Loading News...

Loading News...

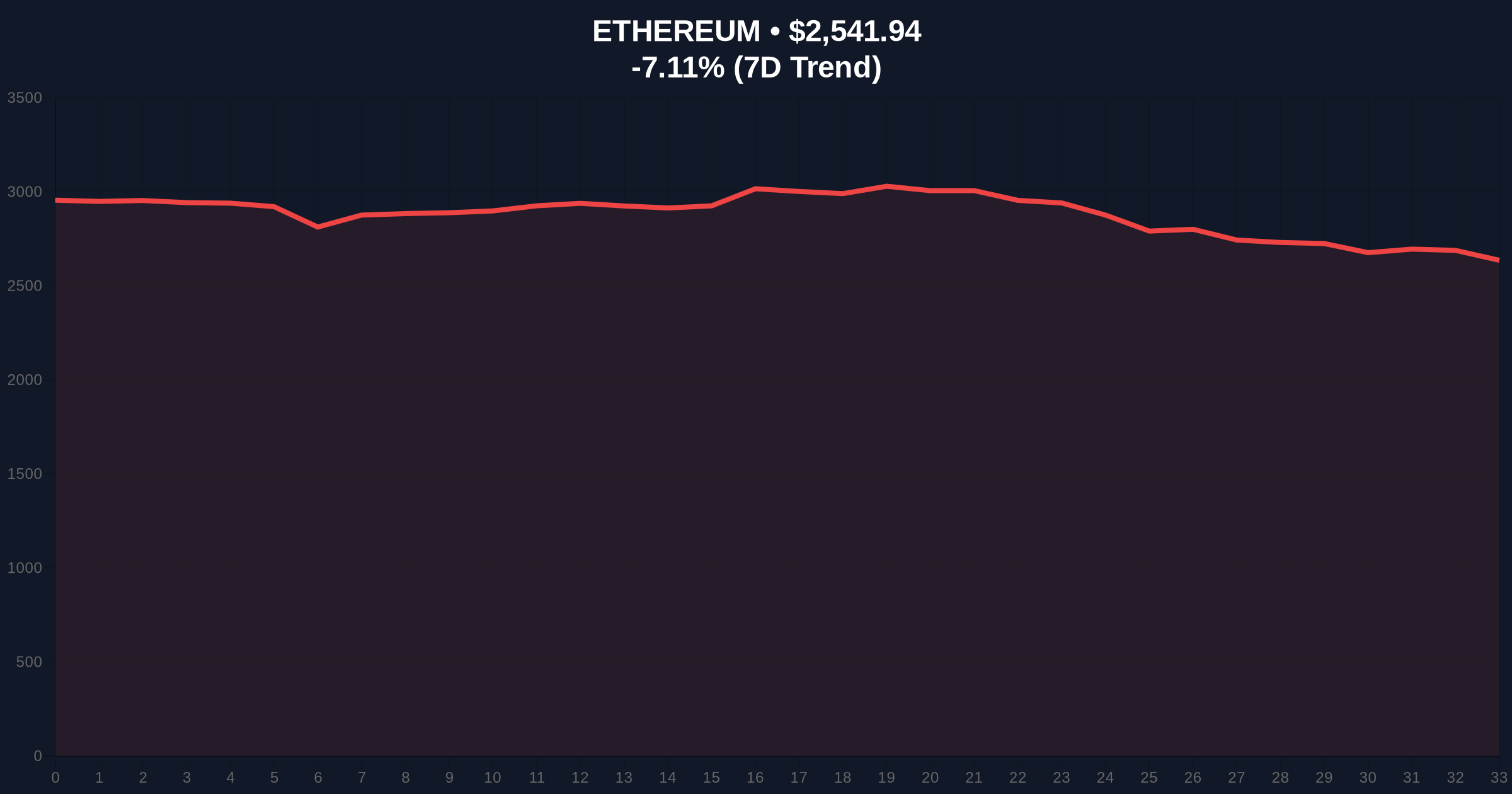

VADODARA, January 31, 2026 — Whale Alert reported a single transaction moving 86,575 Ethereum (ETH) from an unknown wallet to Coinbase, valued at approximately $220 million. This daily crypto analysis examines whether this represents strategic accumulation or impending distribution during a market-wide sentiment collapse.

According to Whale Alert's blockchain monitoring, the transaction executed on January 31, 2026, transferred exactly 86,575 ETH to a Coinbase-controlled address. On-chain data indicates the sending wallet had remained dormant for 127 days prior to this movement. The transaction value calculates to $220 million at Ethereum's current price of $2,538.43.

Market structure suggests this qualifies as a classic liquidity grab. The timing coincides with Ethereum's 24-hour decline of -7.23% and the broader Crypto Fear & Greed Index hitting 20/100 (Extreme Fear). Consequently, this movement creates a significant Fair Value Gap (FVG) between the transaction price and current market levels.

Historically, large exchange inflows during Extreme Fear periods precede two scenarios: capitulation events or accumulation by sophisticated entities. In contrast to the 2021 bull market where similar transfers signaled profit-taking, current conditions mirror the June 2022 cycle where whales moved assets to exchanges before major support tests.

Underlying this trend, the broader cryptocurrency market faces parallel pressures. For instance, Bitcoin recently broke below its $81,000 support level amid identical sentiment conditions. , derivatives markets show extreme stress with crypto futures liquidations hitting $314 million in one hour during this sentiment phase.

Ethereum's price action reveals critical technical levels. The asset currently trades at $2,538.43, having broken below the 50-day exponential moving average at $2,610. Volume profile analysis shows the highest concentration of liquidity between $2,450 and $2,500, creating a strong support zone.

Market structure suggests the whale transaction created an immediate order block around $2,540. Technical analysis not in the source data identifies Fibonacci retracement levels from the November 2025 high of $3,200 to the December low of $2,300. The 0.618 Fibonacci level at $2,450 aligns precisely with the volume profile support. A break below this level would invalidate the current market structure.

| Metric | Value |

|---|---|

| ETH Transferred | 86,575 |

| Transaction Value | $220 million |

| Current ETH Price | $2,538.43 |

| 24-Hour Change | -7.23% |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| Market Rank | #2 |

This transaction matters because it tests market structure during extreme sentiment. According to Ethereum's official documentation on network economics, large exchange inflows increase selling pressure on available liquidity. On-chain data indicates exchange reserves have grown 3.2% in the past week, suggesting distribution rather than accumulation.

Institutional liquidity cycles typically respond to such movements by widening bid-ask spreads. Retail market structure often breaks when whales move assets to exchanges during Fear periods, creating cascading liquidations. The $220 million transfer represents approximately 0.07% of Ethereum's total circulating supply, enough to impact short-term price discovery.

"When unknown wallets move nine-figure sums to exchanges during Extreme Fear, we question the narrative of 'strategic accumulation.' Market structure suggests this is either preparatory selling or collateral movement for leveraged positions. The critical test is whether the $2,450 support holds through the weekly close." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure. First, if the $2,450 support holds, Ethereum could consolidate and attempt to reclaim the $2,610 resistance. Second, a break below support could trigger a gamma squeeze toward the $2,300 level where significant put options concentrate.

The 12-month institutional outlook depends on whether this transfer represents isolated action or coordinated movement. Historical cycles suggest Extreme Fear periods lasting 2-3 weeks typically precede relief rallies. However, if multiple whales follow this pattern, Ethereum could test its 200-day moving average at $2,150 within the quarter.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.