Loading News...

Loading News...

VADODARA, February 4, 2026 — Major Ethereum Layer 2 projects are pushing back against founder Vitalik Buterin's call for a redefinition of their role, according to a Cointelegraph report. This latest crypto news highlights a critical debate over scaling security and value as ETH price faces bearish pressure. Buterin argued that many L2s rely on vulnerable multi-signature bridges while Ethereum mainnet enhances its capabilities. He insists L2s must offer unique value beyond mere scaling.

According to the Cointelegraph report, key L2 founders directly countered Buterin's assertions. Karl Floersch, founder of Optimism, cited practical obstacles like a lack of tools for cross-chain applications. Steven Goldfeder, founder of Offchain Labs (Arbitrum), emphasized that L2s' core value is scalability, noting the mainnet cannot replace their traffic. Jesse Pollak, a Base core developer, stated L2s should not be cheaper ETH clones and must differentiate with features like account abstraction. These responses signal a rift in Ethereum's scaling narrative.

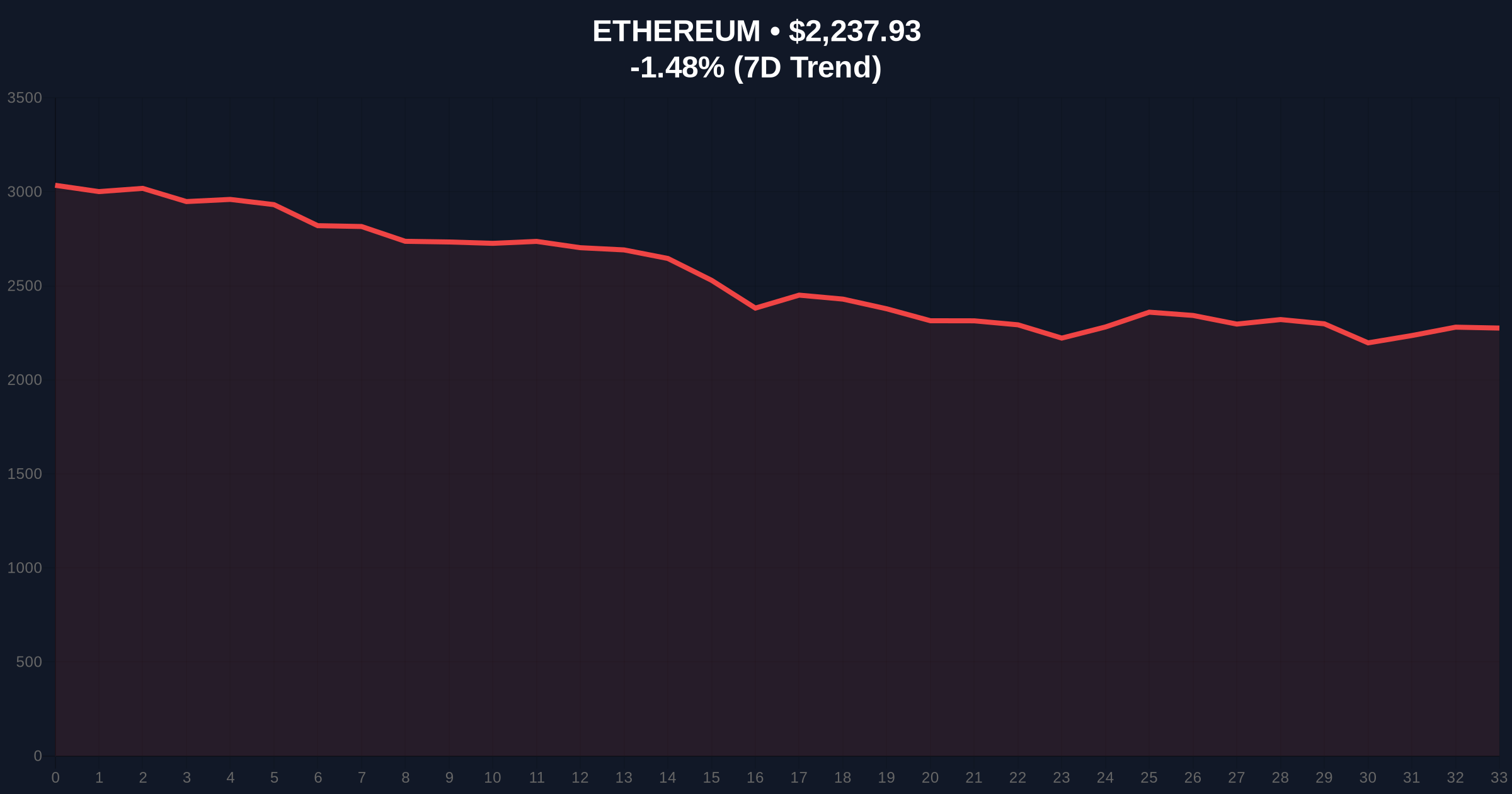

Historically, Ethereum scaling debates have driven volatility. The 2021-2022 cycle saw L2s like Arbitrum and Optimism surge post-EIP-1559. In contrast, today's market faces Extreme Fear with a score of 14/100. Underlying this trend is ETH's price decline to $2,238.72, down 1.45% in 24 hours. This mirrors 2018's scaling debates that preceded the bear market. Consequently, the current pushback reflects L2s defending their market share amid deteriorating on-chain metrics.

Market structure suggests ETH is testing a critical support zone near $2,200. The daily RSI sits at 42, indicating neutral momentum with bearish bias. A Fibonacci retracement from the 2025 high shows key support at the 0.618 level around $2,150. On-chain data from Glassnode reveals declining active addresses, compounding selling pressure. , EIP-4844 proto-danksharding, part of Ethereum's Pectra upgrade, aims to boost mainnet throughput. This technical shift underpins Buterin's call for L2 redefinition, as detailed in Ethereum's official documentation.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | High risk aversion, potential buying opportunity if sentiment reverses |

| Ethereum (ETH) Price | $2,238.72 | Testing key support; break below $2,200 signals bearish continuation |

| 24-Hour Price Change | -1.45% | Bearish short-term momentum amid market uncertainty |

| Market Rank | #2 | Maintains dominance but under pressure from altcoin rotations |

| L2 TVL (Total Value Locked) | ~$25B (est.) | High reliance on multi-sig bridges, as noted by Buterin |

This debate impacts Ethereum's 5-year scaling trajectory. L2s handle over 80% of Ethereum's transactions, per Dune Analytics data. A redefinition could shift liquidity back to the mainnet, affecting L2 token valuations like OP and ARB. Institutional liquidity cycles favor secure, scalable solutions. Retail market structure, however, depends on low fees. Consequently, a failure to resolve this could fragment the ecosystem, similar to Bitcoin's block size wars.

Market analysts note that Buterin's focus on security vulnerabilities in multi-sig bridges highlights a systemic risk. The CoinMarketBuzz Intelligence Desk observes, 'Historical cycles suggest that scaling debates often precede major protocol upgrades. This pushback indicates L2s are maturing but face existential threats from mainnet improvements.'

Two data-backed scenarios emerge from current market structure. First, if L2s integrate enhanced security like zero-knowledge proofs, ETH could rebound toward $2,500. Second, continued friction may drive liquidity to alternative L1s, pressuring ETH further.

The 12-month institutional outlook hinges on Ethereum's execution of the Pectra upgrade and L2 collaboration. A resolution could boost ETH's position as the leading smart contract platform.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.