Loading News...

Loading News...

- IMF confirms ongoing discussions with El Salvador to reduce financial risks and increase transparency around Bitcoin adoption

- Negotiations include potential sale of government-owned Chivo wallet and policy consultations

- El Salvador continues daily Bitcoin purchases, holding 7,509 BTC as of December 2025

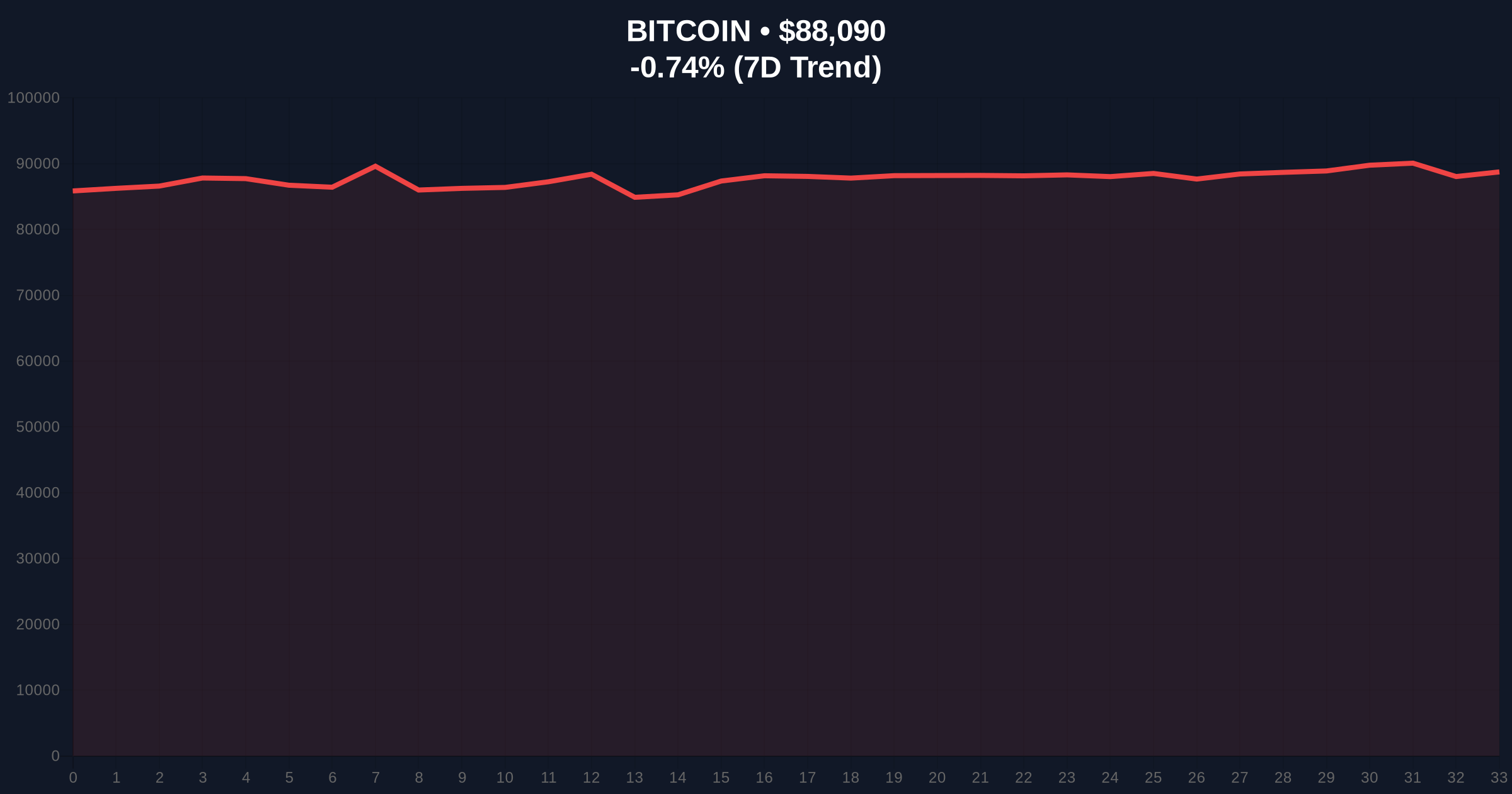

- Market structure shows Bitcoin trading at $88,099 with Extreme Fear sentiment (24/100)

NEW YORK, December 23, 2025 — The International Monetary Fund announced today that it is engaged in active negotiations with El Salvador to establish safeguards around the country's controversial Bitcoin adoption program. This latest crypto news comes as Bitcoin trades at $88,099, down 0.73% over 24 hours, with the global crypto sentiment index registering Extreme Fear at 24 out of 100. Market structure suggests institutional concerns about sovereign cryptocurrency exposure are creating headwinds for broader adoption narratives.

