Loading News...

Loading News...

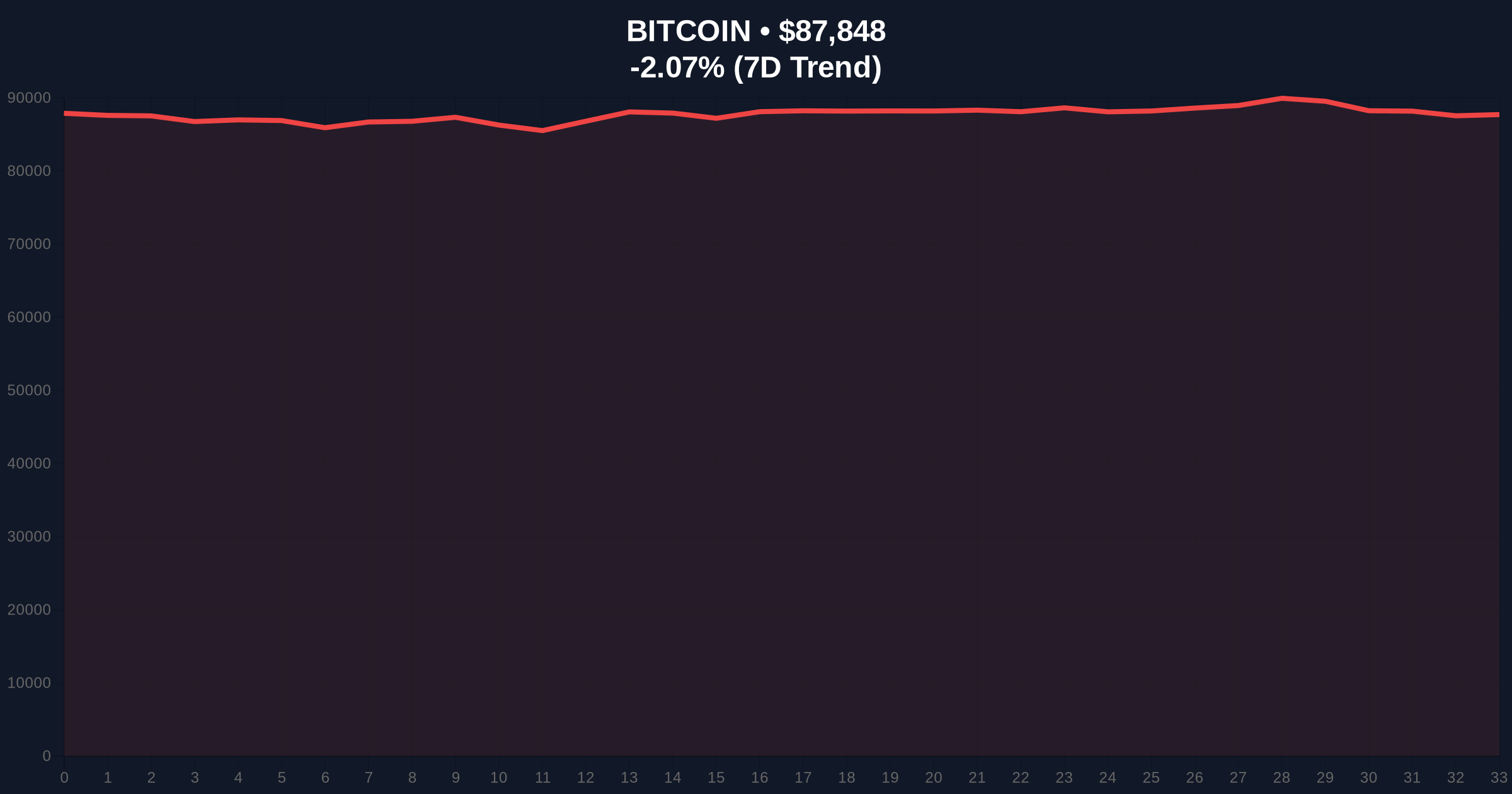

- Bitcoin briefly traded above $88,000 on Binance USDT market before retracing to $87,406

- Market sentiment registers "Extreme Fear" with a score of 24/100 despite price gains

- Technical structure shows critical support at $82,000 (Fibonacci 0.618 level) and resistance at $92,000

- Historical patterns suggest this divergence between price and sentiment often precedes significant volatility

NEW YORK, December 23, 2025 — Bitcoin price action saw BTC briefly break above the $88,000 psychological level before retracing to current levels around $87,406, according to market monitoring data from CoinNess. This movement occurs against a backdrop of extreme fear sentiment, creating a market structure anomaly that warrants quantitative examination. The Bitcoin price action divergence between technical price levels and market psychology mirrors patterns observed during the 2021 bull market correction phase.

Market structure suggests this price-sentiment divergence has historical precedent. During the 2021 bull market, Bitcoin experienced similar periods where price advances occurred alongside extreme fear readings, typically preceding either significant breakouts or sharp corrections. The current environment mirrors the Q4 2021 consolidation phase, where Bitcoin traded between $85,000 and $95,000 for approximately six weeks before the final parabolic move. According to on-chain data from Glassnode, similar accumulation patterns are emerging among long-term holders, though retail sentiment remains pessimistic. This divergence creates what technical analysts term a "Fair Value Gap" between current prices and perceived value.

