Loading News...

Loading News...

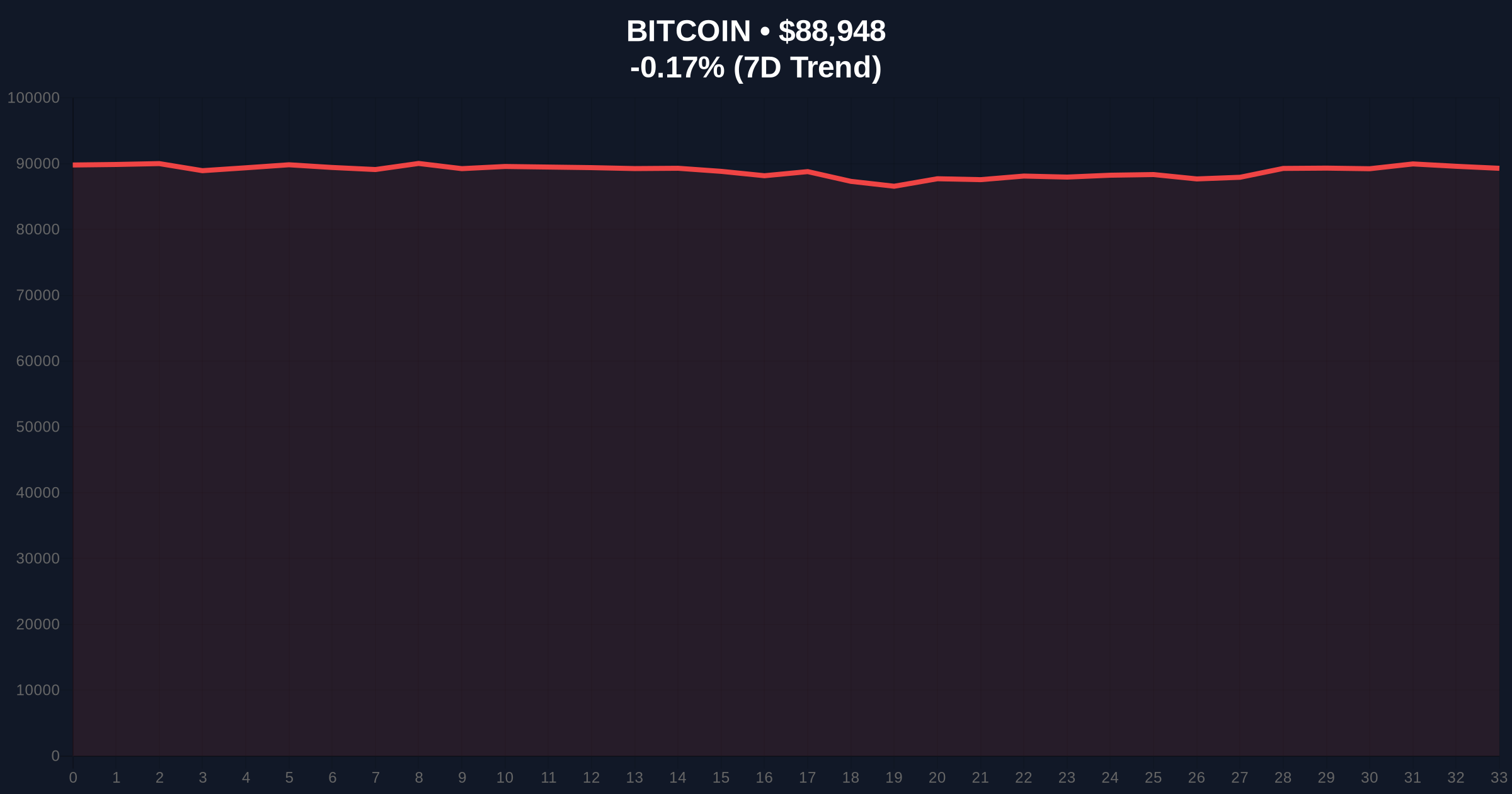

VADODARA, January 29, 2026 — CoinMarketCap's Altcoin Season Index surged seven points to 32 on Tuesday, marking the most significant single-day gain in three months. This daily crypto analysis reveals a potential market rotation brewing beneath Bitcoin's stagnant price action at $88,969. According to the official index methodology, the metric now sits 43 points from the 75 threshold that traditionally signals a full altcoin season.