This development mirrors the 2021-2022 period when El Salvador first adopted Bitcoin as legal tender, triggering immediate IMF warnings about financial stability risks. The current negotiations represent a continuation of that tension, now entering its fourth year. Historical comparison reveals similar patterns when sovereign entities engage with cryptocurrency: the 2023-2024 period saw multiple central banks exploring digital assets while maintaining traditional oversight mechanisms. The Federal Reserve's ongoing research into central bank digital currencies, documented at FederalReserve.gov, provides parallel institutional caution against rapid, unregulated adoption.

Related developments in the regulatory space include Upbit's VASP license renewal under similar market conditions and Kakao's KRW stablecoin ecosystem targeting institutional adoption with built-in compliance frameworks.

According to official statements, the IMF is working toward a formal agreement with El Salvador to "reduce the financial risks and increase the transparency" of the country's Bitcoin adoption. Discussions specifically focus on strengthening transparency measures and protecting public interests related to El Salvador's BTC projects. Two parallel tracks have emerged: negotiations for the potential sale of the government-owned Chivo wallet project, and policy consultations to mitigate risks associated with these initiatives. El Salvador has maintained its daily Bitcoin purchase program since November 18, 2022, accumulating 7,509 BTC at varying price points.

Bitcoin currently trades at $88,099, having failed to reclaim the $92,000 resistance level that formed in early December. The daily chart shows a clear Fair Value Gap between $85,000 and $90,000 that market makers will likely target for liquidity. The 50-day moving average at $86,500 provides immediate support, while Fibonacci retracement levels from the November high of $94,200 indicate potential support at $82,800 (61.8% level). RSI sits at 42, suggesting neutral momentum with bearish bias.

Bullish Invalidation Level: A sustained break below $82,800 would invalidate the current consolidation structure and target the $78,000 volume profile high-density zone.

Bearish Invalidation Level: A reclaim of $92,000 with accompanying volume would signal institutional accumulation and target the $96,500 order block from Q3 2025.

| Metric | Value |

|---|---|

| Bitcoin Current Price | $88,099 |

| 24-Hour Price Change | -0.73% |

| Global Crypto Sentiment Score | 24/100 (Extreme Fear) |

| El Salvador Bitcoin Holdings | 7,509 BTC |

| Daily Purchase Start Date | November 18, 2022 |

For institutional participants, this represents a critical test case for sovereign cryptocurrency integration within traditional financial frameworks. The outcome will establish precedent for how multilateral institutions engage with national cryptocurrency policies. Retail impact is more immediate: continued IMF scrutiny creates regulatory uncertainty that suppresses speculative momentum. Market structure suggests that until clear regulatory frameworks emerge, Bitcoin will struggle to achieve the gamma squeeze conditions necessary for sustained parabolic moves.

Market analysts on X/Twitter are divided. Bulls point to El Salvador's continued accumulation as "proof of long-term conviction," while bears highlight the IMF negotiations as evidence that "sovereign crypto adoption faces structural headwinds." The absence of prominent figure commentary suggests institutional players are awaiting concrete outcomes before taking directional positions.

Bullish Case: Successful IMF negotiations that establish clear risk parameters could trigger institutional validation. A break above $92,000 with volume would target the $98,000-$102,000 resistance zone. On-chain data indicates accumulation between $85,000-$88,000 could provide foundation for Q1 2026 momentum.

Bearish Case: Failed negotiations or increased IMF restrictions would reinforce regulatory uncertainty. A breakdown below $82,800 would likely trigger a liquidity grab toward $78,000. Market structure suggests the Extreme Fear sentiment could persist through Q1 2026 if sovereign adoption narratives weaken.

What is the IMF discussing with El Salvador?The IMF is negotiating to reduce financial risks and increase transparency around El Salvador's Bitcoin adoption, including potential sale of the Chivo wallet and policy consultations.

How much Bitcoin does El Salvador own?El Salvador holds 7,509 BTC as of December 2025, purchased through a daily accumulation program since November 2022.

What is the current Bitcoin price and sentiment?Bitcoin trades at $88,099 with Extreme Fear sentiment (24/100) according to market indices.

How does this affect Bitcoin's price outlook?Regulatory uncertainty from IMF negotiations creates headwinds, with critical levels at $92,000 resistance and $82,800 Fibonacci support.

What historical parallels exist for this situation?Similar to 2021-2022 when El Salvador first adopted Bitcoin, current negotiations represent ongoing tension between sovereign crypto adoption and traditional financial oversight.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.