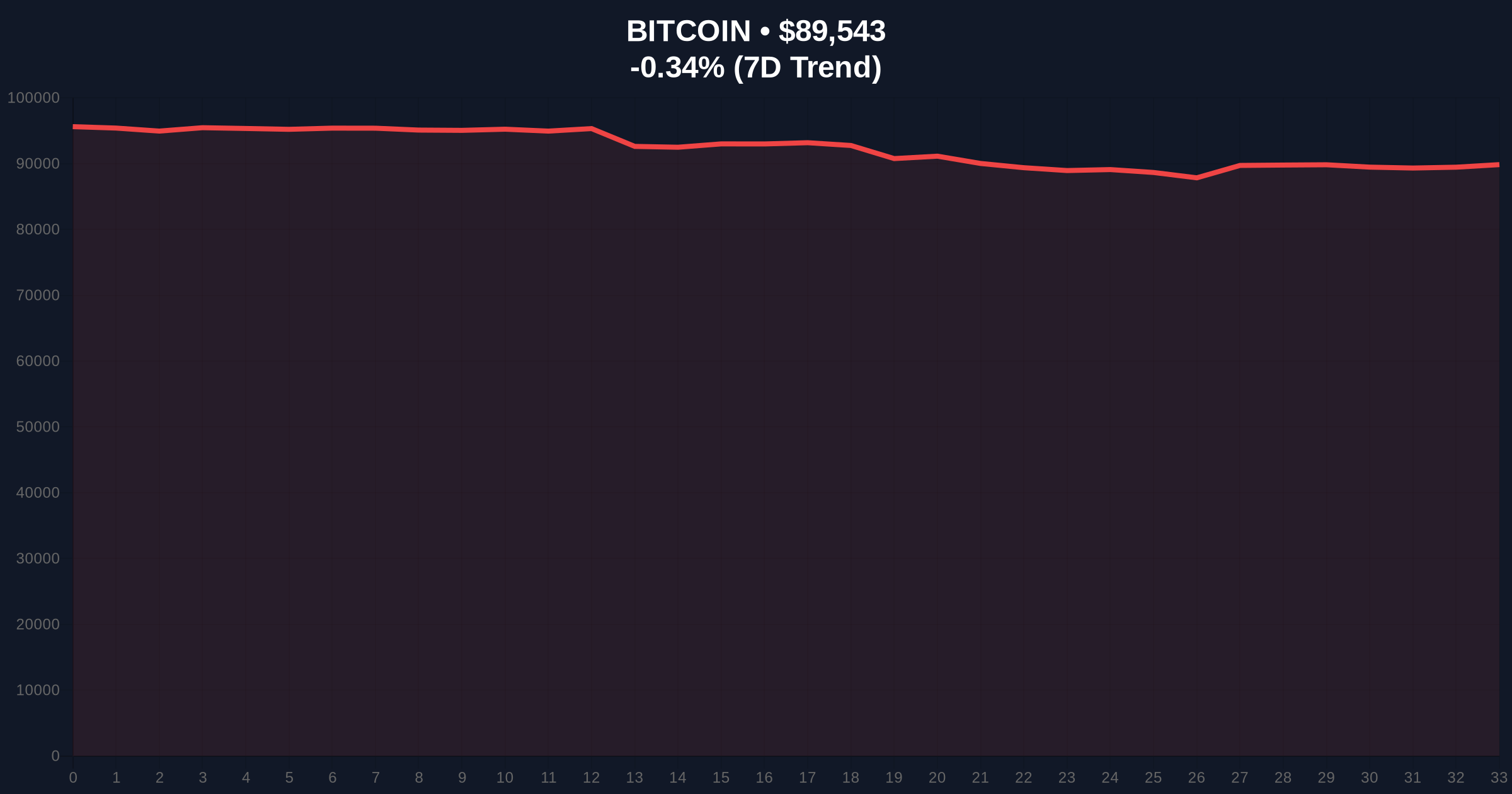

VADODARA, January 23, 2026 — A wallet linked to U.S. retailer GameStop deposited its entire holding of 4,710 BTC into Coinbase Prime, according to CryptoQuant, with on-chain data indicating a likely sale at an estimated $76 million loss. This daily crypto analysis examines the market structure implications as Bitcoin trades at $89,538 amid extreme fear sentiment, questioning whether this move represents a strategic exit or a forced liquidation event.

