Loading News...

Loading News...

- Bitcoin margin long positions on Bitfinex reach 72,700 BTC, highest since early 2024, up from 55,000 BTC in early October.

- Historical data indicates such surges often precede price corrections, serving as a contrarian indicator.

- Current market sentiment is "Extreme Fear" with a score of 25/100, despite Bitcoin trading at $89,687.

- Technical analysis identifies key support at the $82,000 Fibonacci level and resistance near $92,000.

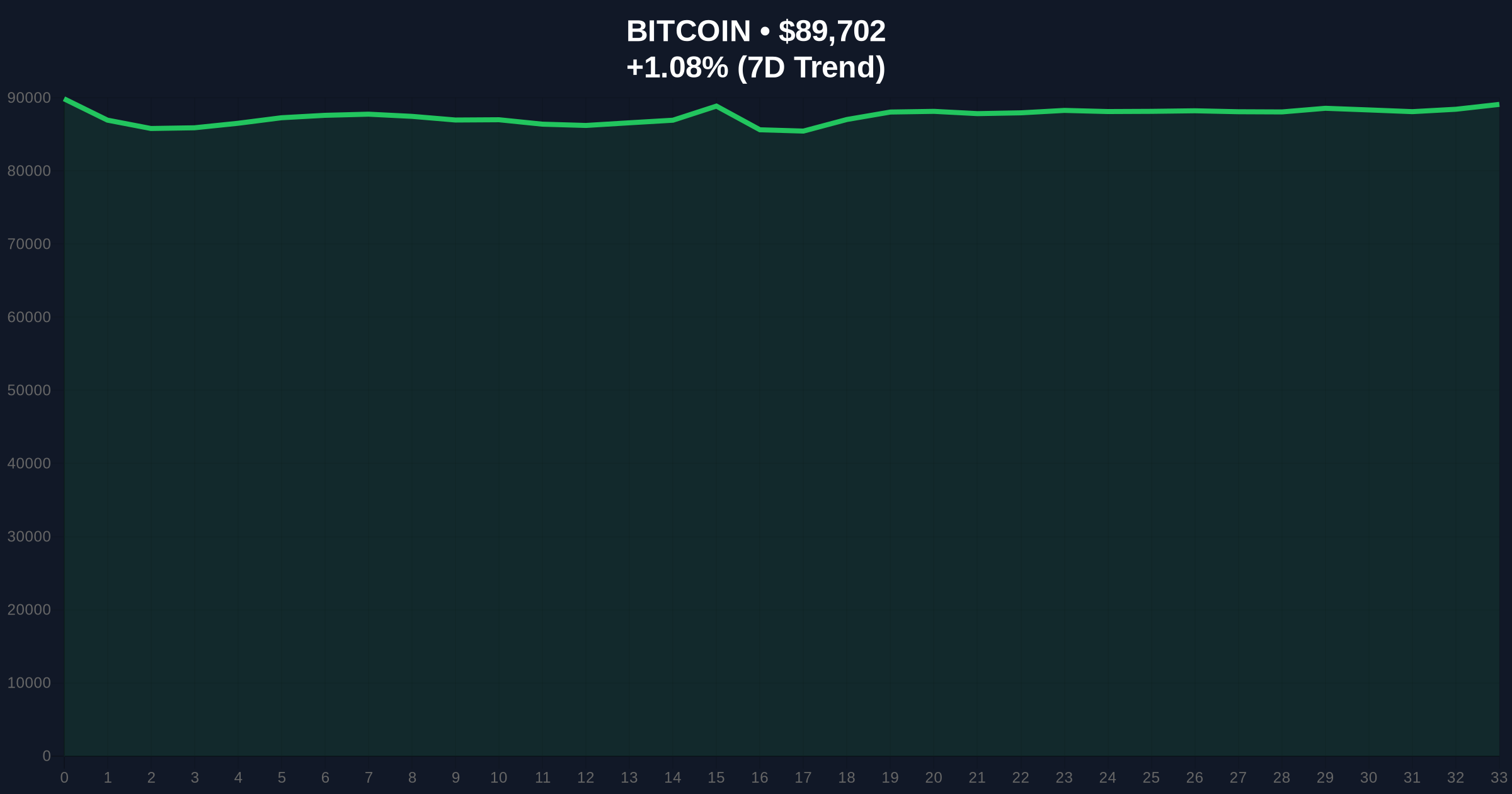

NEW YORK, December 22, 2025 — In today's daily crypto analysis, Bitcoin margin long positions on the Bitfinex exchange have surged to approximately 72,700 BTC, marking their largest size since early 2024, according to a report by Coindesk. This level mirrors the period just before Bitcoin reached its all-time high of $73,000 in March 2024, raising concerns among quantitative analysts who view such spikes as potential contrarian signals. The increase from around 55,000 BTC in early October coincides with Bitcoin's current price of $89,687, up 1.05% in the last 24 hours, amid a global crypto sentiment reading of "Extreme Fear."

