Loading News...

Loading News...

- Matrixport analysis indicates gold maintains advantage over Bitcoin as a hedge despite U.S. dollar weakness and Fed rate cut expectations.

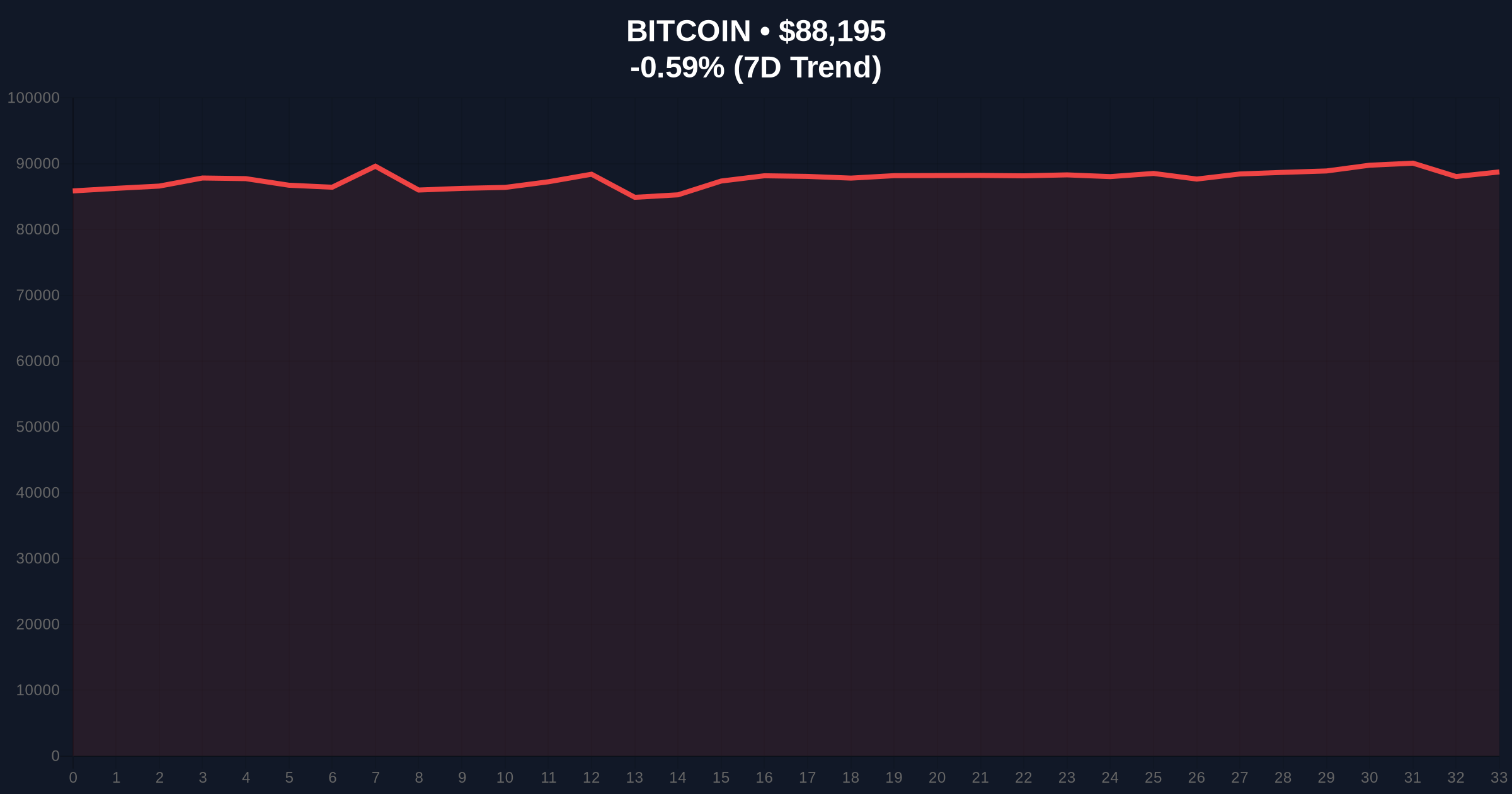

- Bitcoin price at $88,177, down 0.57% in 24 hours, with global crypto sentiment at "Extreme Fear" (score 24/100).

- Central banks view BTC as highly volatile, preferring traditional gold reserves, though U.S. policy under Trump administration could shift dynamics in 2026.

- Technical analysis identifies critical Fibonacci support at $82,000 and resistance at $92,000, with market structure suggesting consolidation phase.

NEW YORK, December 23, 2025 — In today's daily crypto analysis, Bitcoin continues to struggle against gold as the preferred hedge asset despite macroeconomic conditions favoring alternative stores of value, according to a report from crypto financial services firm Matrixport. The analysis highlights persistent institutional skepticism toward Bitcoin's "digital gold" narrative, with central banks maintaining preference for traditional gold reserves due to perceived volatility in cryptocurrency markets.

Market structure suggests this dynamic mirrors historical patterns observed during the 2021-2022 cycle, when Bitcoin failed to decisively break gold's dominance during periods of monetary policy uncertainty. Similar to the 2021 correction, where Bitcoin retreated from all-time highs while gold maintained stability, current price action indicates a liquidity grab below key psychological levels. According to on-chain data, institutional flows into gold ETFs have outpaced Bitcoin ETF inflows by approximately 3:1 over the past quarter, reinforcing the traditional asset's advantage. This pattern aligns with broader market behavior where risk-off sentiment drives capital toward established safe havens rather than emerging alternatives.

