Loading News...

Loading News...

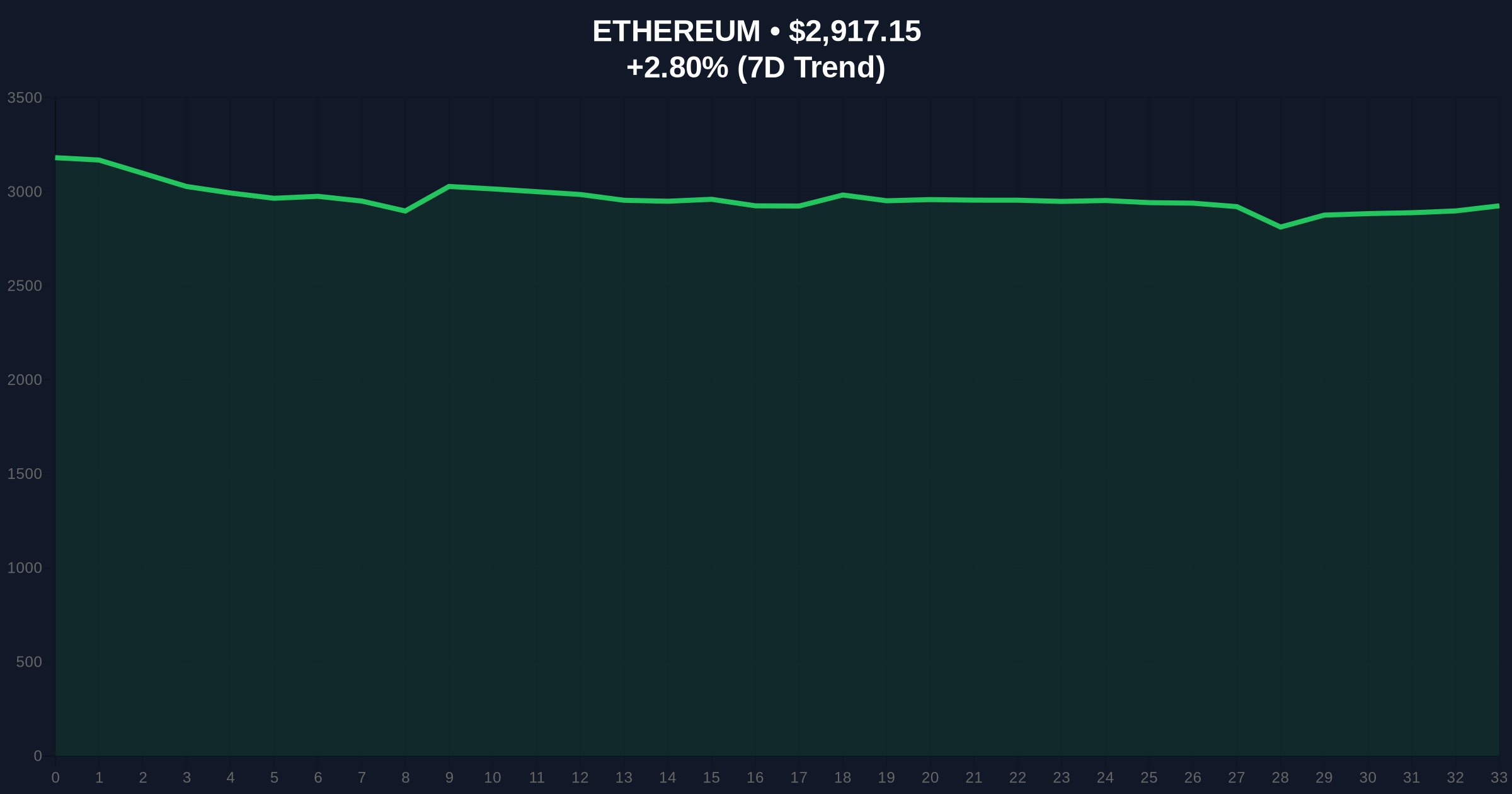

VADODARA, January 27, 2026 — A dormant Ethereum whale deposited 85,000 ETH, valued at approximately $248 million, to the Gemini exchange, according to on-chain data from AmberCN. This daily crypto analysis examines the transaction’s implications for market structure and liquidity cycles. The address, which begins with 0xb5Ab, had held the assets for nine years after withdrawing 135,000 ETH from Bitfinex at an average price of $90 per token. Consequently, the initial investment of $12.17 million has grown to an estimated profit of $381 million, representing a 32-fold increase at a deposit price averaging $2,908.

