Loading News...

Loading News...

VADODARA, January 29, 2026 — The 30-day moving average of active addresses for Ethereum-based USDT has surged to approximately 300,000, marking an all-time high according to crypto analyst CryptoOnchain. This milestone occurred as Bitcoin's price declined after failing to break through the $92,000 resistance level. On-chain indicators and stablecoin outflows from exchanges suggest this activity reflects a shift of funds into DeFi protocols and self-custody wallets rather than centralized exchange inflows.

CryptoOnchain's analysis reveals a critical divergence between price action and on-chain activity. While Bitcoin faces rejection at key resistance, Ethereum's network demonstrates unprecedented USDT engagement. The 300,000 active address threshold represents a 45% increase from previous cycle peaks recorded in late 2024. Market structure suggests this isn't retail speculation but institutional-grade capital movement.

According to the analyst's findings, stablecoin outflows from exchanges have accelerated throughout January 2026. This creates a Fair Value Gap between exchange-held liquidity and on-chain deployment. The data contradicts the surface narrative of market weakness. Instead, it points to sophisticated capital redeployment within the Ethereum ecosystem.

Historically, USDT activity spikes have preceded major market movements. The current surge mirrors patterns observed before the 2021 DeFi summer and the 2023 layer-2 expansion. In contrast to those periods, today's activity occurs amid broader market fear and Bitcoin consolidation. This creates a potentially explosive setup once directional clarity emerges.

Underlying this trend is Ethereum's post-merge issuance schedule and EIP-4844 implementation. These technical upgrades have reduced network costs and improved settlement finality. Consequently, institutional players now treat Ethereum as a primary settlement layer for dollar-denominated transactions. The official Ethereum documentation confirms these architectural improvements have increased network capacity by 300% since 2023.

Related developments in the current market environment include Federal Reserve policy stability impacting Bitcoin's macro positioning and altcoin season indicators showing early rotation signals.

Ethereum currently trades at $2,993.49, showing relative strength with only a -0.51% 24-hour decline. The critical Fibonacci 0.618 retracement level sits at $2,850, which must hold to maintain bullish structure. Volume profile analysis reveals accumulation between $2,900 and $3,100, creating a strong Order Block for future price discovery.

