Loading News...

Loading News...

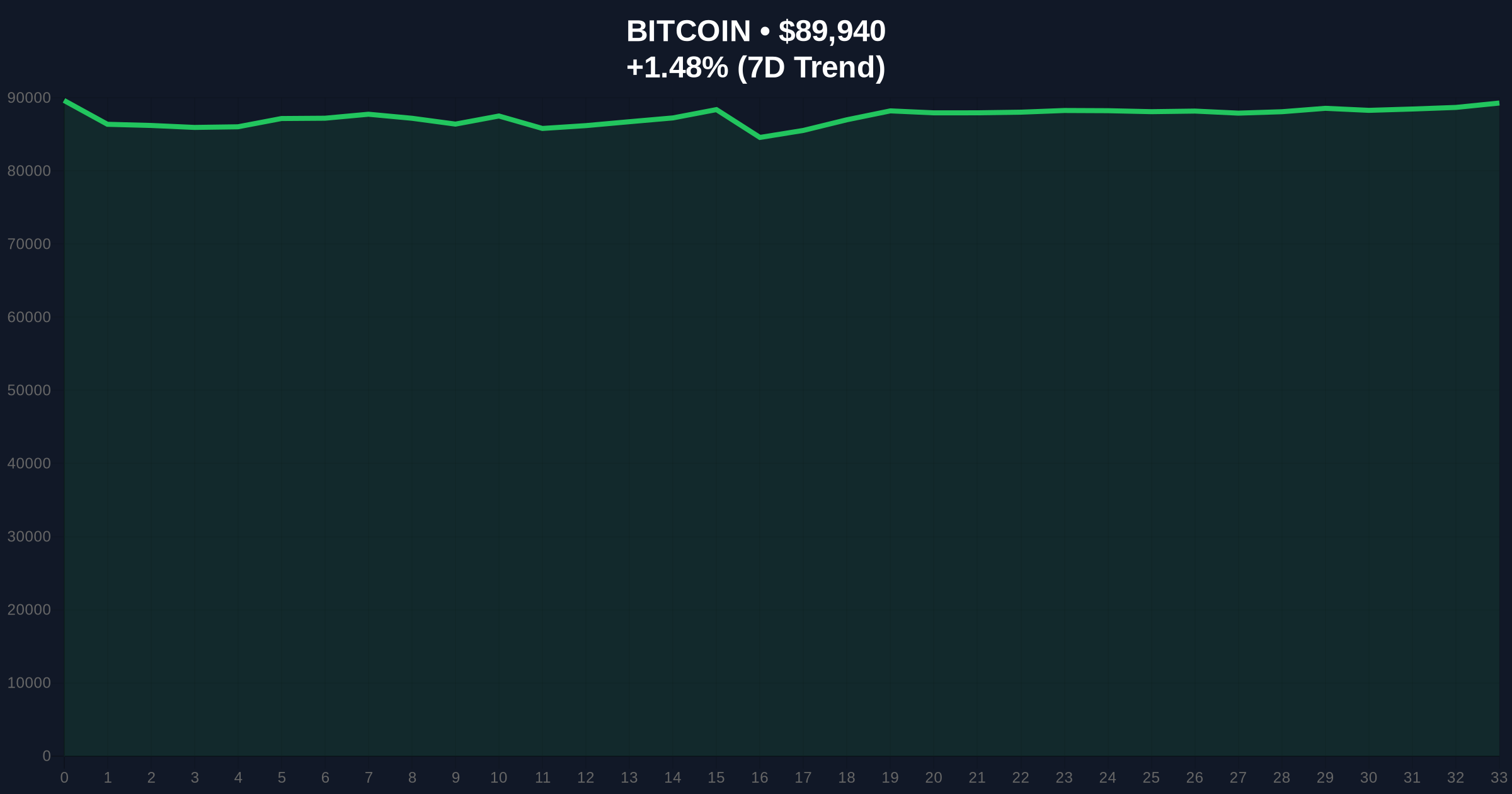

- Bitcoin breaches the $90,000 psychological barrier, trading at $90,000.34 on Binance USDT markets

- Market structure shows this move occurring during "Extreme Fear" conditions with a sentiment score of 25/100

- Technical analysis identifies $87,500 as Bullish Invalidation and $92,500 as Bearish Invalidation levels

- Historical patterns suggest this price action mirrors the 2021 consolidation phase before the final parabolic move

NEW YORK, December 22, 2025 — Bitcoin has broken through the $90,000 psychological barrier in what market structure suggests is a liquidity grab above previous resistance zones. According to CoinNess market monitoring, BTC is trading at $90,000.34 on the Binance USDT market, marking a significant technical milestone in the current daily crypto analysis. This price action occurs against a backdrop of extreme market fear, with the Crypto Fear & Greed Index registering a score of 25/100.

