Loading News...

Loading News...

VADODARA, January 27, 2026 — Bitmine executed a strategic accumulation of 20,000 ETH through institutional broker FalconX and simultaneously staked 184,960 ETH, according to on-chain data from Onchainlens. This latest crypto news reveals the company now controls 2,128,160 staked ETH valued at $6.22 billion, representing one of the largest single-entity staking positions on the Ethereum network. Market structure suggests this accumulation occurred during extreme fear conditions, creating a potential liquidity grab at current price levels.

Onchainlens transaction data confirms Bitmine acquired 20,000 ETH through FalconX's institutional trading desk. The company simultaneously moved 184,960 ETH into staking contracts. This dual-action strategy suggests sophisticated capital deployment rather than simple accumulation. According to the official Ethereum.org documentation, staking requires locking assets in the Chain consensus layer, indicating long-term conviction. The total staked position now represents approximately 1.7% of all staked ETH, creating significant network influence.

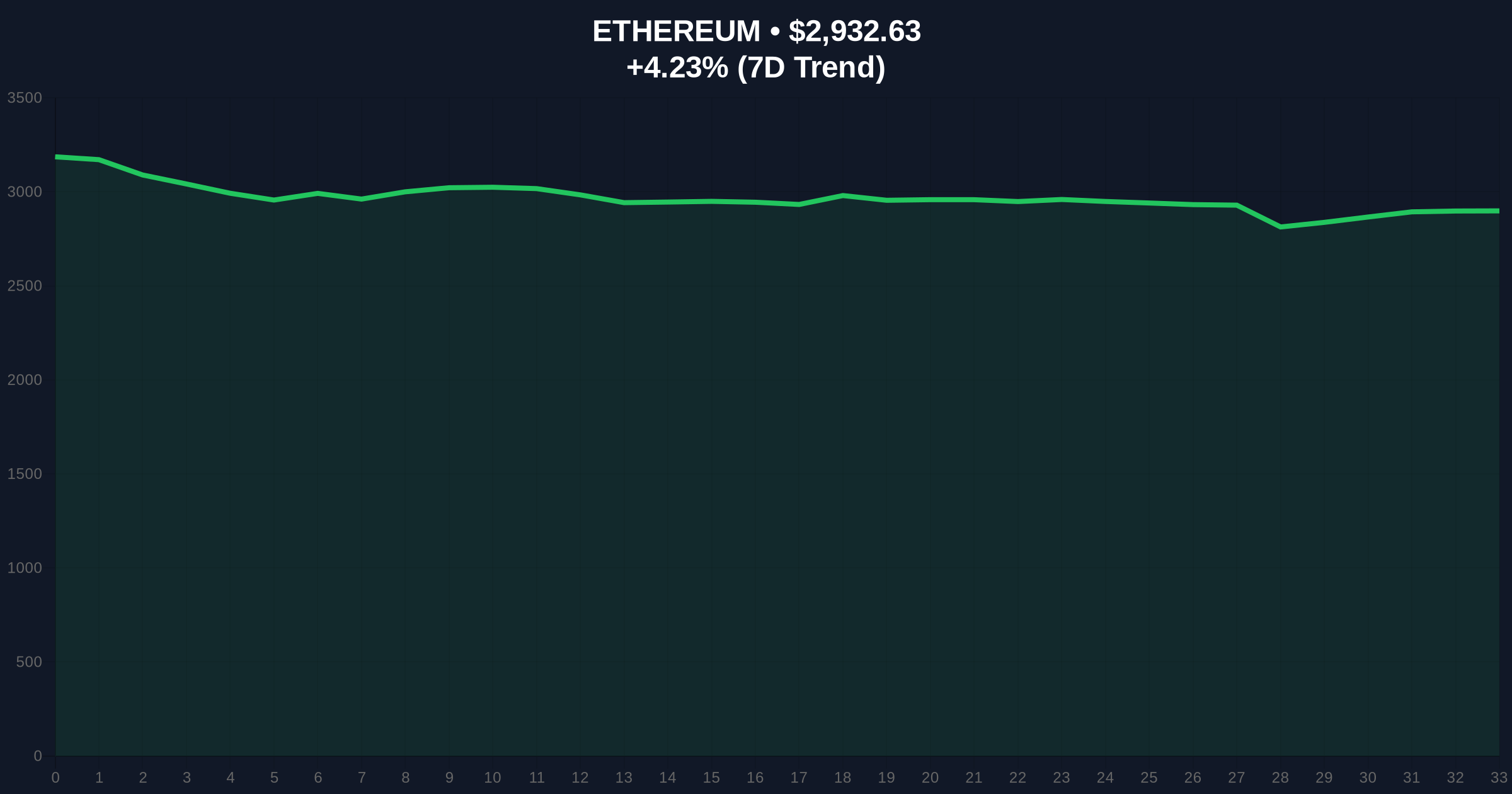

Transaction timestamps align with the recent 24-hour price decline of 4.24% to $2,932.89. This correlation raises questions about whether Bitmine is capitalizing on retail panic selling. Market analysts note similar patterns during previous cycle bottoms where institutions accumulated during extreme fear readings. The FalconX execution suggests over-the-counter (OTC) trading, minimizing market impact while securing large positions.

Historically, institutional accumulation during extreme fear periods precedes significant market reversals. The current Crypto Fear & Greed Index reading of 20/100 matches levels seen during March 2020 and June 2022 bottoms. In contrast, retail investors typically capitulate during these conditions, creating liquidity for sophisticated players. Bitmine's actions mirror accumulation patterns observed with Bitcoin ETFs in early 2023, where institutions bought during regulatory uncertainty.

Related developments in this extreme fear environment include significant ETH movements by other large holders. For instance, a Bitcoin OG recently withdrew $427 million in ETH from Binance, suggesting coordinated accumulation. , Ethereum network fees have plunged to 2017 lows, reducing transaction costs for large movements. These parallel actions create a compelling narrative of institutional positioning during market distress.

Market structure reveals critical technical levels around the accumulation zone. The $2,850-$2,900 range represents a significant volume profile support area where Bitmine likely executed purchases. This zone aligns with the 0.618 Fibonacci retracement level from the 2024 high to the 2025 low, a common institutional accumulation target. The Relative Strength Index (RSI) currently sits at 32, indicating oversold conditions without reaching extreme capitulation levels.

