Loading News...

Loading News...

VADODARA, January 20, 2026 — Delaware Life Insurance Company has launched a fixed indexed annuity product that incorporates Bitcoin exposure through BlackRock's spot Bitcoin ETF, IBIT, according to Bloomberg ETF analyst Eric Balchunas. This latest crypto news represents a significant structural shift in how institutional capital accesses digital assets, moving beyond direct custody into insurance-wrapped vehicles. Market structure suggests this development could create a new demand vector for Bitcoin, particularly as traditional finance seeks yield-enhancing instruments in a low-rate environment.

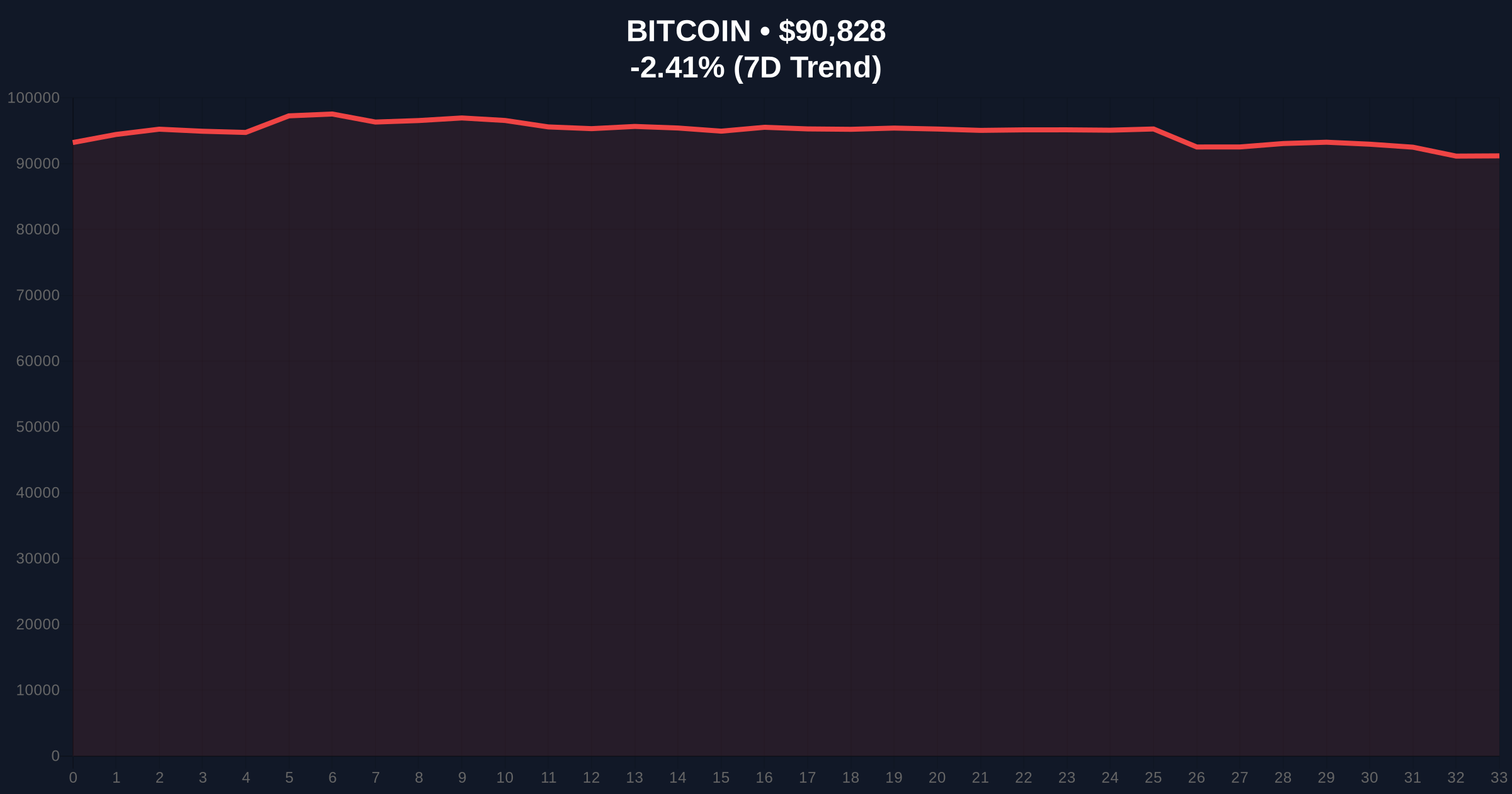

The launch occurs against a backdrop of heightened market volatility, with Bitcoin currently trading at $90,770, down 2.47% in the last 24 hours. This price action reflects broader macroeconomic uncertainty, including potential shifts in Federal Reserve policy that could impact risk assets. Historically, insurance products have served as capital preservation vehicles, making this integration with Bitcoin a notable departure from conservative asset allocation. The move follows BlackRock's successful launch of IBIT in early 2024, which has accumulated substantial assets under management, creating the liquidity foundation necessary for such annuity structures. Underlying this trend is the maturation of Bitcoin's regulatory framework, particularly the SEC's approval of spot Bitcoin ETFs, which has reduced counterparty risk for institutional participants.

