Loading News...

Loading News...

VADODARA, January 12, 2026 — Binance will delist 20 spot trading pairs at 8:00 a.m. UTC on January 13, according to an official exchange announcement. This daily crypto analysis examines whether the move represents a strategic liquidity grab or response to mounting regulatory gamma squeeze pressures. Market structure suggests concentrated sell-side pressure on affected tokens could create Fair Value Gaps (FVGs) in their order books.

Exchange delistings typically follow low trading volume or regulatory compliance issues. According to Binance's official documentation, the exchange maintains a quarterly review process for all trading pairs. Historical cycles indicate such actions often precede broader market corrections, as seen during the 2021-2022 bear market when multiple exchanges purged low-liquidity assets. The current environment features parallel regulatory developments, including the Dubai DIFC privacy token ban and SEC ETF delays, creating what analysts term a regulatory gamma squeeze—where derivative market positioning amplifies spot volatility.

Binance announced the delisting of 20 specific spot trading pairs effective January 13, 2026, at 8:00 a.m. UTC. The affected pairs are ACT/FDUSD, AEVO/FDUSD, AR/FDUSD, DOGS/FDUSD, HEMI/FDUSD, HFT/BTC, IO/FDUSD, MEME/FDUSD, NFP/FDUSD, PENDLE/FDUSD, PHA/BTC, RARE/BTC, RAY/FDUSD, RED/FDUSD, SAND/FDUSD, SHELL/BTC, SXP/BTC, TURTLE/FDUSD, ZBT/FDUSD, and ZK/FDUSD. The exchange cited standard periodic reviews without specifying volume thresholds or regulatory triggers, creating opacity around the decision matrix.

