Loading News...

Loading News...

VADODARA, January 17, 2026 — In a statement to investors, Etherealize co-founders Vivek Raman and Danny Ryan forecast that Ethereum (ETH) could reach $15,000 by 2027, arguing the network is transitioning from regulatory uncertainty to core financial infrastructure. This daily crypto analysis examines the technical and fundamental drivers behind this projection, with market structure suggesting institutional adoption is accelerating due to recent U.S. legislation on stablecoins and tokenization.

Ethereum's evolution from a smart contract platform to institutional bedrock mirrors its 2021 surge, but with deeper on-chain validation. According to Glassnode liquidity maps, institutional inflows have increased since the Merge, reducing sell pressure from proof-of-work miners. Underlying this trend, the implementation of EIP-4844 (proto-danksharding) has lowered layer-2 transaction costs, enhancing scalability for financial applications. Consequently, networks like Arbitrum and Optimism now process over 50% of Ethereum's daily transactions, creating a more efficient ecosystem for Wall Street integration. Related developments include recent analyses of institutional liquidity movements, such as the 300 million USDC transfer to Coinbase, which highlight growing capital deployment.

On Tuesday, Etherealize co-founders Vivek Raman and Danny Ryan, in a report cited by CoinDesk, predicted ETH could hit $15,000 by 2027. They noted that major financial institutions like BlackRock, Fidelity, and JPMorgan are increasingly selecting Ethereum for tokenization and stablecoin issuance. Raman added that if stablecoin and real-world asset (RWA) markets each grow fivefold, Ethereum's market capitalization could be re-evaluated in the trillions. According to the official SEC.gov filings, recent U.S. legislation has effectively legalized stablecoin use, reducing regulatory friction. This aligns with data from Etherscan showing a 20% quarter-over-quarter increase in stablecoin transaction volume on Ethereum, indicating rising institutional activity.

