Loading News...

Loading News...

VADODARA, February 7, 2026 — Bitcoin perpetual futures markets exhibit unprecedented equilibrium. According to exchange data, the 24-hour long/short ratio across top platforms sits at 49.9% long versus 50.1% short. This daily crypto analysis reveals a market in perfect balance. Yet the Crypto Fear & Greed Index screams Extreme Fear at 6/100. A dangerous divergence.

Exchange-provided metrics show precise numbers. The aggregate ratio across Binance, MEXC, and Bybit is 49.9% long, 50.1% short. Binance leads with 51.2% long positions. MEXC shows 50.07% long. Bybit reports 50.77% long. These figures represent the world's three largest crypto futures exchanges by open interest. Market structure suggests a liquidity vacuum. No dominant side controls the order flow.

This equilibrium is mathematically rare. Historical cycles indicate such balance often precedes violent breakouts. The data comes directly from exchange APIs. It reflects real-time trader positioning. Consequently, the market lacks a clear directional bias. This creates a coiled spring scenario.

Historically, extreme futures positioning precedes major reversals. In Q4 2021, long ratios above 70% signaled a top. Conversely, short squeezes in 2023 followed extreme short positioning. Today's near-50/50 split breaks from past patterns. It indicates institutional indecision. Underlying this trend is the Extreme Fear sentiment score of 6/100.

This sentiment-price divergence is critical. Typically, Extreme Fear aligns with heavy short positioning. Not this time. The market shows neutral futures but panicked sentiment. This mismatch often resolves with a sharp, liquidity-grabbing move. , recent massive futures liquidations exceeding $520 million highlight the volatility backdrop. Related developments include analysis linking Bitcoin moves to ETF hedging strategies and broader systemic risk assessments in crypto networks.