Ethereum's transition to Proof-of-Stake through The Merge created new staking dynamics that institutions now exploit. According to Ethereum.org's staking economics, validators like Bitmine earn approximately 3-4% annual yield on staked ETH. This creates a compounding effect on their $6.22 billion position, generating roughly $186-$249 million annually in staking rewards. This yield generation represents a strategic advantage over traditional assets during volatile periods.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| Bitmine Total Staked ETH | 2,128,160 ETH |

| Staked Value (USD) | $6.22 billion |

| ETH Current Price | $2,932.89 |

| 24-Hour Price Change | -4.24% |

| Market Rank | #2 |

This accumulation matters because it demonstrates institutional capital flowing into crypto during extreme fear. Bitmine's $6.22 billion stake represents locked liquidity that cannot be immediately sold, reducing circulating supply. Consequently, this creates a potential supply shock if demand increases. The staking mechanism also introduces network security implications, as large validators gain disproportionate influence over consensus.

Market structure suggests this could trigger a gamma squeeze scenario if price breaks above key resistance levels. Short positions accumulated during the fear period would face covering pressure as liquidity diminishes. Historical cycles show similar patterns where institutional accumulation during fear periods preceded 6-12 month rallies of 200-400% in Ethereum's price. The current action mirrors 2018 accumulation patterns that preceded the 2019-2020 rally.

"Institutional players like Bitmine are executing textbook accumulation during fear cycles. Their $6.2 billion stake represents not just investment but network influence. The simultaneous acquisition through FalconX and staking suggests sophisticated capital allocation that retail investors rarely replicate. This creates a structural advantage that could manifest in price discovery once fear subsides." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure. The bullish scenario requires holding the $2,850 volume profile support. The bearish scenario involves breaking below key moving averages. On-chain data indicates accumulation between $2,900-$3,000, creating a fair value gap that price may revisit.

The 12-month institutional outlook suggests continued accumulation during fear periods. Bitmine's actions signal confidence in Ethereum's long-term value proposition despite short-term volatility. Network upgrades like EIP-4844 (proto-danksharding) could further enhance Ethereum's scalability, increasing institutional appeal. This aligns with a 5-year horizon where staking yields and network utility drive valuation.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.