Loading News...

Loading News...

- US spot Bitcoin ETFs recorded $142.09 million net outflow on December 22, marking third consecutive day of withdrawals

- BlackRock's IBIT was sole fund with inflows ($6.1 million) while Bitwise, VanEck, Grayscale, and Ark Invest led outflows

- Market structure suggests this represents a liquidity grab below the $90,000 psychological level

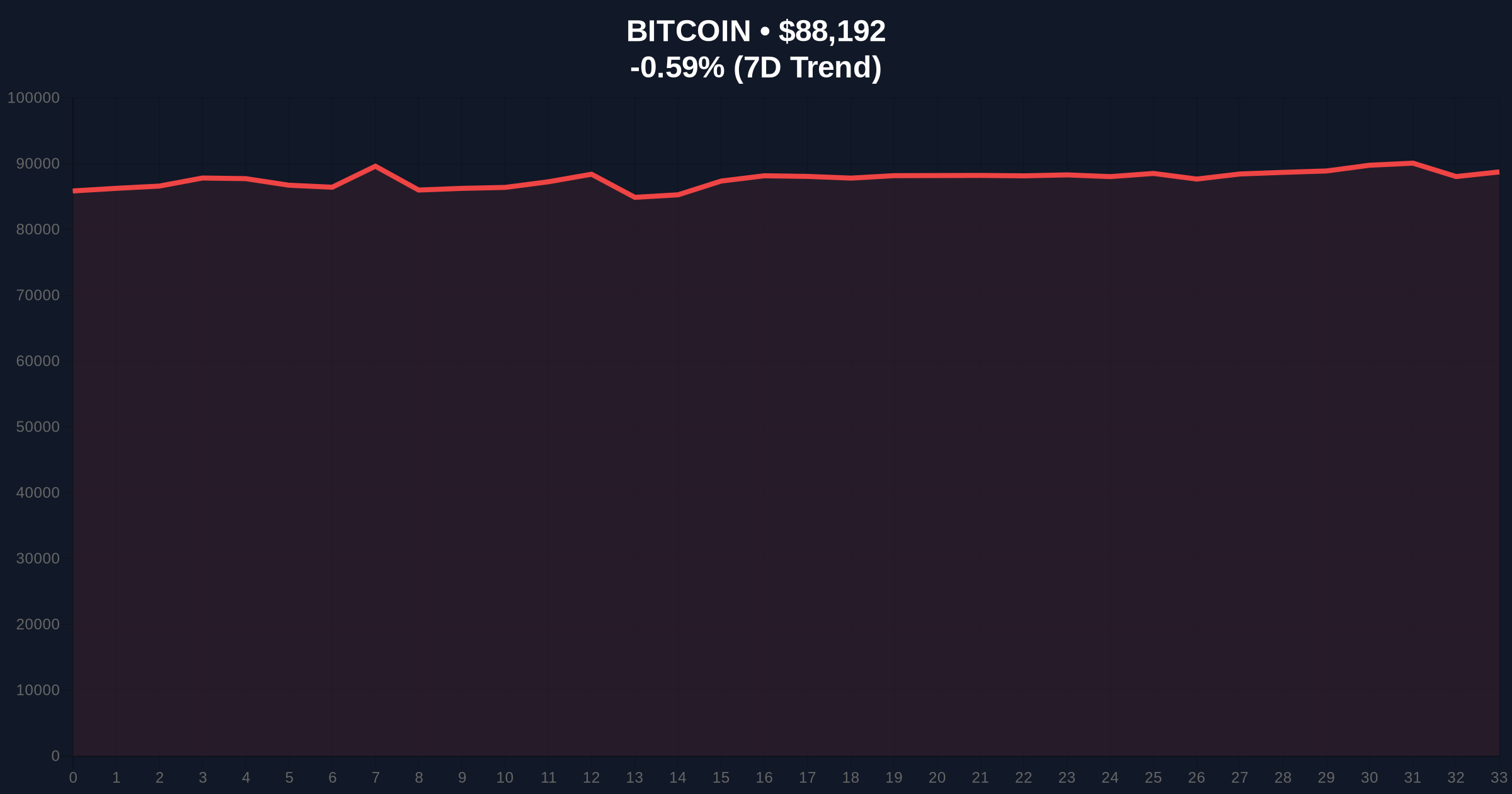

- Global crypto sentiment at "Extreme Fear" (24/100) with Bitcoin trading at $88,178, down 0.60% in 24 hours

NEW YORK, December 23, 2025 — Daily crypto analysis reveals US spot Bitcoin exchange-traded funds experienced $142.09 million in net outflows on December 22, continuing a three-day withdrawal pattern that contradicts bullish institutional adoption narratives. According to data compiled by TraderT, BlackRock's IBIT stood as the solitary fund attracting capital with $6.1 million in inflows, while competitors including Bitwise, VanEck, Grayscale, and Ark Invest collectively hemorrhaged assets. This divergence occurs against a backdrop of extreme fear sentiment and Bitcoin's struggle to maintain momentum above key technical levels.

