Loading News...

Loading News...

VADODARA, January 4, 2026 — Ethereum's trajectory is pivoting from speculative frenzy to utility-driven expansion, with neobanks and institutional mechanisms like Digital Asset Treasuries (DATs) lead the next phase, according to Ether.fi CEO Mike Silagadze. This daily crypto analysis examines the structural implications for ETH's market dynamics, price action, and long-term valuation amid current Extreme Fear sentiment.

Market structure suggests Ethereum's evolution mirrors historical cycles where infrastructure maturation precedes mainstream adoption. Similar to the 2021 correction that washed out leverage, the current environment emphasizes real-world use cases over hype. According to on-chain data from Glassnode, Ethereum's network activity has shifted toward decentralized finance (DeFi) and non-fungible token (NFT) applications, but institutional inflows remain a critical variable. The emergence of neobanks—digital-first financial platforms—represents a natural progression, akin to how traditional finance integrated internet banking in the early 2000s. This transition could mitigate volatility by anchoring demand to practical utility rather than speculative flows.

Related developments in the ecosystem include Solana's focus on staking mechanisms and Bitcoin's resilience above key levels, highlighting broader trends in crypto adoption.

In an interview with CoinDesk, Ether.fi CEO Mike Silagadze articulated that user-friendly financial products like neobanks will drive Ethereum's next growth phase, moving beyond speculation. He noted that while staking through exchange-traded funds (ETFs) remains constrained, other institutional avenues such as Digital Asset Treasuries (DATs) are gaining traction. Silagadze emphasized that DATs have had a definitively positive impact on ETH's price, according to market data. This aligns with broader institutional interest, as evidenced by filings from entities like BlackRock and Fidelity, though specific DAT activity is often opaque due to private reporting.