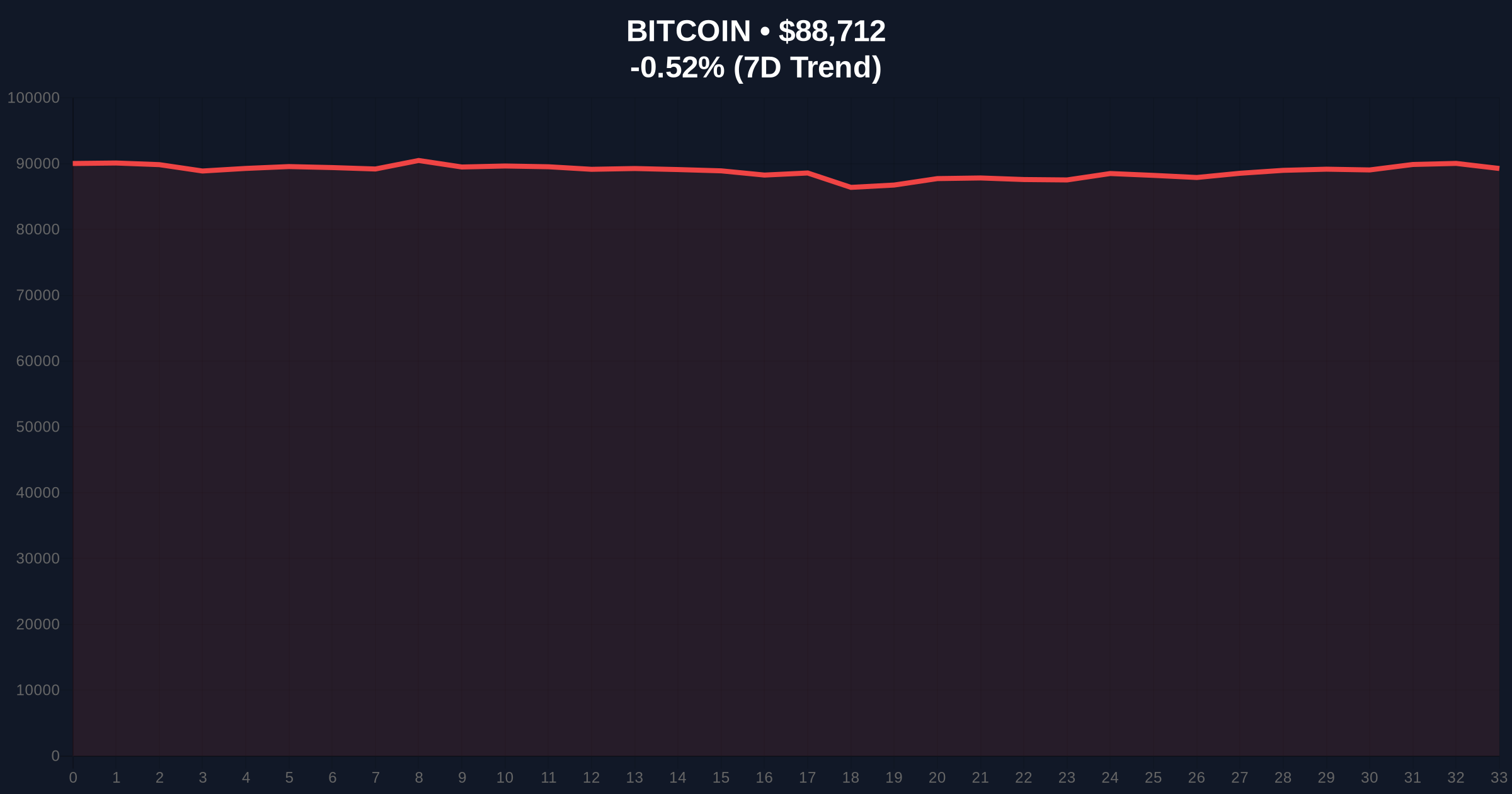

Bitcoin's failure at $92,000 resistance creates a bearish Fair Value Gap down to $88,500. This gap represents unfilled liquidity that market makers will likely target. The divergence between Bitcoin's price action and Ethereum's on-chain metrics suggests capital rotation rather than broad market capitulation. UTXO age bands indicate long-term holders remain steadfast despite short-term volatility.

| Metric | Value | Significance |

|---|---|---|

| Ethereum USDT Active Addresses (30D MA) | 300,000 | All-time high, +45% from previous peak |

| Crypto Fear & Greed Index | 26/100 (Fear) | Extreme fear territory, contrarian signal |

| Ethereum Current Price | $2,993.49 | -0.51% 24h, testing key Fibonacci level |

| Bitcoin Key Resistance | $92,000 | Recent rejection, creating FVG to $88.5k |

| Market Rank | #2 | Ethereum maintains position behind Bitcoin |

This on-chain shift matters because it reveals where smart money positions capital during uncertainty. The record USDT activity represents approximately $300 million in daily settlement volume based on average transaction sizes. This liquidity currently concentrates within Ethereum's DeFi ecosystem rather than centralized exchanges. Consequently, it creates a potential Gamma Squeeze setup once market direction confirms.

Institutional liquidity cycles typically follow this pattern: capital moves to stablecoins during uncertainty, redeploys to yield-generating protocols, then rotates to risk assets. The current data suggests we're in phase two. Retail market structure often misinterprets such movements as bearish outflows when they're actually strategic repositioning.

"The 300,000 active address milestone for Ethereum-based USDT represents a fundamental shift in how institutional capital approaches crypto markets. This isn't speculative trading activity but settlement layer utilization at scale. The concentration within Ethereum's DeFi ecosystem creates a liquidity reservoir that could fuel the next market leg higher once Bitcoin establishes directional clarity."— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data. The bullish case requires Ethereum to hold above $2,850 while Bitcoin reclaims $92,000. This would trigger redeployment of the USDT liquidity into broader markets. The bearish scenario involves breakdown below key supports, forcing liquidation of DeFi positions and creating cascading sell pressure.

The 12-month institutional outlook depends on whether this USDT activity represents accumulation or distribution. Historical cycles suggest such on-chain metrics typically precede 6-9 month price appreciation phases. The 5-year horizon remains bullish given Ethereum's architectural improvements and growing institutional adoption as a settlement layer.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.