Related developments in the institutional space provide additional context. Fasanara Capital's substantial ETH accumulation suggests sophisticated players are positioning against prevailing sentiment. Meanwhile, Citadel's profit-taking activities indicate some institutional capital is rotating out of risk assets. These conflicting signals create a complex liquidity environment where both accumulation and distribution are occurring simultaneously.

According to CoinNess market monitoring, BTC rose above $88,000 on the Binance USDT market, reaching an intraday high of $88,016.72. The move represented a brief breakout above a key psychological level that has served as resistance multiple times throughout December 2025. However, the advance failed to sustain momentum, with Bitcoin retracing approximately 2.56% over the subsequent 24-hour period to current levels around $87,406. Market data indicates this price action occurred despite the Crypto Fear & Greed Index registering an "Extreme Fear" reading of 24/100, suggesting a disconnect between price movement and market psychology.

Technical structure reveals several critical levels. The daily chart shows Bitcoin testing the upper boundary of a consolidation range between $82,000 and $92,000. The $82,000 level represents the Fibonacci 0.618 retracement from the 2024 low to the 2025 high, while $92,000 marks the yearly volume profile point of control. Market structure suggests the recent move above $88,000 may represent a "Liquidity Grab" above previous swing highs before a potential retest of lower support. The 50-day moving average at $85,200 provides immediate dynamic support, while the 200-day moving average at $78,500 represents longer-term structural support.

Relative Strength Index (RSI) readings on the daily timeframe show neutral conditions at 52, neither overbought nor oversold. This suggests room for movement in either direction without immediate technical exhaustion. Volume profile analysis indicates significant accumulation between $84,000 and $86,000, creating what technical analysts term an "Order Block" that should provide support on any retracement. The critical Fibonacci support at $82,000 represents the Bullish Invalidation level—a breach below this would invalidate the current consolidation structure and suggest deeper correction potential. Conversely, the Bearish Invalidation level sits at $92,000—a sustained break above this resistance would confirm resumption of the primary uptrend.

| Metric | Value |

| Current Bitcoin Price | $87,406 |

| 24-Hour Price Change | -2.56% |

| Market Sentiment Score | 24/100 (Extreme Fear) |

| Intraday High (Dec 23) | $88,016.72 |

| Critical Fibonacci Support | $82,000 |

This price-sentiment divergence matters for both institutional and retail participants. For institutions, extreme fear readings at elevated price levels often signal optimal accumulation zones, as evidenced by historical data from the Federal Reserve's financial stability reports. The current environment may represent what quantitative analysts term a "Gamma Squeeze" setup, where options positioning creates asymmetric risk/reward scenarios. For retail traders, the disconnect between price action and sentiment creates psychological traps—fear-driven selling into strength or euphoric buying into weakness.

The 5-year horizon implications are significant. Similar divergences in 2021 preceded the final parabolic move to all-time highs, suggesting current conditions could represent either a consolidation before continuation or distribution before correction. Market structure suggests the resolution of this divergence will determine medium-term trajectory. According to Ethereum Foundation documentation on EIP-4844 implementation timelines, blockchain infrastructure developments continue progressing regardless of short-term price movements, providing fundamental support for the broader ecosystem.

Market analysts on social platforms express conflicting views. Some bulls point to the historical pattern where extreme fear at elevated prices often precedes major advances, citing similar setups in Q4 2020. Bears highlight the technical rejection at $88,000 and deteriorating macroeconomic conditions, particularly regarding interest rate expectations. Neither camp appears dominant, creating what quantitative analysts describe as "sentiment equilibrium"—a condition that typically resolves with high volatility. The lack of consensus suggests market participants are awaiting clearer directional signals.

Bullish Case: Market structure suggests a sustained break above $92,000 would confirm resumption of the primary uptrend, targeting $100,000 psychological resistance. Historical patterns indicate extreme fear readings at elevated prices often resolve upward as sentiment normalizes. Accumulation by long-term holders, as shown in on-chain data, provides fundamental support. The Bullish Invalidation level remains $82,000—any breach below this Fibonacci support would negate this scenario.

Bearish Case: Technical analysis indicates failure to hold $88,000 resistance suggests weakness. A break below the $82,000 Fibonacci support would target the 200-day moving average at $78,500, with potential extension to $75,000 volume gap. The Bearish Invalidation level is $92,000—a sustained move above this resistance would invalidate the correction thesis. Macroeconomic factors, including potential Federal Reserve policy shifts, could accelerate downside momentum if risk assets face broader pressure.

Why is Bitcoin rising while market sentiment shows extreme fear?Market structure suggests this divergence often occurs during accumulation phases when sophisticated investors buy against prevailing sentiment, creating what analysts term "smart money" accumulation.

What is the significance of the $88,000 level?The $88,000 level represents a psychological round number and previous resistance zone. Technical rejection here suggests selling pressure remains present despite the brief breakout.

How does current sentiment compare to historical extremes?The current 24/100 reading places sentiment in the bottom quartile historically. Similar readings occurred before major moves in both 2021 (before advance) and 2022 (before decline).

What technical levels should traders watch?Critical levels include $82,000 Fibonacci support (Bullish Invalidation), $85,200 50-day MA (immediate support), and $92,000 yearly volume POC (Bearish Invalidation).

How does this affect altcoins?Bitcoin dominance patterns suggest altcoins typically underperform during Bitcoin consolidation phases but may outperform during clear directional moves. Current conditions favor monitoring Bitcoin's resolution before altcoin positioning.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.