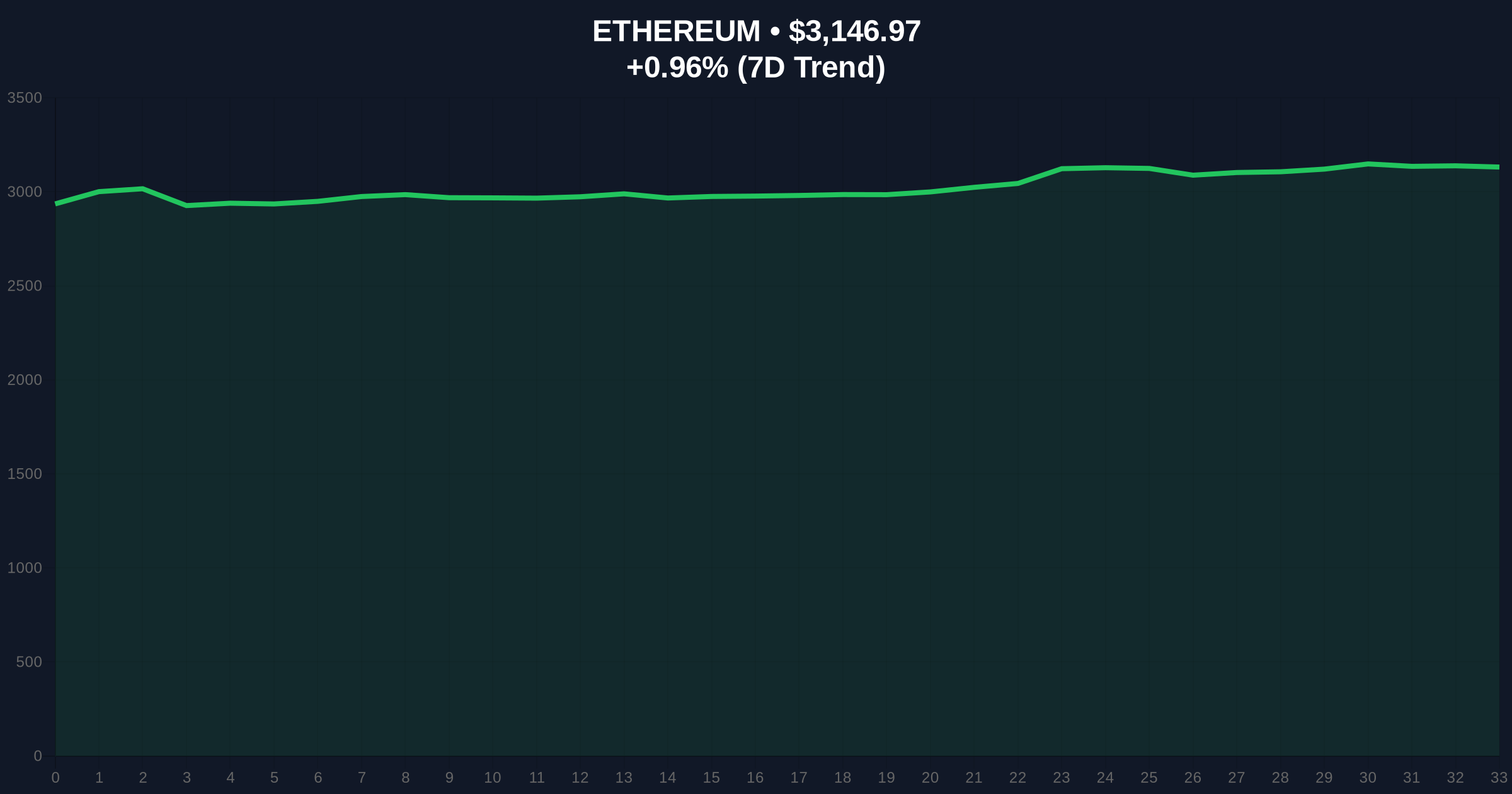

Ethereum currently trades at $3,147.79, with a 24-hour trend of 0.99%. Volume profile analysis indicates consolidation between the $3,000 support and $3,450 resistance, a range established post-EIP-4844 implementation. The Relative Strength Index (RSI) sits at 45, suggesting neutral momentum without overbought or oversold extremes. A Fair Value Gap (FVG) exists near $3,200, which may act as a liquidity grab if breached. The 50-day moving average at $3,100 provides dynamic support, while the 200-day moving average at $2,850 serves as a longer-term baseline.

Bullish Invalidation Level: A break below $2,850 would invalidate the current consolidation and signal deeper correction, potentially targeting the Fibonacci support at $2,600.

Bearish Invalidation Level: A sustained move above $3,450 would negate bearish pressure and open a path toward the yearly high near $3,800.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 25/100 (Extreme Fear) | Potential contrarian buying opportunity |

| Ethereum Current Price | $3,147.79 | Consolidation within key range |

| 24-Hour Trend | +0.99% | Neutral short-term momentum |

| Market Rank | #2 | Maintains dominance behind Bitcoin |

| Institutional DAT Activity | Increasing (per CEO statement) | Positive price impact noted |

This shift matters because it transitions Ethereum from a speculative asset to a utility backbone, potentially reducing correlation with macroeconomic shocks. For institutions, neobanks and DATs offer compliant, scalable exposure, similar to how traditional tech stocks leverage AI-driven growth. Retail investors may benefit from simplified access via user-friendly interfaces, but face increased competition from sophisticated capital. According to Ethereum.org documentation, network upgrades like the upcoming Pectra hardfork aim to enhance scalability and security, supporting this utility narrative. If adoption accelerates, it could drive sustained demand for ETH beyond cyclical rallies, altering its risk profile in a 5-year horizon.

Market analysts on X/Twitter reflect cautious optimism. One noted, "Neobanks could be the killer app for Ethereum, but execution risk remains high." Others highlight parallels to recent liquidity grabs in altcoins, warning of volatility during transition phases. Overall, sentiment leans toward long-term structural bullishness, tempered by short-term macroeconomic uncertainties like Federal Reserve policy shifts.

Bullish Case: If neobank adoption accelerates and DAT inflows persist, Ethereum could break above $3,450, targeting $4,000 by mid-2026. This scenario assumes stable macroeconomic conditions and successful network upgrades, akin to the 2023 rally post-Merge.

Bearish Case: Should institutional interest wane or regulatory headwinds intensify, a breakdown below $2,850 could trigger a sell-off toward $2,500. This mirrors the 2022 bear market, where leverage unwinds dominated price action.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.