Loading News...

Loading News...

- ZOOZ Strategy (ZOOZ) faces Nasdaq delisting after share price remains below $1 threshold

- Company holds 1,036 BTC worth approximately $90.8 million at current prices

- Must achieve $1+ closing price for 10 consecutive days by June 15, 2026 to avoid delisting

- Market structure suggests this reflects broader institutional stress during Extreme Fear sentiment periods

NEW YORK, December 23, 2025 — In today's daily crypto analysis, Nasdaq-listed ZOOZ Strategy faces imminent delisting procedures as its Bitcoin-centric investment strategy fails to maintain minimum share price requirements. The company, which pivoted from electric vehicle infrastructure to Bitcoin investment, must achieve a $1 closing price for 10 consecutive trading days by June 15, 2026, or face removal from the exchange.

Market structure suggests this event mirrors the 2021-2022 period when multiple crypto-adjacent public companies faced similar compliance issues during market corrections. Similar to the MicroStrategy volatility events of late 2021, publicly traded companies with concentrated Bitcoin exposure demonstrate amplified sensitivity to crypto market cycles. The current Extreme Fear sentiment score of 24/100 creates a liquidity environment where institutional Bitcoin holders face disproportionate pressure. This pattern resembles the 2021 Q4 correction when Bitcoin-backed equities underperformed the underlying asset by 15-20% during similar sentiment extremes.

Related developments in the current market environment include slowing Bitcoin accumulation patterns and exchange restructuring amid extreme fear conditions.

According to regulatory filings, ZOOZ Strategy has failed to meet Nasdaq Listing Rule 5550(a)(2), which requires a minimum bid price of $1.00. The company's shares have traded below this threshold for an extended period, triggering compliance procedures. ZOOZ currently holds 1,036 BTC valued at approximately $90.8 million based on Bitcoin's current price of $87,780. Management is reportedly considering a reverse stock split to reduce outstanding shares and artificially boost per-share pricing to regain compliance. The company has until June 15, 2026, to demonstrate 10 consecutive trading days with closing prices at or above $1.00.