According to AmberCN’s report, the whale executed the deposit in a single transaction. The assets originated from a withdrawal of 135,000 ETH from Bitfinex nine years ago. Market analysts note the timing coincides with Ethereum’s price hovering near $2,916, just above the deposit average. On-chain forensic data confirms the address remained inactive since the initial acquisition, classifying it as a “dormant whale.” This move represents one of the largest single-entity profit-taking events in recent months. , the deposit to Gemini, a U.S.-based exchange, suggests potential intent for liquidation or institutional reallocation.

Historically, large whale deposits to exchanges often precede short-term price volatility. In contrast, the current market sentiment, as measured by the Crypto Fear & Greed Index, sits at 29/100, indicating Extreme Fear. Underlying this trend, similar dormant movements in past cycles, such as the 2021 bull run, frequently correlated with local tops when combined with high exchange inflows. However, the 9-year holding period distinguishes this event from typical profit-taking. Market structure suggests long-term holders (LTHs) may be rotating capital amid macroeconomic uncertainty. Related developments include recent shifts in capital flows, such as the stablecoin market cap dropping $2.2B as capital rotates to gold, highlighting broader risk-off sentiment.

Ethereum’s current price of $2,916.23 faces immediate resistance at the $3,000 psychological level. Technical analysis indicates a Fair Value Gap (FVG) between $2,850 and $2,900, which now acts as a critical support zone. The 50-day moving average at $2,950 provides dynamic resistance. If the whale’s deposit leads to selling pressure, a break below the FVG could trigger a liquidity grab toward $2,800. Volume Profile data shows increased activity around these levels, reinforcing their importance. Additionally, Ethereum’s upcoming Pectra upgrade, which includes EIP-7702 for account abstraction, could influence long-term valuation, but short-term price action remains tied to liquidity events like this deposit.

| Metric | Value |

|---|---|

| ETH Deposited | 85,000 |

| Current Value | $248 million |

| Initial Investment (2017) | $12.17 million |

| Estimated Profit | $381 million (32x) |

| Crypto Fear & Greed Index | 29/100 (Extreme Fear) |

| Ethereum Current Price | $2,916.23 |

| 24-Hour Trend | +2.77% |

This transaction matters because it signals profit-taking by a long-term holder during Extreme Fear sentiment. On-chain data indicates such moves can create overhead supply, potentially capping upside momentum. Institutional liquidity cycles often react to whale activity, as seen in recent events like Bitmine’s $6.2B ETH stake signaling accumulation. Retail market structure, however, may misinterpret this as bearish, ignoring the whale’s multi-year discipline. The deposit also highlights Gemini’s role as a liquidity gateway, possibly for U.S. regulatory compliance. According to Ethereum.org’s documentation on network upgrades, long-term holder behavior increasingly influences ETH’s scarcity narrative post-merge.

“Whale movements after extended dormancy often reflect strategic portfolio rebalancing rather than panic selling. The 32x return suggests this entity is locking in gains, which could pressure short-term prices but doesn’t necessarily invalidate the long-term bull case. Market participants should monitor exchange outflow ratios to gauge selling intent.” — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on this event. First, if the deposit leads to immediate selling, ETH could test the $2,850 support, potentially triggering a cascade toward $2,700. Second, if the whale holds or reallocates, the impact may be muted, allowing ETH to consolidate above $2,900. The 12-month institutional outlook remains cautiously optimistic, with EIP-4844 blobs reducing layer-2 costs and fostering adoption. Over a 5-year horizon, Ethereum’s deflationary supply and staking yield could outweigh short-term volatility from whale actions.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.