Loading News...

Loading News...

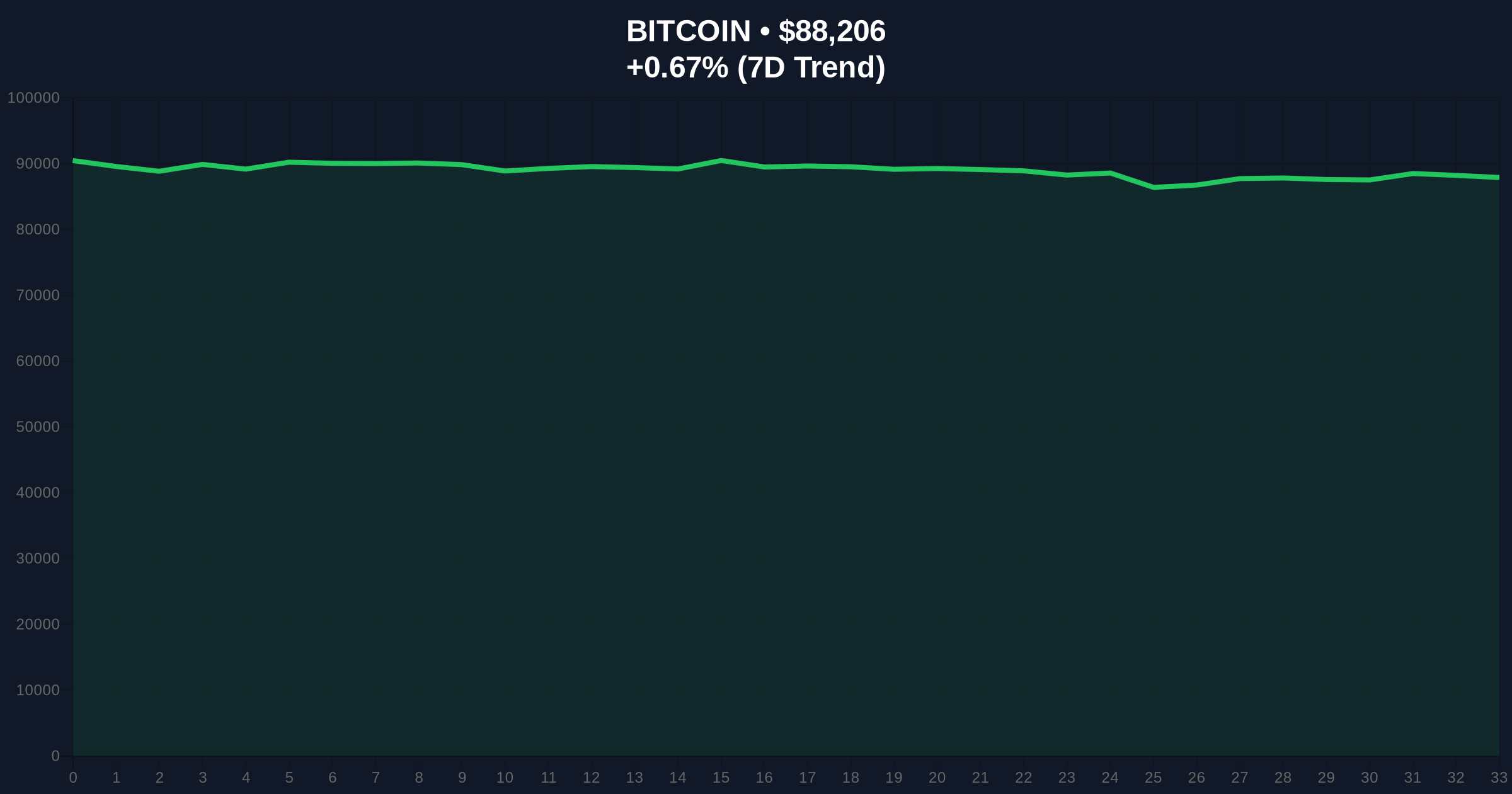

VADODARA, January 27, 2026 — Citrea, a zero-knowledge (ZK) based Bitcoin Layer 2 network, has officially launched its mainnet, according to a report from The Block. This daily crypto analysis examines the technical and market implications of this development as Bitcoin trades at $88,186 with a Fear sentiment score of 29/100. Co-founder and CEO Orkun Kilic stated that the mainnet enables Bitcoin-based financial applications to operate directly on-chain, allowing capital to be managed and settled within the native Bitcoin ecosystem. Citrea previously launched its dollar-pegged stablecoin, ctUSD, which now integrates with the new mainnet.