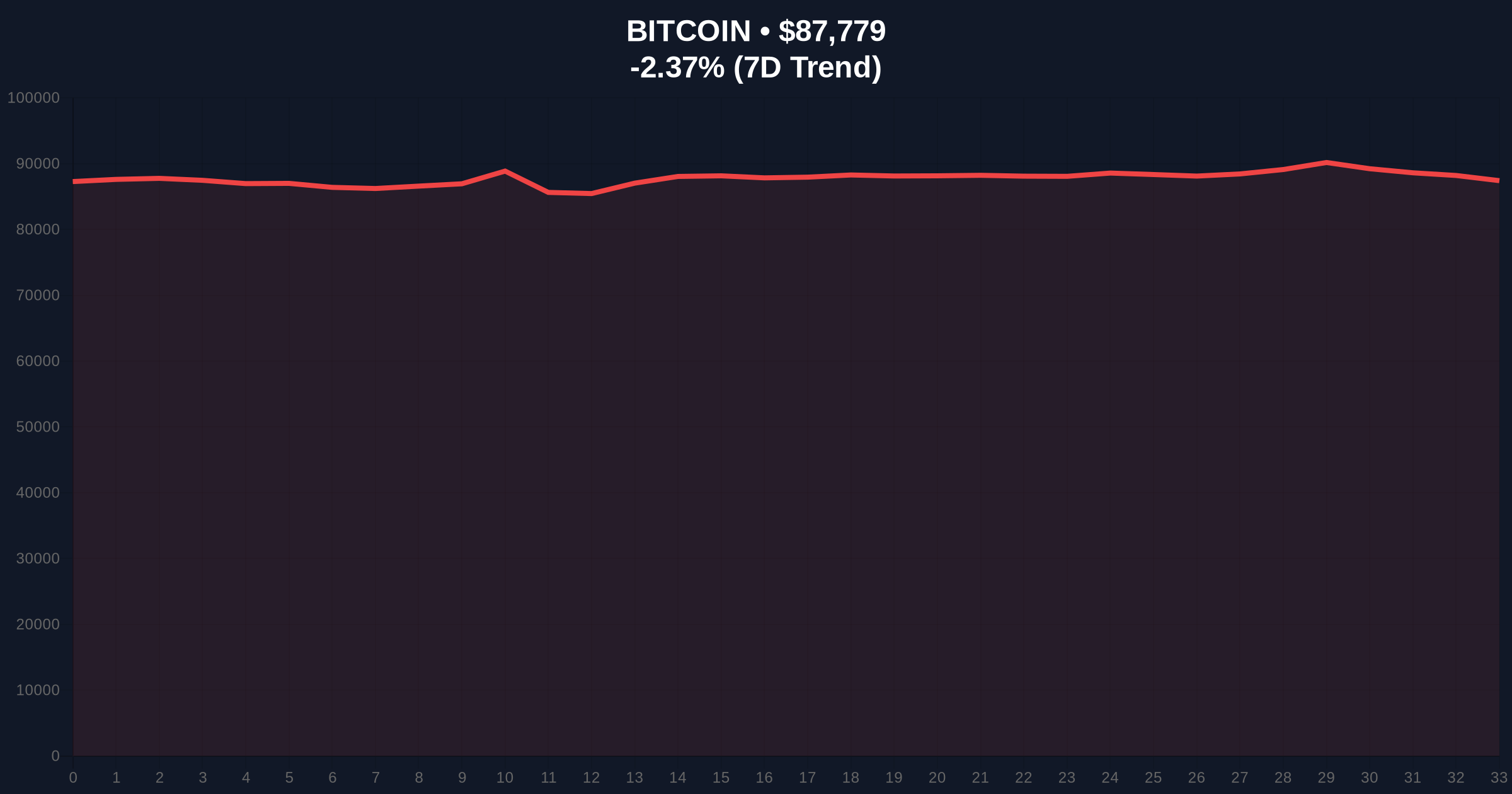

Bitcoin's current price of $87,780 represents a -2.37% decline over the past 24 hours. Market structure suggests critical support at the $82,000 Fibonacci 0.618 retracement level from the 2024-2025 rally. The 50-day moving average at $89,200 currently acts as resistance, creating a compression zone between $82,000 and $89,200. RSI readings at 42 indicate neutral momentum with bearish bias. Volume profile analysis shows significant liquidity accumulation between $80,000 and $85,000, suggesting potential for a liquidity grab in either direction.

Bullish invalidation level: $79,800 (below key Fibonacci support). Bearish invalidation level: $92,500 (above current resistance cluster).

| Metric | Value |

|---|---|

| ZOOZ Bitcoin Holdings | 1,036 BTC |

| Current Bitcoin Price | $87,780 |

| 24-Hour Bitcoin Change | -2.37% |

| Global Crypto Sentiment | Extreme Fear (24/100) |

| Nasdaq Compliance Deadline | June 15, 2026 |

For institutional investors, this event represents a stress test for publicly traded Bitcoin vehicles during market downturns. The 1,036 BTC held by ZOOZ represents approximately $90.8 million in potential selling pressure if the company faces liquidation scenarios. Market structure suggests similar pressures could affect other crypto-adjacent public companies, creating cascading effects. Retail investors face indirect exposure through market sentiment contagion, where delisting fears amplify existing Extreme Fear conditions. The SEC's evolving stance on crypto securities, detailed in recent SEC.gov guidance, adds regulatory dimension to these market mechanics.

Market analysts on X/Twitter highlight the divergence between Bitcoin's underlying network strength and public equity performance. One quantitative researcher noted, "ZOOZ's situation demonstrates the gamma squeeze dynamics of concentrated Bitcoin positions during low-liquidity periods." Bulls emphasize the company's substantial Bitcoin holdings as long-term value, while bears point to the compliance failure as symptomatic of broader institutional overextension.

Bullish Case: If Bitcoin maintains support above $82,000 and ZOOZ executes a successful reverse split, the compliance resolution could create a short squeeze scenario. Historical patterns indicate similar events in 2021 led to 25-40% rebounds in affected equities once compliance was achieved. Market structure suggests this would require Bitcoin breaking above the $92,500 resistance level with sustained volume.

Bearish Case: Failure to regain compliance by June 2026 triggers delisting procedures, potentially forcing liquidation of Bitcoin holdings. This creates additional selling pressure during already fragile market conditions. Technical analysis indicates breakdown below $79,800 could trigger stop-loss cascades, testing the $75,000 psychological support level. The current Fair Value Gap between $85,000 and $89,000 suggests vulnerability to further downside if sentiment deteriorates.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.