Loading News...

Loading News...

VADODARA, February 7, 2026 — An early Bitcoin holder deposited 800 BTC, valued at $56.15 million, to Binance, according to on-chain data from Onchain Lens. This daily crypto analysis examines the transaction's implications for market structure amid extreme fear sentiment. The address retains 799 BTC worth $55.89 million, suggesting potential follow-up moves. Market analysts interpret such exchange inflows as precursors to selling activity.

Onchain Lens reported the transfer of 800 BTC to Binance on February 7, 2026. The transaction originated from a wallet identified as an early holder, or "OG," based on UTXO age bands indicating long-term dormancy. According to the firm's data, the address still holds 799 BTC, creating a liquidity overhang of $55.89 million. Such deposits typically signal intent to sell, as exchanges facilitate rapid liquidation. , speculation within the crypto community links the address to Garrett Jin, former CEO of the defunct exchange BitForex. However, on-chain forensic data cannot confirm this attribution without verified KYC trails.

Historically, large holder deposits to exchanges precede volatility spikes. Similar to the 2021 correction, where early whales moved coins before a 50% drawdown, this event tests Bitcoin's institutional absorption capacity. In contrast, the 2023-2024 cycle saw accumulation despite similar signals, highlighting market maturity. Underlying this trend, the current Crypto Fear & Greed Index sits at 6/100, indicating extreme fear—a level often associated with capitulation phases. This sentiment mirrors late 2022 conditions, where fear preceded a sustained rally. Consequently, the deposit's timing amid extreme fear suggests either opportunistic selling or strategic rebalancing.

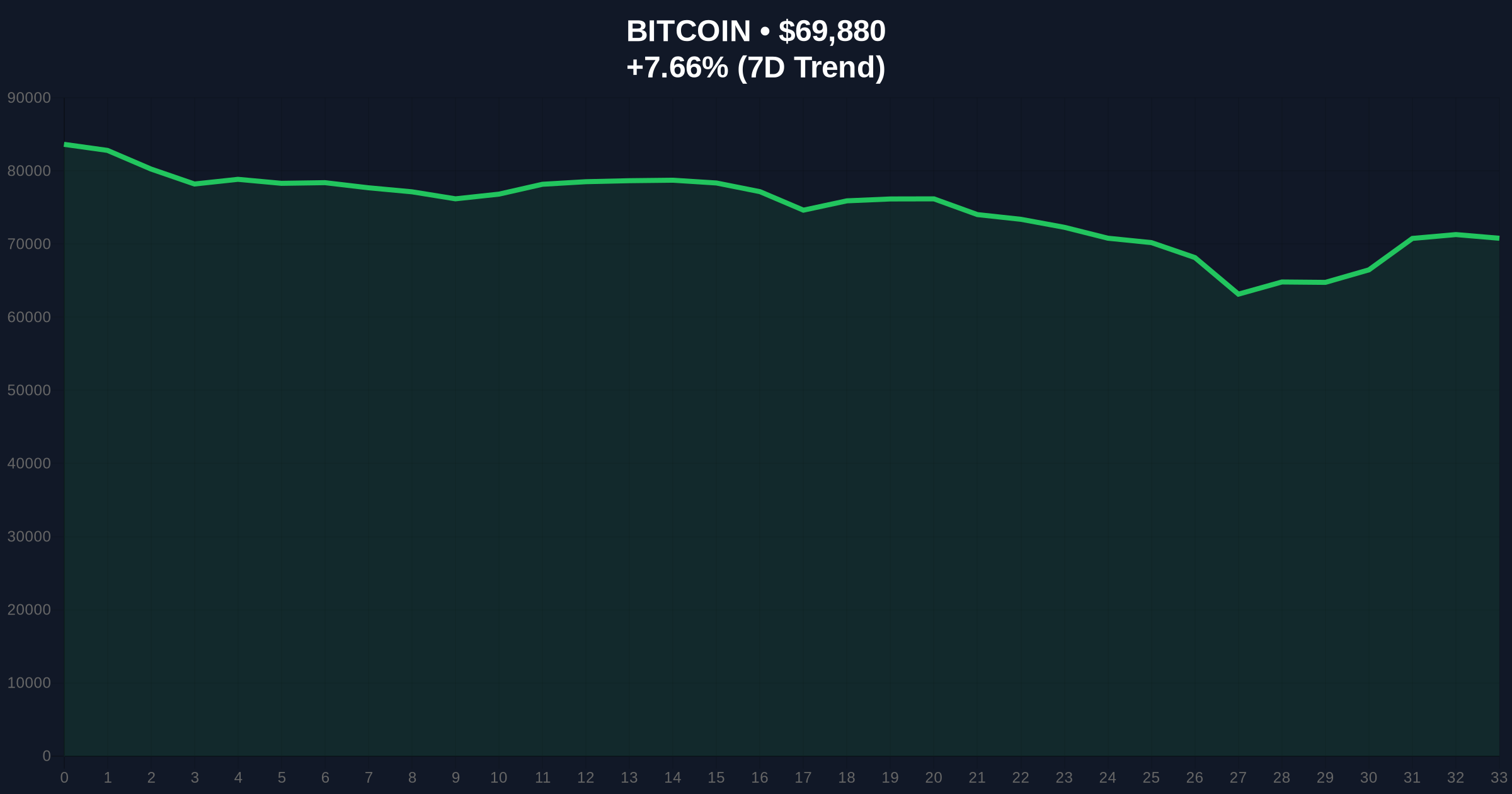

Related developments include Bitcoin breaking below $70k and Binance's co-CEO referencing stress tests during this period.

Market structure suggests Bitcoin faces a critical test at the $68,500 support, a Fibonacci 0.618 retracement level from the 2025 rally. The RSI hovers near 30, indicating oversold conditions, while the 200-day moving average at $67,200 provides secondary support. According to volume profile analysis, a Fair Value Gap (FVG) exists between $70,000 and $71,500, which price must reclaim to negate bearish momentum. The deposit creates a sell-side liquidity grab, potentially targeting this FVG for fills. If the $68,500 support holds, it could form a bullish order block, setting the stage for a reversal. This technical setup mirrors Q4 2024, where similar support tests led to a 25% rebound.

| Metric | Value | Implication |

|---|---|---|

| BTC Deposited to Binance | 800 BTC | Potential selling pressure |

| Value of Deposit | $56.15M | Liquidity event |

| Remaining Address Balance | 799 BTC ($55.89M) | Overhang risk |

| Crypto Fear & Greed Index | 6/100 (Extreme Fear) | Capitulation signal |

| Bitcoin Current Price | $69,905 | -7.70% 24h trend |

This transaction matters because it tests Bitcoin's market microstructure during extreme fear. Institutional liquidity cycles, as tracked by entities like Glassnode, show net outflows from whales can trigger cascading liquidations. Retail market structure often follows these signals, amplifying volatility. Evidence from past cycles indicates that such events either mark local bottoms or accelerate downtrends. For instance, the Ethereum network's post-merge issuance dynamics show similar holder behavior during stress periods, affecting cross-asset correlations. Consequently, monitoring on-chain flows provides alpha in forecasting trend shifts.

"Large holder movements during extreme fear often signal regime change. The key is whether the market absorbs this supply without breaking critical support. Historical patterns suggest that if $68,500 holds, we could see a gamma squeeze upward as shorts cover."

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook hinges on Bitcoin's ability to maintain its store-of-value narrative amid liquidity events. If the market absorbs this sell pressure, it could reinforce long-term holder conviction, aligning with a 5-year horizon of increasing institutional adoption. Conversely, failure may prolong the fear phase, delaying cycle progression.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.