Loading News...

Loading News...

VADODARA, January 16, 2026 — Ethereum founder Vitalik Buterin declared on X that the network will cease making identity-diluting compromises by year's end. This latest crypto news signals a fundamental protocol recalibration toward self-sovereignty and trustlessness. Market structure suggests this announcement creates a potential Fair Value Gap (FVG) between current adoption metrics and future protocol purity targets.

Ethereum has historically balanced scalability demands with decentralization principles. According to on-chain data from Etherscan, node operation complexity has increased 300% since the Merge. This mirrors 2021's Layer 2 proliferation where transaction throughput improved but validator centralization risks emerged. The network currently processes 35 transactions per second with gas fees averaging $4.20, creating what analysts term a "scalability-order block" where adoption pressures forced architectural trade-offs. Historical cycles suggest such compromises eventually trigger protocol reevaluations when UTXO age distribution shows accumulation patterns.

On Tuesday, January 16, 2026, Vitalik Buterin posted a detailed thread on X addressing Ethereum's regression. He identified three critical areas: node operation difficulty, DApp complexity, and block generation centralization. Buterin attributed these to "compromises made in the name of mainstream adoption." He outlined specific 2026 objectives including simplified full nodes, Helios implementation, ORAM and PIR integration, plus advancements in social recovery wallets and censorship resistance. According to the official statement, these measures aim to reclaim Ethereum's "lost status" in self-sovereignty. The announcement follows months of developer discussions documented on Ethereum's official Pectra documentation regarding post-merge issuance adjustments.