Market structure suggests that margin long positions often act as a liquidity grab, where excessive bullish leverage creates vulnerability to sharp corrections. Similar to the 2021 correction, when Bitcoin fell from $64,000 to $30,000 after a surge in leveraged longs, the current buildup echoes patterns observed before major tops. Historical cycles show that large-scale investors typically reduce long positions at market bottoms, but on-chain data indicates no such signal has emerged yet. This context is critical for understanding whether the current activity represents sustainable accumulation or a speculative bubble. Related developments in institutional behavior, such as recent outflows and consolidation, can be explored in our analysis of institutional liquidity dynamics and market consolidation trends.

According to on-chain data from Bitfinex, Bitcoin margin long positions have increased to approximately 72,700 BTC, up significantly from around 55,000 BTC in early October. This level is comparable to early 2024, just before Bitcoin's peak in March. The report notes that in past cycles, such surges have often served as contrarian indicators, suggesting that high leverage can precede price declines. Market analysts highlight that while major bottoms have previously coincided with reductions in long positions by large investors, no bottoming signal is currently evident. The current price action places Bitcoin at $89,687, with the market exhibiting "Extreme Fear" sentiment, scoring 25 out of 100 on the Fear and Greed Index.

Technical analysis reveals that Bitcoin is trading within a defined range, with immediate resistance near $92,000, a level that has acted as an order block in recent weeks. Support is identified at the $82,000 Fibonacci retracement level, derived from the 2024 high-to-low move, which aligns with a volume profile node indicating accumulation. The Relative Strength Index (RSI) is currently at 58, suggesting neutral momentum without overbought conditions. A Fair Value Gap (FVG) exists between $85,000 and $87,000, which may attract price action for a fill. Bullish invalidation is set at $82,000; a break below this level would negate the current uptrend structure. Bearish invalidation is at $92,000; a sustained move above could trigger a gamma squeeze toward higher targets. For broader market insights, refer to the Federal Reserve's monetary policy updates at FederalReserve.gov, which influence macroeconomic conditions affecting crypto assets.

| Metric | Value |

|---|---|

| Bitcoin Margin Long Positions (Bitfinex) | 72,700 BTC |

| Previous Level (Early October) | 55,000 BTC |

| Current Bitcoin Price | $89,687 |

| 24-Hour Price Change | +1.05% |

| Global Crypto Sentiment Score | 25/100 (Extreme Fear) |

This development matters significantly for both institutional and retail participants. For institutions, the surge in margin longs indicates heightened speculative activity, which could lead to increased volatility and potential liquidations if prices reverse. Historical patterns suggest that such leverage buildups often precede corrections, impacting portfolio strategies and risk management. For retail traders, the contrarian signal serves as a warning against over-leveraging, emphasizing the need for caution in a market characterized by "Extreme Fear" sentiment. The absence of a bottoming signal from large investors further complicates the outlook, suggesting that current optimism may be premature. In the long term, this event tests the resilience of Bitcoin's market structure, with implications for adoption and regulatory scrutiny over leveraged trading practices.

Industry leaders on X/Twitter have expressed mixed views. Bulls argue that the increase in margin longs reflects growing confidence in Bitcoin's upward trajectory, citing institutional adoption trends. However, bears caution that this mirrors past cycles where leverage spikes led to sharp downturns, with one analyst stating, "High margin longs are a classic set-up for a liquidity grab." Market sentiment remains skewed toward caution, as evidenced by the "Extreme Fear" reading, indicating that despite price gains, underlying anxiety persists. This dichotomy highlights the tension between technical indicators and market psychology in the current environment.

Bullish Case: If Bitcoin holds above the $82,000 support and breaks through the $92,000 resistance, it could target new highs toward $100,000. This scenario would require sustained institutional inflow and a reduction in leverage, aligning with historical breakouts after consolidation phases. Market structure suggests that a clean break above resistance could invalidate bearish signals and attract fresh capital.

Bearish Case: If margin longs trigger a liquidation cascade, Bitcoin could retrace to the $75,000 support zone, filling the Fair Value Gap. This would align with past contrarian indicators where leverage buildups preceded corrections of 20-30%. A break below $82,000 would confirm bearish momentum, potentially leading to a test of lower supports near $70,000.

What are Bitcoin margin long positions?Margin long positions involve borrowing funds to buy Bitcoin, amplifying potential gains but also increasing risk of liquidation if prices fall.

Why is a surge in margin longs considered a contrarian indicator?Historical data shows that excessive leverage often precedes price corrections, as over-optimistic traders become vulnerable to market reversals.

What is the current global crypto sentiment?The sentiment is "Extreme Fear" with a score of 25/100, indicating high anxiety among investors despite recent price increases.

What are key technical levels to watch for Bitcoin?Support at $82,000 (Fibonacci level) and resistance at $92,000 (order block) are critical for determining near-term direction.

How does this relate to institutional behavior?Institutions often reduce long positions at market bottoms; the absence of such action suggests caution, as explored in our analysis of institutional adoption trends.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.