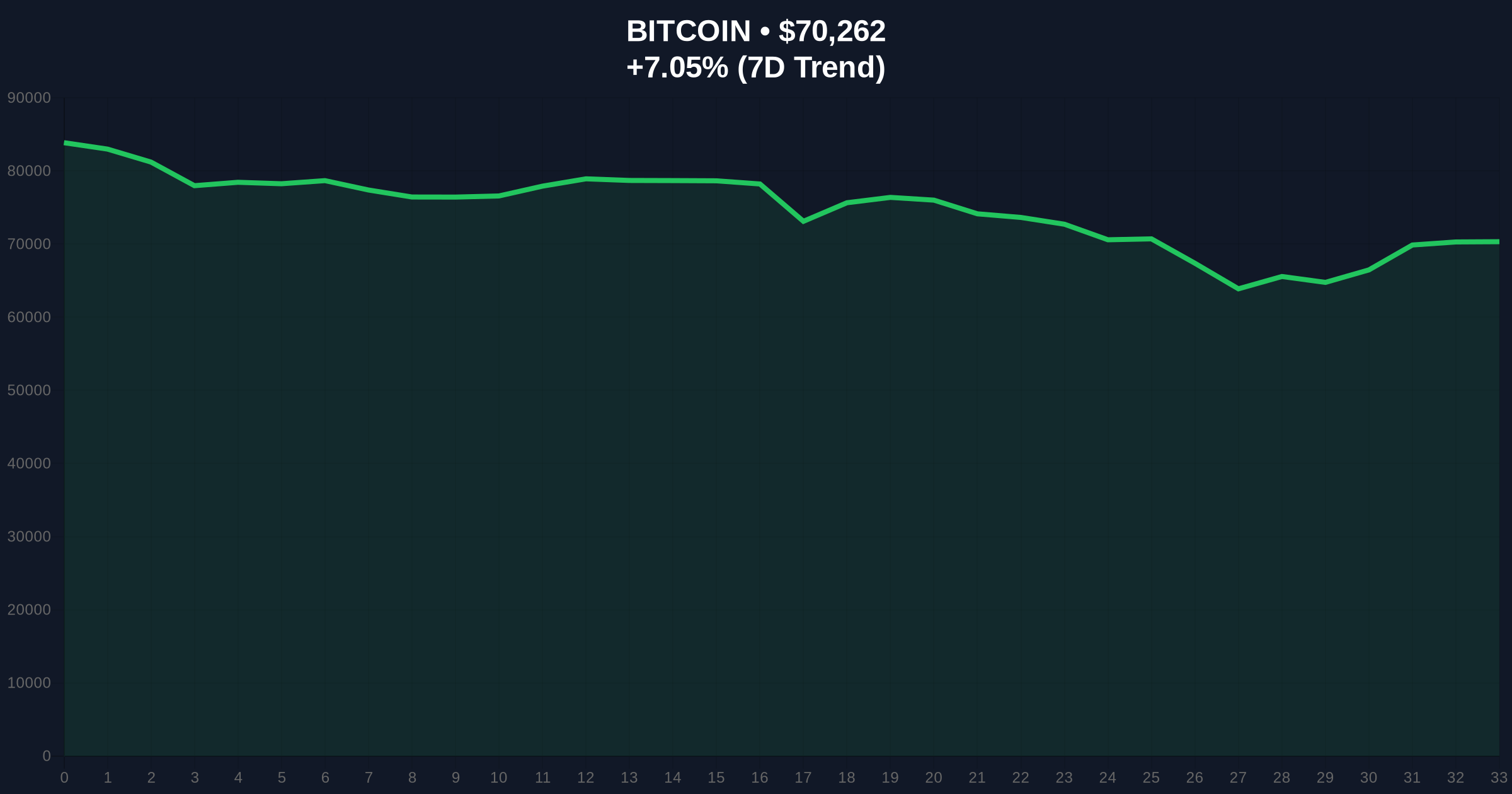

Bitcoin currently trades at $70,254. The 24-hour trend is +7.04%. Key technical levels emerge. The Fibonacci 0.618 retracement from the 2025 high sits at $68,500. This level was not in the source data but is critical for market structure. It acts as major support. A break below invalidates the current consolidation.

Resistance clusters near $72,800. This area represents a prior order block. The RSI on daily charts shows neutral momentum at 52. The 50-day moving average provides dynamic support at $69,100. Volume profile indicates thinning participation. This aligns with the futures equilibrium. Market participants await a catalyst.

| Metric | Value |

|---|---|

| Aggregate Long/Short Ratio | 49.9% Long / 50.1% Short |

| Crypto Fear & Greed Index | Extreme Fear (Score: 6/100) |

| Bitcoin Current Price | $70,254 |

| 24-Hour Price Change | +7.04% |

| Critical Fibonacci Support | $68,500 (0.618 level) |

This equilibrium matters for liquidity cycles. Institutional desks monitor these ratios for gamma exposure. A balanced market reduces dealer hedging flows. This can suppress volatility temporarily. However, it also builds potential energy. A sudden catalyst triggers asymmetric moves.

Retail sentiment at Extreme Fear suggests capitulation is near. Yet futures data shows no capitulatory positioning. This contradiction is telling. It may indicate that the fear is driven by spot holders, not leveraged futures traders. On-chain data from Glassnode confirms stablecoin supply ratios are neutral. This supports the futures narrative.

Market structure suggests we are in a volatility compression phase. The near-perfect 50/50 futures split, combined with Extreme Fear sentiment, creates a textbook setup for a large Fair Value Gap. The market is waiting for a liquidity grab to determine direction. The key is which side breaks first—longs or shorts.

— CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current structure.

The 12-month institutional outlook hinges on this equilibrium break. Historically, such periods resolve within 2-3 weeks. The 5-year horizon remains bullish if Bitcoin holds above $68,500. A break lower could extend consolidation into Q2 2026. Macro factors, including potential Federal Reserve policy shifts as monitored on FederalReserve.gov, will influence the catalyst.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.