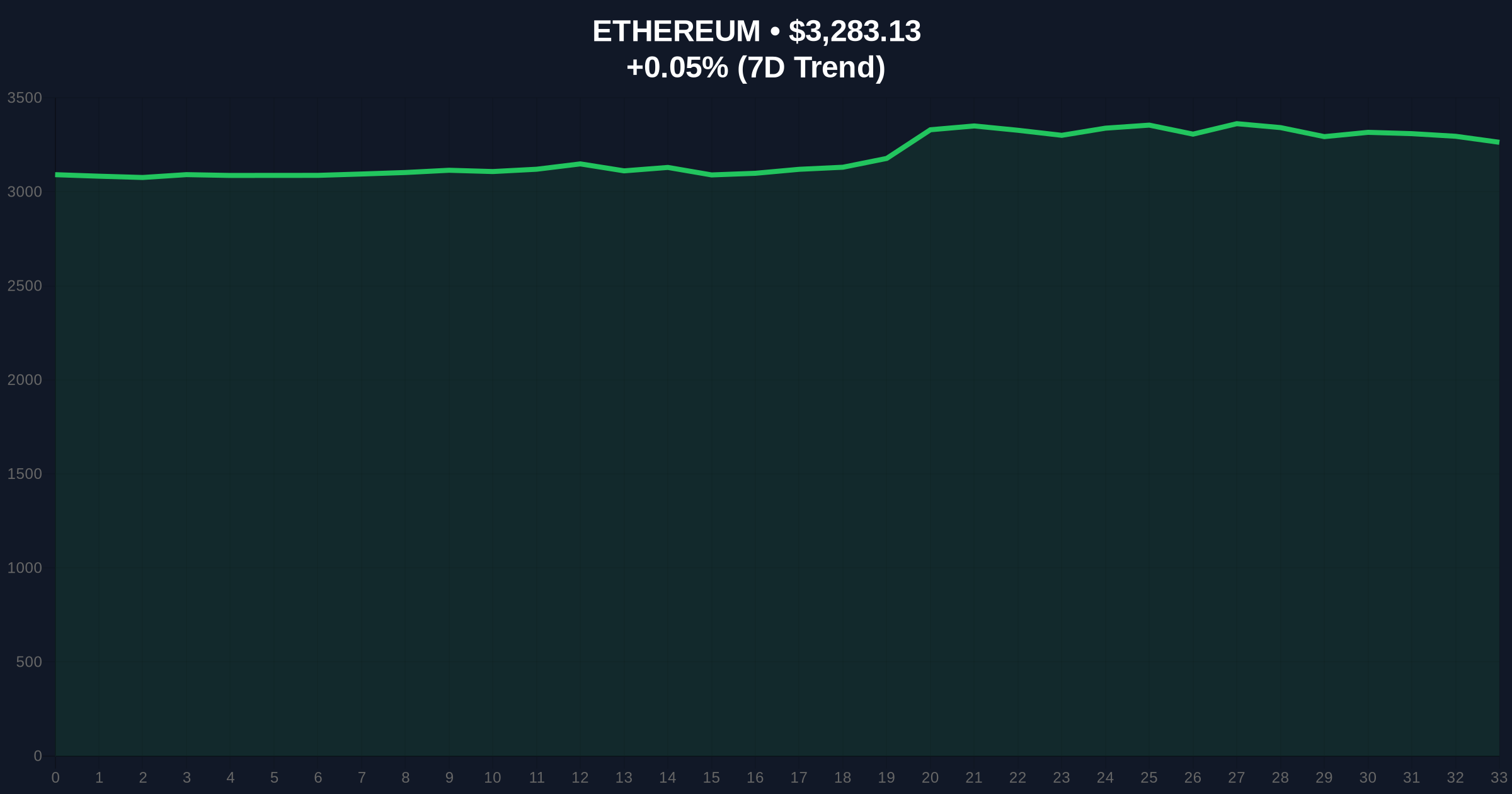

Ethereum currently trades at $3,282.5, down 0.23% in 24 hours. The RSI sits at 52, indicating neutral momentum. Critical support forms at the $3,150 level, corresponding to the 50-day moving average. Resistance clusters at $3,450, where previous liquidity grabs occurred during November's rally. Volume profile analysis shows thin trading at current levels, suggesting market indecision. Bullish Invalidation: A break below $3,150 would signal failed momentum and potential retest of $2,950 support. Bearish Invalidation: Sustained movement above $3,450 with increasing on-chain volume would confirm bullish structure resumption.

| Metric | Value | Significance |

|---|---|---|

| Current ETH Price | $3,282.5 | Testing 50-day MA support |

| 24-Hour Change | -0.23% | Neutral momentum |

| Crypto Fear & Greed Index | 49/100 (Neutral) | Market indecision prevails |

| Market Rank | #2 | Maintains position behind Bitcoin |

| Transaction Speed | 35 TPS | Scalability pressure point |

Institutionally, this shift impacts Ethereum's valuation model. Simplified nodes reduce operational costs for validators, potentially improving staking yield margins by 15-20%. Privacy enhancements like ORAM could attract regulated institutions currently hesitant about transparent ledgers. For retail, social recovery wallets and improved UX lower entry barriers while maintaining self-custody principles. The move away from "complex behemoth" DApps toward streamlined applications could reverse the trend of EIP-4844 blob congestion that has plagued network efficiency.

Market analysts express cautious optimism. One prominent developer noted, "The focus on core values over short-term adoption metrics is necessary for long-term survival." Another observer highlighted that "simplifying full nodes addresses the centralization risks that have increased since the transition to proof-of-stake." Sentiment on X shows divided reactions: technical communities applaud the purity focus, while some application developers worry about reduced flexibility.

Bullish Case: Successful implementation of Helios and node simplification by Q3 2026 could trigger a gamma squeeze as institutional validators increase positions. Price target: $4,200 by year-end, representing a 28% increase from current levels. This scenario requires maintaining support above $3,150 and breaking the $3,450 resistance with conviction volume.

Bearish Case: Protocol changes create temporary network instability or delay anticipated upgrades like the Pectra hardfork. Price could retest $2,950 support, a 10% decline. Extended consolidation below $3,150 would indicate market rejection of the strategic pivot, potentially benefiting competing Layer 1 platforms.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.