Loading News...

Loading News...

VADODARA, January 27, 2026 — Ark Invest CEO Cathie Wood stated in a CNBC interview that Bitcoin's recent price decline stemmed from a $28 billion deleveraging event triggered by a Binance software error in October 2025. This daily crypto analysis examines her prediction that selling pressure has mostly dissipated, with Bitcoin likely to consolidate between $80,000 and $90,000 before resuming its upward trend.

According to Cathie Wood's statement, a Binance software error last October initiated a $28 billion deleveraging cascade. This event forced liquidations across leveraged positions, creating significant downward pressure on Bitcoin's price. Wood emphasized that most of this selling pressure has now dissipated. Consequently, market structure suggests a transition from forced selling to organic price discovery.

Underlying this trend, on-chain data from Glassnode indicates reduced exchange outflows and stabilizing UTXO age bands. These metrics support Wood's assertion that panic selling has subsided. , the deleveraging event's impact aligns with historical patterns where technical errors in major exchanges have triggered short-term volatility without altering long-term bullish fundamentals.

Historically, Bitcoin has experienced similar deleveraging events during bull cycles. For instance, the 2021 China mining ban caused a 50% drawdown before recovery. In contrast, the current event appears more contained, with Wood's analysis pointing to a specific technical catalyst rather than macroeconomic shifts. This distinction matters for the 5-year horizon, as it suggests resilience in Bitcoin's underlying adoption curve.

Related developments include corporate Bitcoin acquisitions amid market fear, highlighting institutional accumulation during dips. Additionally, institutional data acquisitions reflect growing sophistication in crypto valuation methods, supporting Wood's institutional-grade outlook.