Delaware Life Insurance Company, a subsidiary of Group 1001, introduced a fixed indexed annuity that allocates a portion of its returns to Bitcoin performance through BlackRock's IBIT. According to the Bloomberg report, the product is structured as a partnership, utilizing IBIT as the underlying Bitcoin exposure mechanism. This allows policyholders to gain indirect Bitcoin exposure without dealing with custody, wallet management, or direct cryptocurrency transactions. The annuity functions within existing insurance regulatory frameworks, providing a familiar wrapper for conservative investors. Consequently, this product targets the massive U.S. annuity market, valued at over $2.5 trillion, according to data from the National Association of Insurance Commissioners. The integration leverages IBIT's daily liquidity and regulatory compliance, reducing operational friction compared to direct Bitcoin investments.

Bitcoin's current price of $90,770 sits within a critical consolidation range between $88,500 and $93,200. On-chain data indicates strong accumulation at the $88,500 level, forming a significant Order Block that has held through recent sell-offs. The Relative Strength Index (RSI) reads 42, suggesting neutral momentum with slight bearish bias, while the 50-day moving average at $91,200 acts as immediate resistance. Volume Profile analysis shows increased activity around the $90k psychological level, indicating institutional participation. Market structure suggests a Bullish Invalidation level at $88,500; a sustained break below would signal failure of the current accumulation phase and potential retest of the $85,000 Fibonacci support. Conversely, the Bearish Invalidation level is set at $93,200; a close above this resistance would confirm breakout momentum toward the $95,000 Fair Value Gap (FVG).

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 32/100 (Fear) | Indicates risk-off sentiment, potential contrarian opportunity |

| Bitcoin Current Price | $90,770 | Down 2.47% in 24h, testing key support |

| 24-Hour Trend | -2.47% | Reflects short-term volatility amid structural news |

| U.S. Annuity Market Size | $2.5+ trillion | Potential addressable market for Bitcoin-linked products |

| BlackRock IBIT AUM (Est.) | $25+ billion | Provides liquidity foundation for annuity structure |

This development matters because it represents a new institutional demand channel for Bitcoin, distinct from direct ETF flows or corporate treasury allocations. For institutions, the annuity wrapper reduces regulatory and operational complexity, allowing pension funds and insurance companies to allocate to Bitcoin within existing compliance frameworks. For retail investors, it offers a familiar, insurance-backed vehicle with potential upside from Bitcoin's performance, lowering the barrier to entry. The product's structure through IBIT leverages the ETF's regulatory approval and daily liquidity, mitigating traditional crypto risks like custody failure. According to Ethereum.org documentation on token standards, such integrations often precede broader financial product innovation, similar to how ERC-20 enabled decentralized finance. Consequently, this could catalyze similar products from other insurers, increasing Bitcoin's integration into mainstream finance.

Market analysts on X/Twitter have highlighted the structural implications rather than short-term price impact. Bulls argue this creates a "sticky" demand source, as annuity investments typically have long lock-up periods, reducing sell-side pressure. Bears caution that the product's success depends on Bitcoin's volatility profile aligning with insurance return expectations, noting that sharp drawdowns could deter adoption. One quantitative analyst stated, "The gamma squeeze potential from options hedging around these structured products could amplify volatility if adoption scales." Overall, sentiment leans cautiously optimistic, with focus on the multi-year capital flow implications rather than immediate price action.

Bullish Case: If the annuity product attracts significant inflows, it could create sustained buying pressure on IBIT, forcing BlackRock to acquire more Bitcoin underlying. This, combined with holding above the $88,500 Bullish Invalidation level, could propel Bitcoin toward $95,000 to fill the Fair Value Gap. Historical cycles suggest that institutional product launches often precede multi-month accumulation phases, leading to breakout rallies in subsequent quarters.

Bearish Case: If macroeconomic headwinds intensify, such as a Federal Reserve rate hike signaled on FederalReserve.gov, Bitcoin could break below $88,500, invalidating the current support structure. This would likely trigger a Liquidity Grab toward $85,000, with increased futures liquidations exacerbating the decline. In this scenario, annuity inflows may be insufficient to offset broader market selling pressure, leading to extended consolidation below $90k.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.