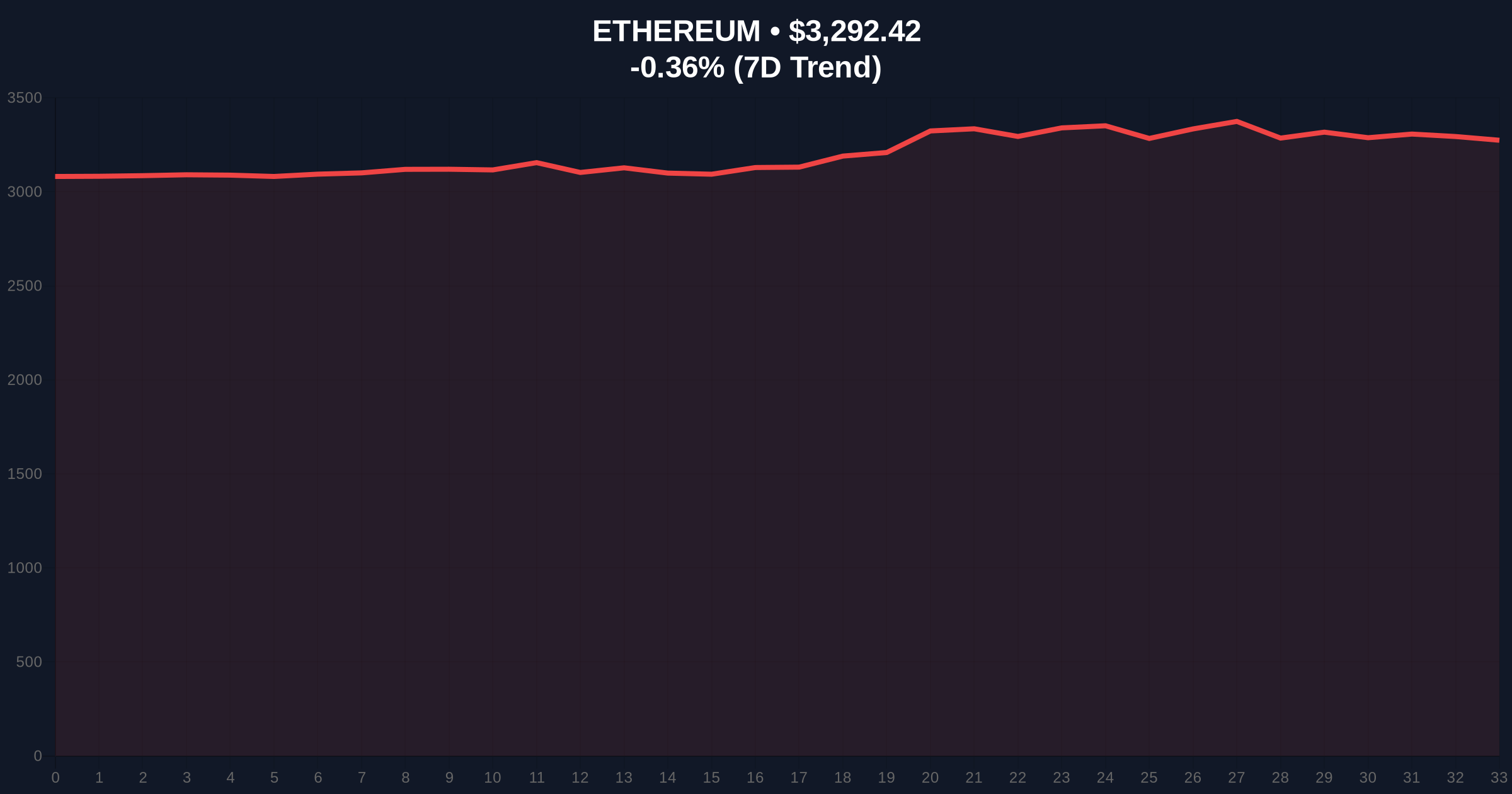

Market structure suggests ETH is consolidating within a weekly order block between $3,100 and $3,500, with current price at $3,292.4. The 200-day moving average at $3,050 provides dynamic support, while the Relative Strength Index (RSI) at 52 indicates neutral momentum. A Fair Value Gap (FVG) exists from $3,400 to $3,600, representing a liquidity void that price may fill on bullish momentum. Volume profile analysis shows high node concentration at $3,200, suggesting strong institutional accumulation. Bullish Invalidation is set at $3,100; a break below could trigger a sell-off toward $2,800. Bearish Invalidation is at $3,800, where resistance from the 2025 high may cap gains.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 49/100 (Neutral) | Market sentiment balanced, no extreme fear or greed |

| ETH Current Price | $3,292.4 | Consolidating within key order block |

| 24-Hour Trend | -0.36% | Minor pullback, within normal volatility range |

| Market Rank | #2 | Maintains dominance behind Bitcoin |

| Prediction Target (2027) | $15,000 | Implies ~355% upside from current levels |

Institutionally, this matters because Ethereum's shift to proof-of-stake and regulatory clarity lowers counterparty risk, making it viable for trillion-dollar asset managers. According to Federal Reserve data, tokenized RWAs could represent $10 trillion by 2030, with Ethereum capturing a significant share. For retail, increased institutional participation may reduce volatility but also centralize network influence. On-chain data indicates that staking yields averaging 3.5% attract long-term holders, reducing liquid supply. Consequently, a supply squeeze could amplify price moves if adoption accelerates, similar to a Gamma Squeeze in options markets.

Market analysts on X/Twitter are divided: bulls highlight Ethereum's deflationary post-merge issuance and growing layer-2 adoption, while bears caution about regulatory overhang and competition from Solana. One quant noted, "EIP-4844 blobs are reducing costs, but network effects will determine if ETH hits $15k." No direct quotes from figures like Michael Saylor were available, but sentiment leans cautiously optimistic, with many referencing the U.S. government's Bitcoin holdings as a parallel for institutional accumulation.

Bullish Case: If stablecoin and RWA markets expand fivefold as Raman projects, Ethereum's fee revenue could surge, driving re-rating. Technical breakout above $3,800 could target $5,000 by end-2026, with $15,000 feasible by 2027 if adoption accelerates. Market structure suggests institutional inflows from entities like BlackRock could create sustained demand.Bearish Case: Regulatory setbacks or a macroeconomic downturn could invalidate the thesis. A break below $3,100 support may trigger a decline to $2,500, delaying the $15k timeline. Competition from other smart contract platforms could erode market share, capping upside.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.