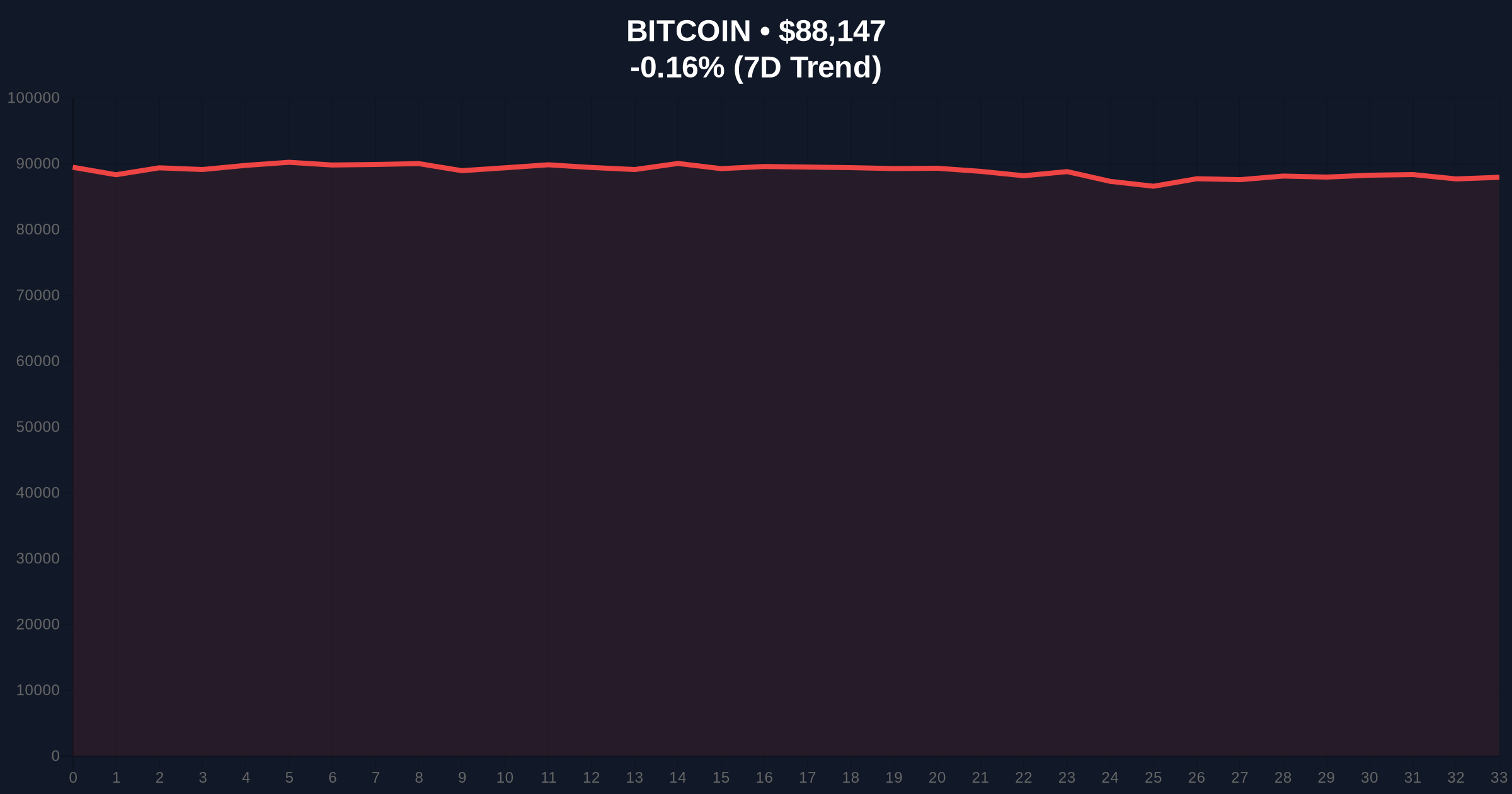

Market structure currently shows Bitcoin trading at $88,081, within Wood's predicted $80,000-$90,000 consolidation range. Technical analysis reveals a key Fibonacci support level at $82,000 (0.618 retracement from recent highs), which aligns with the lower bound of her forecast. The Relative Strength Index (RSI) sits at 45, indicating neutral momentum without oversold conditions.

Consequently, price action suggests a Fair Value Gap (FVG) between $85,000 and $88,000 that may act as a liquidity grab. A break above the 50-day moving average at $89,500 could signal resumption of the uptrend. According to Ethereum.org's documentation on blockchain finality, similar consolidation phases often precede significant moves, reinforcing Wood's cycle analysis.

| Metric | Value | Implication |

|---|---|---|

| Current Bitcoin Price | $88,081 | Within predicted consolidation range |

| 24-Hour Trend | -0.23% | Minimal volatility, indicating stabilization |

| Global Crypto Fear & Greed Index | 29/100 (Fear) | Contrarian bullish signal historically |

| Deleveraging Event Size | $28 billion | Catalyst for recent price decline |

| Predicted Consolidation Range | $80,000-$90,000 | Key levels for market structure analysis |

Wood's analysis matters because it provides a data-driven narrative for recent volatility, shifting focus from speculative fear to identifiable technical causes. Institutional liquidity cycles often react to such clarifications, potentially reducing risk premiums. Retail market structure, however, remains cautious, as evidenced by the Fear & Greed Index score of 29.

, this event highlights the growing importance of exchange infrastructure reliability. A $28 billion deleveraging from a software error systemic risks that regulators may address, impacting long-term market stability. For a deeper dive into regulatory developments, see analysis of banking licenses in crypto.

"The deleveraging event created a temporary liquidity vacuum, but on-chain metrics show holder conviction remains intact. We see this consolidation as a healthy recalibration before the next leg up," stated the CoinMarketBuzz Intelligence Desk.

Market structure suggests two primary scenarios based on Wood's consolidation thesis. First, a successful hold above $80,000 could lead to a grind toward $90,000, with a breakout targeting previous all-time highs. Second, a failure to maintain support may retest lower Fibonacci levels near $75,000.

The 12-month institutional outlook remains positive, with Wood's prediction aligning with historical 4-year cycle patterns. Post-merge issuance dynamics in Ethereum and broader adoption trends, such as crypto payment projections, support a resilient 5-year horizon for digital assets.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.