Market structure suggests the current ETF outflow pattern mirrors the liquidity dynamics observed during the 2021-2022 cycle, when institutional products initially attracted capital before experiencing sustained withdrawals during consolidation phases. The Securities and Exchange Commission's approval of spot Bitcoin ETFs in January 2024 created expectations of continuous institutional inflows, yet recent data indicates this narrative may be oversimplified. According to on-chain data, large wallet holders have been redistributing assets during this period, creating what technical analysts identify as a Fair Value Gap (FVG) between $85,000 and $91,000. The current outflow pattern represents the most significant three-day withdrawal since September 2025, when similar skepticism emerged following the Federal Reserve's hawkish policy statements.

Related developments in the regulatory include recent VASP license renewals in Asian markets and stablecoin ecosystem expansions targeting institutional adoption, both occurring amid similar extreme fear sentiment readings.

On December 22, 2025, US spot Bitcoin ETFs recorded aggregate net outflows of $142.09 million, according to TraderT data. This marked the third consecutive day of net withdrawals, with the outflow distribution revealing significant divergence among fund providers. Bitwise's BITB led outflows with $34.96 million, followed by VanEck's HODL ($33.64 million), Grayscale's GBTC ($28.99 million), Grayscale's Mini BTC product ($25.40 million), and Ark Invest's ARKB ($21.36 million). In stark contrast, BlackRock's IBIT attracted $6.1 million in net inflows, representing approximately 4.3% of the total outflow volume. The data indicates that while most ETF providers experienced capital flight, BlackRock maintained marginal positive momentum despite the broader trend.

Bitcoin's price action at $88,178 reveals critical technical levels that contextualize the ETF outflow data. The asset has established a clear order block between $86,500 and $89,200, with volume profile analysis indicating significant accumulation in this range. The Relative Strength Index (RSI) sits at 42, suggesting neutral momentum with bearish bias, while the 50-day moving average at $90,450 acts as immediate resistance. Market structure suggests the current price represents a retest of the Fibonacci 0.618 support level drawn from the October 2025 low of $78,200 to the November high of $94,800. The convergence of ETF outflows with price rejection at the $90,000 psychological level indicates potential for a liquidity grab targeting stops below $85,000.

Bullish invalidation occurs if Bitcoin fails to hold the $85,000 support level, which would confirm breakdown of the current order block. Bearish invalidation triggers if price reclaims and sustains above the $91,500 resistance, filling the Fair Value Gap and potentially triggering short covering.

| Metric | Value |

|---|---|

| Total ETF Net Outflow (Dec 22) | $142.09 million |

| BlackRock IBIT Inflow | $6.1 million |

| Bitcoin Current Price | $88,178 |

| 24-Hour Price Change | -0.60% |

| Fear & Greed Index Score | 24/100 (Extreme Fear) |

For institutional investors, the ETF outflow pattern contradicts the narrative of steady capital allocation to Bitcoin through regulated vehicles. The data suggests either profit-taking after the November rally or strategic reallocation ahead of potential tax-loss harvesting in Q4 2025. According to SEC disclosure requirements, ETF flows provide transparent insight into institutional sentiment that often precedes broader market movements. For retail participants, the extreme fear sentiment combined with institutional withdrawals creates a contrarian signal—historical patterns indicate such conditions often precede reversal opportunities, though timing remains uncertain. The divergence between BlackRock's inflows and competitor outflows may indicate market share consolidation rather than broad institutional rejection.

Market analysts on social platforms express skepticism about the sustainability of Bitcoin's institutional adoption narrative. One quantitative researcher noted, "The ETF outflow data reveals what volume profile analysis suggested—large players are taking profits between $88,000 and $92,000 rather than accumulating for a breakout." Another analyst pointed to potential gamma squeeze dynamics in options markets, suggesting dealers may be hedging short gamma positions that could amplify volatility. The predominant view questions whether current outflows represent temporary profit-taking or the beginning of a more sustained institutional rotation away from Bitcoin exposure.

Bullish Case: If Bitcoin holds the $85,000 support and ETF outflows reverse, market structure suggests a retest of the $94,800 yearly high becomes probable. BlackRock's continued inflows could signal institutional preference for scale and liquidity, potentially triggering a gamma squeeze if price approaches $92,000 where significant call options concentrate. Historical data from the Federal Reserve's policy archives indicates that easing cycles typically benefit store-of-value assets, creating fundamental tailwinds.

Bearish Case: Continued ETF outflows combined with failure to hold $85,000 support would confirm breakdown of the current order block. This could trigger a liquidity grab targeting the $82,000 level where significant stop losses cluster. Market structure suggests such a move would fill the Fair Value Gap to the downside, potentially testing the 200-day moving average near $80,500. The extreme fear sentiment could become self-reinforcing if retail participants follow institutional outflows.

What caused the Bitcoin ETF outflows? Data indicates profit-taking after November's rally to $94,800, combined with potential tax-loss harvesting strategies ahead of year-end.

Why did only BlackRock see inflows? Market analysts suggest BlackRock's scale and established institutional relationships may provide perceived advantages during periods of market uncertainty.

How does this affect Bitcoin's price? ETF flows represent institutional sentiment that can influence price direction, though technical levels and on-chain dynamics provide more immediate signals.

Is this the end of institutional Bitcoin adoption? Historical patterns indicate temporary outflow periods often occur during consolidation phases within longer-term adoption trends.

What should traders watch next? Critical levels include $85,000 support and $91,500 resistance, along with whether ETF flow patterns reverse in coming sessions.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.