GameStop's original Bitcoin purchase at an average price of $107,900, as reported by CryptoQuant, occurred during a period of high retail speculation in 2024-2025. Market structure suggests such large-scale institutional entries often create order blocks that later act as resistance or support. The current deposit to Coinbase Prime, a platform favored for institutional sales, mirrors patterns seen in previous capitulation events, such as the 2022 Luna collapse, where distressed selling triggered cascading liquidations. This event unfolds against a backdrop of extreme fear, with the Crypto Fear & Greed Index at 24/100, indicating potential oversold conditions but also heightened volatility risk. Related developments include recent tariff shifts impacting Bitcoin liquidity and exchange listings testing market resilience.

On January 23, 2026, CryptoQuant identified a wallet address believed to belong to GameStop moving 4,710 BTC to Coinbase Prime. The analytics firm suggested the deposit was likely made with intent to sell, based on transaction patterns and exchange inflow metrics. According to the report, GameStop's original purchase price averaged $107,900 per Bitcoin, meaning a sale at current prices around $89,538 would result in an approximate $76 million loss. This represents a 17% decline from the acquisition cost, highlighting the volatility inherent in cryptocurrency investments. The move follows a broader trend of institutional rebalancing, as seen in recent SEC filings for Bitcoin ETFs, which show mixed flows amid regulatory scrutiny.

Bitcoin's price action at $89,538, down 0.34% in 24 hours, is testing a critical volume profile area between $88,500 and $90,000. Market structure suggests this zone acts as a liquidity pool, with the GameStop deposit potentially serving as a liquidity grab to fill fair value gaps (FVGs) created during last week's decline. The Relative Strength Index (RSI) on daily charts is near 40, indicating neutral momentum but leaning bearish. The 50-day moving average at $91,200 provides immediate resistance, while the 200-day moving average at $85,000 offers longer-term support. A break below the $88,500 support would invalidate the current bullish order block and target the $85,000 region, aligning with Fibonacci retracement levels from the 2025 high. Bullish invalidation is set at $88,500; bearish invalidation at $91,200.

| Metric | Value |

|---|---|

| GameStop BTC Deposit | 4,710 BTC |

| Estimated Loss | $76 million |

| Bitcoin Current Price | $89,538 |

| 24-Hour Trend | -0.34% |

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) |

For institutions, this event the risks of timing large Bitcoin allocations without hedging strategies, as detailed in Federal Reserve research on digital asset volatility. The $76 million loss may pressure other corporate holders to reassess their crypto treasuries, potentially leading to further sell-offs. For retail traders, the deposit into Coinbase Prime—a venue known for over-the-counter (OTC) deals—suggests minimal immediate market impact, but on-chain data indicates increased exchange supply could weigh on prices if not absorbed by buyers. The move highlights the importance of monitoring UTXO age bands and spent output profit ratios (SOPR) to gauge seller motivation.

Market analysts on X/Twitter are divided. Bulls argue this is a classic capitulation signal, often preceding market bottoms, citing historical cycles like 2018. Bears point to the loss as evidence of poor institutional timing and potential contagion to other meme-stock-linked crypto holdings. One quant trader noted, "The Gamma Squeeze potential is low here, but the liquidity grab could flush out weak hands." No official statement from GameStop has been verified, leaving the narrative open to speculation.

Bullish Case: If Bitcoin holds the $88,500 support and absorbs the GameStop selling pressure, a rebound toward $95,000 is plausible. Market structure suggests extreme fear readings often precede rallies, and on-chain data shows accumulation by long-term holders per Glassnode metrics. The invalidation level for this scenario is $88,500.

Bearish Case: A break below $88,500 could trigger stop-losses and target the $85,000 support zone. The GameStop loss may spook other institutions, leading to a cascade of sales. This aligns with bearish divergences in funding rates and open interest. The invalidation level for this scenario is $91,200.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.