Loading News...

Loading News...

VADODARA, February 4, 2026 — U.S. spot Ethereum ETFs recorded a $15 million net inflow on February 3. This daily crypto analysis reveals a critical reversal after three consecutive trading days of outflows. According to TraderT data, BlackRock's ETHA led with +$43.82 million. Fidelity's FETH saw -$54.84 million in outflows. Market structure suggests institutional players are selectively accumulating during extreme fear conditions.

TraderT's flow data provides surgical precision. The $15 million net positive movement breaks a three-day outflow streak. BlackRock's ETHA product absorbed $43.82 million. Grayscale's Mini Trust (ETH) added $19.12 million. Invesco's QETH contributed $1.14 million. Grayscale's ETHE saw +$8.25 million.

Conversely, Fidelity's FETH experienced $54.84 million in outflows. VanEck's ETHV lost $2.47 million. This creates a net positive of $15 million across all tracked products. The data indicates a split in institutional strategy. Some entities are building positions while others reduce exposure.

Historically, ETF inflows during extreme fear periods precede medium-term rallies. The current Crypto Fear & Greed Index sits at 14/100. This marks "Extreme Fear." Similar conditions existed during the March 2023 banking crisis. Ethereum then rallied 45% over the following eight weeks.

In contrast, the broader market shows stress. Recent futures liquidations hit $577 million. This exacerbates the fear sentiment. , a dormant Ethereum whale purchased $8.7M in ETH. This aligns with the ETF accumulation pattern.

Related developments include regulatory challenges. South Korean executives are fighting proposed stake limits. Additionally, Justin Sun's AI claims face skepticism. These events compound the current market uncertainty.

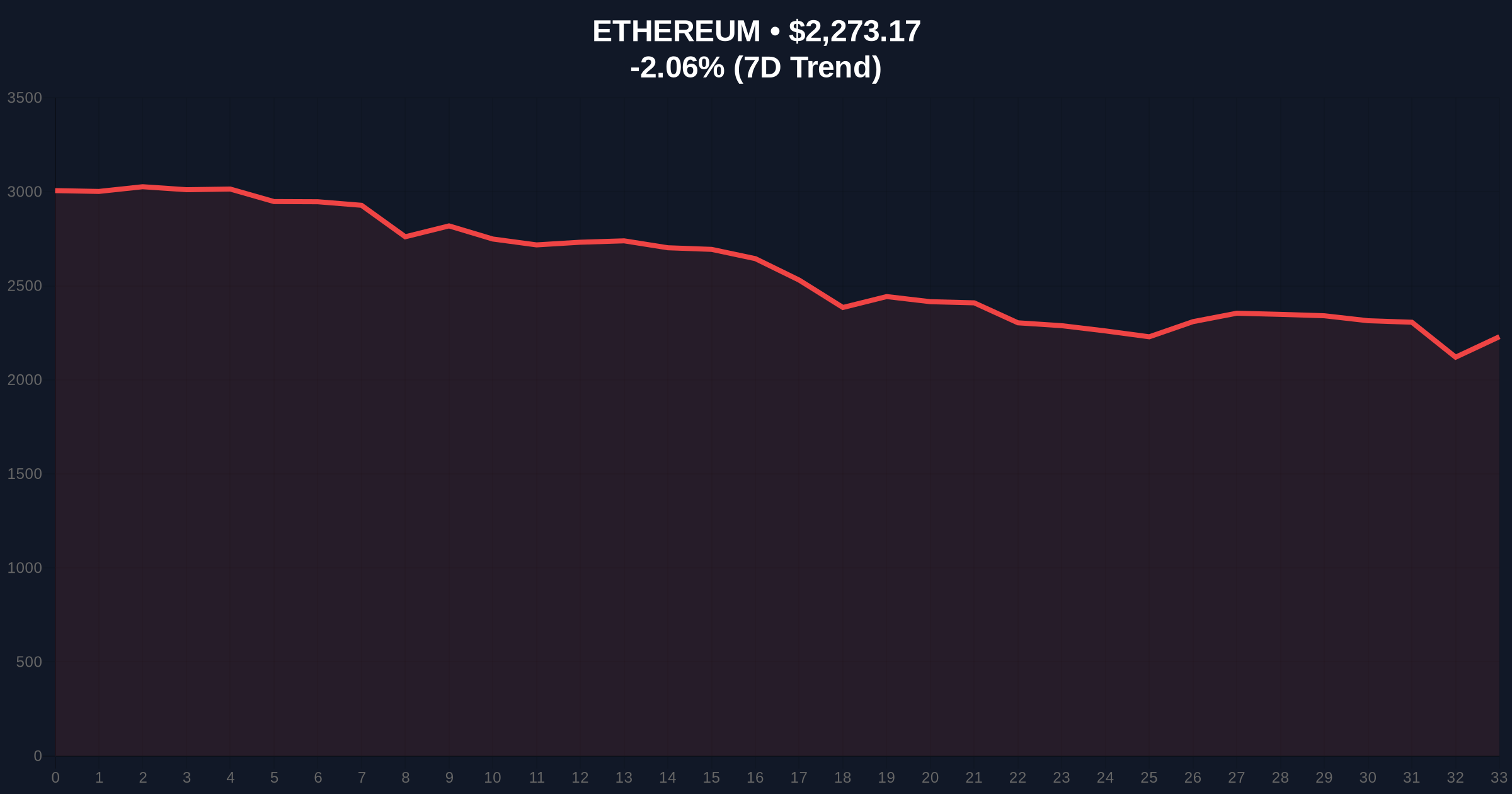

Ethereum currently trades at $2,273.53. The 24-hour trend shows a -2.05% decline. Market structure suggests a critical test at the $2,150 support level. This aligns with the 0.618 Fibonacci retracement from the recent swing high.

On-chain data indicates a volume profile node at $2,200. A break below creates a Fair Value Gap (FVG) down to $2,100. The Relative Strength Index (RSI) sits at 38. This shows neutral momentum despite the price decline. The 50-day moving average provides dynamic resistance near $2,400.

Post-merge issuance remains a structural tailwind. According to Ethereum's official documentation, the network now operates under a proof-of-stake consensus. This reduces sell pressure from miners. The upcoming Pectra upgrade could further enhance scalability and demand.

| Metric | Value |

|---|---|

| Net ETF Inflow (Feb 3) | $15 Million |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Ethereum Current Price | $2,273.53 |

| 24-Hour Price Change | -2.05% |

| Market Rank | #2 |

This inflow matters for institutional liquidity cycles. ETFs represent a permanent capital vehicle. Unlike futures, they require physical ETH backing. Each dollar inflow creates direct buy pressure on the spot market. This establishes a liquidity floor during fear-driven sell-offs.

Market analysts note the divergence. Extreme fear grips retail traders. Institutions are accumulating. This classic contrarian signal often marks local bottoms. The $15 million inflow, while modest, breaks a negative trend. It suggests some large players see value at current levels.

The ETF flow reversal is a critical data point. It shows institutional conviction amid retail panic. Historically, such divergences precede mean reversion rallies. The key is whether this inflow sustains or proves ephemeral. Watch the $2,150 support for confirmation.

— CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure.

The 12-month institutional outlook hinges on ETF adoption. Continued inflows could drive a re-rating of ETH's valuation. The 5-year horizon benefits from Ethereum's scalable roadmap. Upgrades like EIP-4844 for proto-danksharding will reduce layer-2 costs. This enhances network utility and demand.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.