CoinMarketCap's Altcoin Season Index operates as a quantitative market structure indicator. The index measures whether capital favors altcoins or Bitcoin by comparing the price performance of the top 100 cryptocurrencies by market capitalization. According to the official methodology, the calculation excludes stablecoins and wrapped coins to isolate pure speculative flows. An altcoin season triggers when 75% of these top 100 assets outperform Bitcoin over a rolling 90-day window. Consequently, Tuesday's jump from 25 to 32 represents a 28% increase in the index value, suggesting improved relative strength among alternative cryptocurrencies.

Historically, Altcoin Season Index readings between 30-50 have preceded major rotation events. In the 2021 cycle, similar readings in February preceded a 120% altcoin rally over the subsequent 60 days. In contrast, the current market operates under different macro conditions with elevated interest rates. Underlying this trend is Bitcoin's dominance hovering near 52%, creating a potential liquidity grab scenario if altcoins break higher. This development occurs alongside Federal Reserve policy decisions impacting crypto volatility and exchange expansion during market uncertainty.

Market structure suggests Bitcoin faces critical technical resistance at the $92,000 Fibonacci 0.618 retracement level from the 2025 high. The Relative Strength Index (RSI) on daily charts prints at 42, indicating neutral momentum with bearish divergence. Simultaneously, Ethereum's weekly chart shows a hidden bullish divergence against Bitcoin, potentially explaining the Altcoin Season Index movement. On-chain data from Glassnode indicates Bitcoin's Short-Term Holder SOPR (Spent Output Profit Ratio) has turned negative, suggesting retail capitulation that often precedes altcoin rotations. The 200-day moving average at $84,500 provides immediate support.

| Metric | Value | Change |

|---|---|---|

| Altcoin Season Index | 32 | +7 points (28%) |

| Bitcoin Price | $88,969 | -0.15% (24h) |

| Crypto Fear & Greed Index | 26/100 (Fear) | -2 points |

| Bitcoin Dominance | 52.3% | -0.4% |

| Days to Altcoin Season | 43 points needed | N/A |

The Altcoin Season Index movement matters because it signals potential institutional liquidity cycles shifting. When Bitcoin consolidates after major rallies, capital typically seeks higher beta opportunities in altcoins. This creates a self-reinforcing cycle where altcoin outperformance attracts more capital, potentially leading to a full season. Retail market structure currently shows fear-driven selling in Bitcoin, which historically precedes altcoin rallies. The index rise coincides with regulatory developments including South Korea's stance on exchange limits and expanded U.S. prediction markets that could fuel altcoin volatility.

"The Altcoin Season Index movement represents early-stage rotation signals. When Bitcoin dominance plateaus above 50% while fear metrics remain elevated, we typically see capital flow toward high-conviction altcoin narratives. This doesn't guarantee a full season, but it establishes the preconditions for one if Bitcoin holds key support." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current technical positioning. The bullish scenario requires Bitcoin to hold the $84,500 200-day moving average while altcoins continue outperforming. The bearish scenario involves Bitcoin breaking below critical support, triggering a liquidity cascade that would invalidate altcoin strength. Historical cycles from 2017 and 2021 indicate that Altcoin Season Index readings above 30 with Bitcoin in consolidation often precede 3-6 month outperformance periods.

The 12-month institutional outlook depends on Bitcoin's ability to maintain its store-of-value narrative while altcoins demonstrate utility. If Ethereum's upcoming Pectra upgrade delivers scalability improvements, it could catalyze the altcoin rotation indicated by today's index movement. Consequently, the 5-year horizon favors protocols with clear technological differentiation rather than pure speculative assets.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.