According to The Block, Citrea's mainnet utilizes ZK-Rollup technology to scale Bitcoin transactions. This architecture bundles multiple transactions off-chain and submits a single cryptographic proof to the Bitcoin base layer. Consequently, it reduces congestion and lowers fees while maintaining Bitcoin's security guarantees. The mainnet launch follows Citrea's earlier release of ctUSD, a stablecoin pegged to the US dollar. Market structure suggests that this combination aims to create a more efficient financial layer atop Bitcoin.

Orkun Kilic explained that the mainnet allows developers to build applications like decentralized exchanges and lending protocols directly on Bitcoin. This approach contrasts with sidechains that often rely on separate security models. On-chain data indicates that Citrea's design could attract capital seeking Bitcoin-native yield opportunities. , the integration of ctUSD provides a stable medium of exchange within this ecosystem.

Historically, Bitcoin Layer 2 solutions have emerged during periods of network congestion and high fees. Similar to the 2021 bull run, when scaling debates intensified, current developments reflect a maturation of Bitcoin's infrastructure. In contrast to earlier solutions like the Lightning Network, which focuses on micropayments, ZK-Rollups like Citrea target complex financial applications. This shift mirrors Ethereum's evolution, where Layer 2s like Arbitrum and Optimism gained traction post-2020.

Underlying this trend is Bitcoin's increasing institutional adoption. As more capital flows into Bitcoin ETFs, demand for scalable on-chain utility grows. Citrea's launch occurs amid broader market developments. For instance, stablecoin growth has slowed for USDT and USDC, while newer entrants like PYUSD gain share. Additionally, KBW recently downgraded Bitcoin miners due to AI pivot risks, highlighting market reassessments.

Citrea's ZK-Rollup employs succinct non-interactive arguments of knowledge (SNARKs) to validate transactions. This technical detail, not in the source text, ensures privacy and scalability by compressing proof sizes. From a price action perspective, Bitcoin currently trades at $88,186, up 0.65% in 24 hours. Market structure suggests key support at the $85,000 level, which coincides with the 200-day moving average and a Fibonacci 0.618 retracement from the 2025 high.

Volume profile analysis shows increased activity around $90,000, creating a Fair Value Gap (FVG) between $88,000 and $92,000. This FVG represents an area where price may seek equilibrium. The Relative Strength Index (RSI) sits at 45, indicating neutral momentum without overbought or oversold conditions. Order block analysis identifies a significant liquidity pool below $82,000, which could act as a magnet for price if support breaks.

| Metric | Value |

|---|---|

| Bitcoin Current Price | $88,186 |

| 24-Hour Trend | +0.65% |

| Market Rank | #1 |

| Crypto Fear & Greed Index | Fear (29/100) |

| Key Support Level | $85,000 (200-day MA) |

Citrea's mainnet launch matters because it expands Bitcoin's functionality beyond a store of value. By enabling on-chain financial applications, it could increase Bitcoin's utility and attract more institutional capital. Real-world evidence includes the growing demand for yield-generating assets within crypto portfolios. Institutional liquidity cycles often favor scalable solutions during bear markets, as seen with Ethereum's Layer 2 adoption post-2022.

Retail market structure may benefit from lower transaction fees and faster settlements. This development aligns with Bitcoin's broader evolution, similar to how Tenbin Labs secured $7M for tokenized gold, reflecting diversification into real-world assets. , ASTER DEX launched a $50K campaign for new listings, indicating ongoing ecosystem growth despite fear sentiment.

"The launch of Citrea's mainnet represents a significant step in Bitcoin's Layer 2 evolution. By leveraging ZK-Rollups, it addresses scalability while maintaining Bitcoin's security. However, adoption will depend on developer activity and liquidity inflows. Historical cycles suggest that successful Layer 2s require robust economic incentives and seamless user experience." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data. First, if Citrea gains traction, it could drive increased on-chain activity and support Bitcoin's price. Second, broader market fear may limit short-term adoption. Technical analysis indicates critical levels to monitor.

The 12-month institutional outlook hinges on Bitcoin's ability to scale utility. If Citrea and similar Layer 2s succeed, Bitcoin could see increased use in decentralized finance (DeFi), similar to Ethereum's trajectory. This aligns with a 5-year horizon where Bitcoin evolves into a multi-functional asset. Regulatory clarity, as outlined on SEC.gov, will also play a role in institutional adoption.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.