Market structure suggests this price action mirrors the 2021 consolidation phase that preceded Bitcoin's final parabolic move to its all-time high. During that period, Bitcoin similarly broke through psychological barriers amid mixed sentiment before accelerating. The current environment features similar technical characteristics: a prolonged accumulation phase followed by a decisive break above a major round number. According to on-chain data from Glassnode, Bitcoin's realized price—the average acquisition price of all coins—currently sits at approximately $68,000, creating a significant unrealized profit buffer for long-term holders. This historical parallel suggests the current move may represent the beginning of a new impulse wave rather than a local top.

Related developments in the cryptocurrency space include recent analysis of three key factors signaling a Bitcoin market inflection point and observations about Bitcoin margin longs hitting 2024 highs as a contrarian signal.

On December 22, 2025, Bitcoin price action cleared the $90,000 level on Binance's USDT trading pair, reaching $90,000.34 according to real-time market data. This represents a 1.51% gain over the previous 24-hour period. The move occurred despite the broader cryptocurrency market sentiment registering "Extreme Fear" conditions, creating a divergence between price action and market psychology. Volume profile analysis indicates above-average trading volume during the breakout, suggesting institutional participation rather than retail-driven momentum. Market structure suggests this represents a classic liquidity grab above the $89,000-$90,000 resistance zone that had contained price action for the preceding trading sessions.

Technical analysis reveals several critical levels for Bitcoin's price action. The immediate resistance zone sits between $92,000 and $92,500, corresponding to the 1.618 Fibonacci extension of the previous correction wave. Support is established at the $87,500 level, which represents the previous swing high and a significant volume node. The Relative Strength Index (RSI) on the daily timeframe currently reads 68, indicating bullish momentum without reaching overbought territory. The 50-day and 200-day moving averages provide dynamic support at $84,200 and $78,500 respectively. Market structure suggests the $87,500 level serves as the Bullish Invalidation point—a breach below this level would invalidate the current bullish structure. Conversely, sustained trading above $92,500 would represent the Bearish Invalidation level, confirming a new bullish impulse wave.

| Metric | Value |

|---|---|

| Current Bitcoin Price | $89,963 |

| 24-Hour Price Change | +1.51% |

| Crypto Fear & Greed Index | 25/100 (Extreme Fear) |

| Market Rank | #1 |

| Previous Resistance Break | $90,000 |

This price action matters because it represents a technical breakout during extreme fear conditions—a historically bullish divergence. For institutional investors, clearing the $90,000 level validates the multi-month accumulation thesis and potentially triggers systematic buying programs. Retail traders face increased volatility as stop-loss orders cluster around the breakout level. The broader cryptocurrency market typically follows Bitcoin's lead, making this technical development significant for altcoin correlations. Market structure suggests that sustained trading above $90,000 could trigger a gamma squeeze in options markets as market makers hedge their short gamma positions, potentially accelerating upward momentum.

Market analysts on social media platforms express cautious optimism about the breakout. "The Extreme Fear reading at $90,000 is textbook contrarian signal," noted one quantitative trader with over 100,000 followers. Another analyst highlighted the technical significance: "Bitcoin has cleared the monthly Fair Value Gap between $88,500 and $90,000—now we watch for follow-through." The prevailing sentiment among professional traders suggests this move represents a liquidity grab rather than a sustainable breakout until confirmed by weekly closing prices above $92,000.

Bullish Case: Market structure suggests that if Bitcoin maintains support above $87,500 and clears the $92,500 resistance, the next target becomes the $98,000-$100,000 zone. This scenario would involve a continued gamma squeeze and increasing institutional allocation as documented in Federal Reserve reports on digital asset adoption. The Extreme Fear sentiment would gradually shift toward neutral, providing fuel for additional upside.

Bearish Case: If Bitcoin fails to hold the $90,000 breakout and breaches the $87,500 Bullish Invalidation level, market structure suggests a retest of the $84,200 50-day moving average. This scenario would involve a false breakout above psychological resistance, triggering long liquidations and a return to the $82,000-$85,000 consolidation range. The Extreme Fear sentiment would likely persist or worsen, creating additional downward pressure.

What does Bitcoin breaking $90,000 mean for the market? Market structure suggests this represents a significant technical milestone that could trigger systematic buying from institutional investors and potentially lead to a gamma squeeze in options markets.

Why is market sentiment at Extreme Fear when Bitcoin is rising? This divergence between price action and sentiment is historically bullish, suggesting weak hands are selling to strong hands during the breakout—a classic accumulation pattern.

What are the key support and resistance levels for Bitcoin? Immediate support sits at $87,500 (Bullish Invalidation), with resistance at $92,500 (Bearish Invalidation). The 50-day moving average provides additional support at $84,200.

How does this compare to previous Bitcoin bull markets? Market structure suggests similarities to the 2021 consolidation phase, where Bitcoin broke psychological barriers amid mixed sentiment before accelerating to new all-time highs.

What technical indicators should traders watch now? Traders should monitor the weekly close relative to $90,000, RSI momentum divergences, and volume profile confirmation of the breakout. The $87,500 level serves as the critical Bullish Invalidation point.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.