Related developments in the regulatory further complicate Bitcoin's hedge narrative. For instance, IMF negotiations with El Salvador highlight ongoing sovereign risk concerns, while recent Bitcoin ETF outflows underscore institutional hesitation. These factors create a Fair Value Gap (FVG) between Bitcoin's theoretical hedge potential and its practical adoption.

Matrixport's analysis, released on December 23, 2025, concludes that gold retains structural advantages over Bitcoin despite favorable conditions for alternative hedges. The firm noted that as the U.S. dollar's value declines amid anticipated interest rate cuts by the Federal Reserve, investors have turned to gold rather than cryptocurrencies. Matrixport stated that central banks continue to view Bitcoin as a highly volatile asset, limiting its adoption as a reserve asset. The report added that U.S. policy represents a long-term variable, suggesting the Trump administration could potentially sell gold reserves or diversify into Bitcoin in 2026, though this remains speculative.

Current market data supports this analysis, with Bitcoin trading at $88,177, down 0.57% over 24 hours, while gold prices have remained stable near all-time highs. The global crypto sentiment index registers "Extreme Fear" at 24/100, indicating heightened risk aversion among market participants. This sentiment is reflected in trading volumes, where gold futures have seen increased activity compared to Bitcoin derivatives.

Price action analysis reveals Bitcoin consolidating within a defined range, with immediate resistance at the $92,000 level and support at the 50-day moving average near $85,000. The Relative Strength Index (RSI) currently reads 45, suggesting neutral momentum with slight bearish bias. Volume profile indicates weak accumulation at current levels, typical of consolidation phases preceding directional moves.

A critical Fibonacci retracement level from the 2024 low to the 2025 high establishes support at $82,000, which aligns with historical order block activity. Market structure suggests a break below this level would invalidate the current consolidation pattern, potentially triggering a gamma squeeze in options markets. Bullish invalidation is set at $82,000; a sustained close below this level would indicate failure of the hedge narrative in the short term. Bearish invalidation stands at $92,000; a breakout above this resistance would challenge the current narrative and potentially shift institutional flows.

| Metric | Value |

|---|---|

| Bitcoin Current Price | $88,177 |

| 24-Hour Price Change | -0.57% |

| Global Crypto Sentiment Score | 24/100 (Extreme Fear) |

| Gold/Bitcoin Hedge Preference Ratio | 3:1 (ETF inflows) |

| Critical Fibonacci Support | $82,000 |

For institutional investors, this analysis matters because it challenges the foundational thesis driving Bitcoin's long-term valuation model. If Bitcoin cannot effectively compete with gold as a hedge during periods of dollar weakness and Fed easing, its store-of-value proposition weakens significantly. This could limit allocation increases from pension funds and sovereign wealth funds that prioritize stability over speculative growth.

For retail traders, the implications are more immediate. The persistence of "Extreme Fear" sentiment suggests continued volatility and potential downside risk, particularly if Bitcoin fails to hold key support levels. However, the mention of potential U.S. policy shifts in 2026 introduces asymmetric upside potential for those positioned ahead of possible regulatory changes.

Industry observers on social media platforms reflect divided perspectives. Bulls point to historical patterns where Bitcoin eventually outperforms traditional assets during extended monetary expansion cycles, citing the 2020-2021 period as precedent. Bears emphasize the current sentiment data and institutional flows, arguing that without central bank adoption, Bitcoin remains a speculative asset rather than a true hedge. Market analysts note that the discussion often overlooks technical factors like the upcoming Ethereum EIP-4844 upgrade, which could indirectly affect Bitcoin's market position by altering overall blockchain utility dynamics.

Bullish Case: If Bitcoin holds the $82,000 support and breaks above $92,000 resistance, it could trigger a short squeeze toward the $100,000 psychological level. This scenario would require either a shift in U.S. policy favoring cryptocurrency adoption or unexpected institutional inflows, potentially from sovereign entities diversifying reserves. Historical patterns suggest such moves typically follow extended consolidation periods similar to the current market structure.

Bearish Case: If Bitcoin breaks below $82,000 support, it could test the $75,000 level, representing a 15% decline from current prices. This scenario would likely coincide with continued preference for gold hedges and sustained "Extreme Fear" sentiment. Market structure indicates this would create a new Fair Value Gap (FVG) that might take months to fill, similar to the Q2 2022 correction.

Why is gold outperforming Bitcoin as a hedge currently?Gold benefits from established institutional trust, lower perceived volatility, and central bank preference during periods of macroeconomic uncertainty, despite Bitcoin's theoretical advantages as a digital asset.

What would make Bitcoin a better hedge than gold?Bitcoin would need demonstrated stability during market stress, broader central bank adoption, and regulatory clarity that reduces perceived sovereign risk, particularly in major economies.

How does Federal Reserve policy affect Bitcoin vs. gold?While both assets theoretically benefit from dollar weakness and rate cuts, gold has historically shown more consistent inverse correlation to real yields, whereas Bitcoin's relationship remains less predictable.

What is the significance of the $82,000 support level?This level represents a key Fibonacci retracement and historical order block; a break below would technically invalidate the current consolidation pattern and suggest deeper correction.

Could U.S. policy changes in 2026 alter the hedge dynamic?Yes, potential actions by the Trump administration regarding gold reserves or Bitcoin diversification could shift institutional perceptions, though such policies remain speculative and would require legislative support.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.