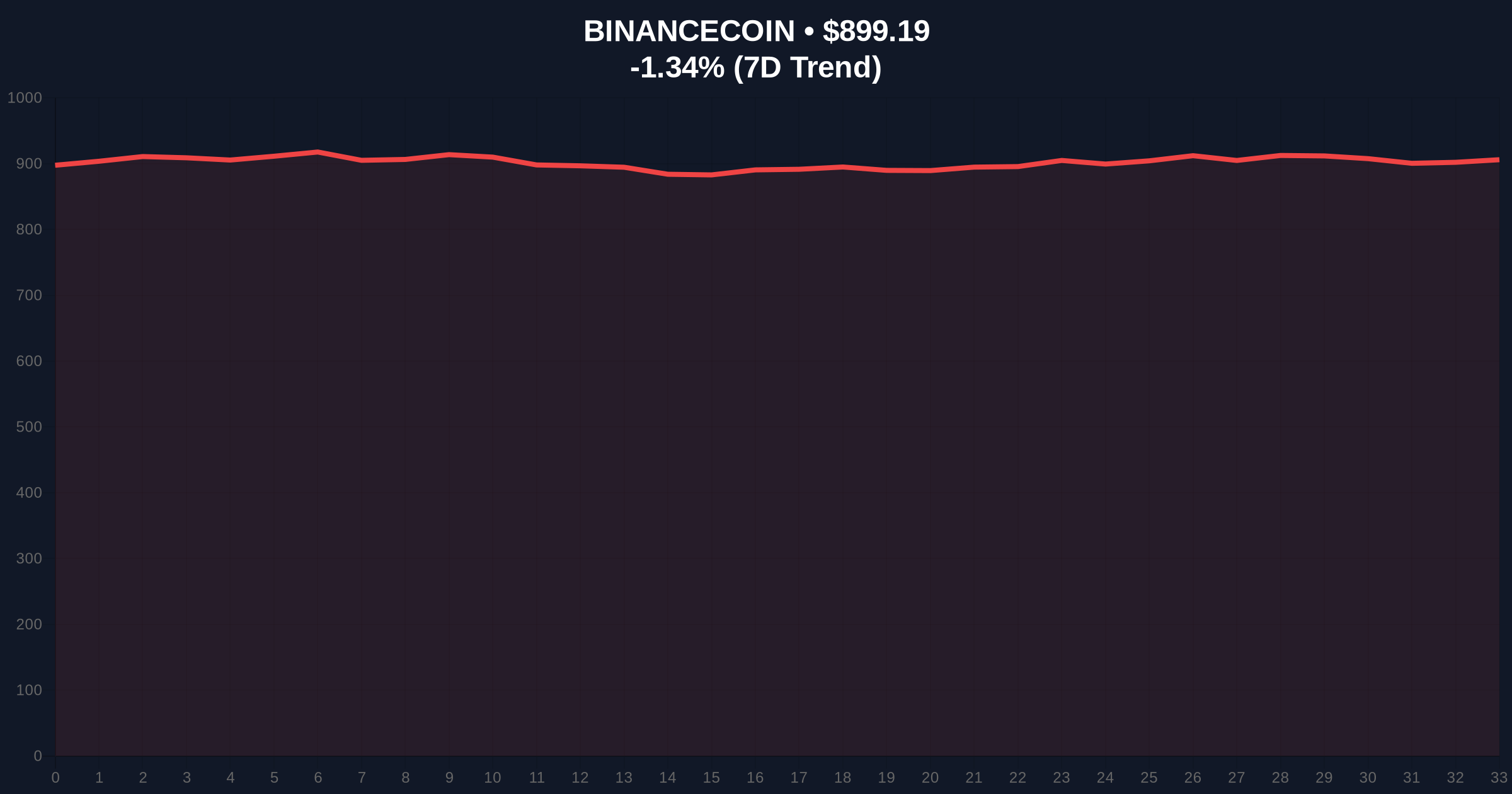

BNB's price action shows concerning signals. The asset trades at $898.6 with a 24-hour decline of -1.41%, underperforming the broader market. Volume profile analysis indicates weakening buy-side liquidity near the $900 psychological level. The 50-day moving average at $920 acts as immediate resistance, while the 200-day moving average provides dynamic support at $850. RSI readings at 42 suggest neutral momentum with bearish divergence on higher timeframes. Bullish Invalidation stands at $920—a break above could signal relief rally. Bearish Invalidation is $850—loss of this level opens path to $780 Fibonacci support from the 2025 rally.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 27/100 (Fear) | Extreme risk-off sentiment |

| BNB Current Price | $898.6 | -1.41% 24h change |

| BNB Market Rank | #5 | Maintains top-5 position |

| Delisted Pairs | 20 | All against FDUSD or BTC |

| Effective Time | Jan 13, 8:00 a.m. UTC | Immediate liquidity impact |

For institutional traders, reduced pair availability complicates arbitrage strategies and increases execution slippage. Retail investors face immediate liquidation risk if holding affected tokens without alternative exit liquidity. The concentration of delistings against FDUSD—a regulated stablecoin—suggests compliance considerations per the SEC's ongoing stablecoin scrutiny. Market structure indicates this could be a proactive liquidity grab before potential regulatory actions, similar to Upbit's recent transfer halts.

Market analysts on X/Twitter express skepticism. One quant trader noted, "Delisting 20 pairs simultaneously reeks of risk management overdrive, not organic volume decay." Another observed, "The FDUSD focus suggests Binance anticipates stablecoin regulatory gamma squeeze." Bulls argue this cleans up low-quality pairs, but bears counter that it signals deeper exchange vulnerabilities.

Bullish Case: If BNB holds $850 support and regulatory pressure eases, a rebound to $950 is plausible. Cleaned order books could improve overall exchange health, attracting institutional flow. EIP-4844 implementation on Ethereum might spill positive sentiment to BNB chain.

Bearish Case: Break below $850 targets $780 Fibonacci support. Further delistings or regulatory actions could trigger cascading liquidations. The Fear & Greed Index at 27 suggests capitulation risk remains elevated. Parallel developments like the Seoul Web3 event highlight industry anxiety.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.